Following in the footsteps of Bitcoin, Ethereum’s native token ETH is beginning to show signs of life. The bulls are taking control of the market this week, which bodes well for the ETH price. Despite intense selling pressure, bulls were able to maintain a foothold at the beginning of this week, keeping Ethereum in the positive zone.

Ethereum price hits monthly low

Last week, Ethereum price experienced a decline of 3.89% on the weekly chart, reaching its monthly low of $1737 on May 12th, accompanied by a bullish doji candle. However, the bulls have shown resilience this week, making a slight recovery as they pushed the ETH price up by 1.6% earlier in the week.

Also Read: Bitcoin Tests Major Support: Price Reverses Above $27K

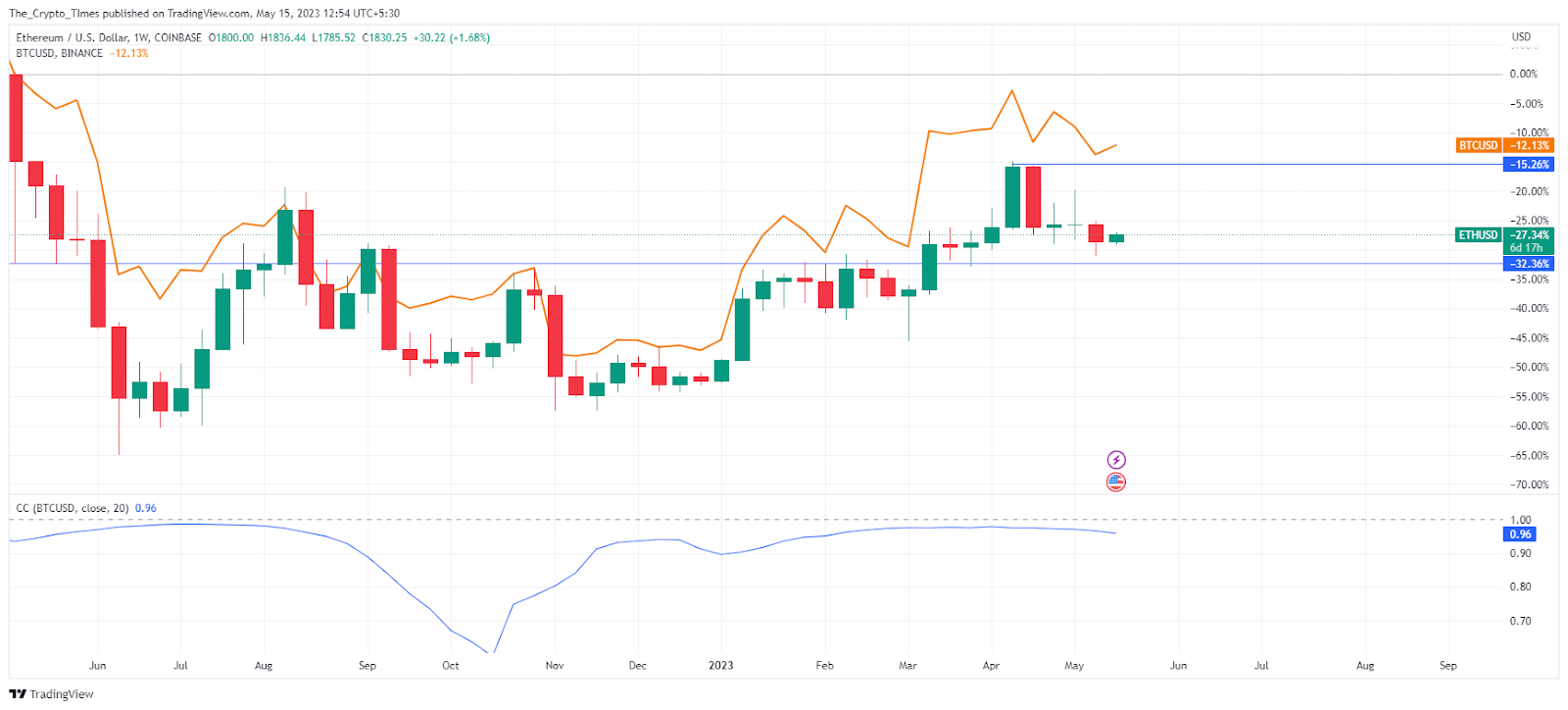

The relationship between Ethereum and Bitcoin seems to be tightly connected, with the Correlation Coefficient indicator consistently hovering around 0.96. This suggests that Bitcoin’s influence strongly impacts the momentum of Ethereum’s price.

Ethereum Overcame Short-Term Upside Hurdle Today

Bulls are showing their strength today by pushing Ethereum’s price above the $1815 level, a significant hurdle in the past 72 hours. As a result, Ethereum is up 1.7% in the intraday trading session, currently settling around $1830.

According to CoinMarketCap, the trading volume has surged to $6.1 billion in the last 24 hours. This increase in trading volume suggests a growing accumulation of ETH during this week.

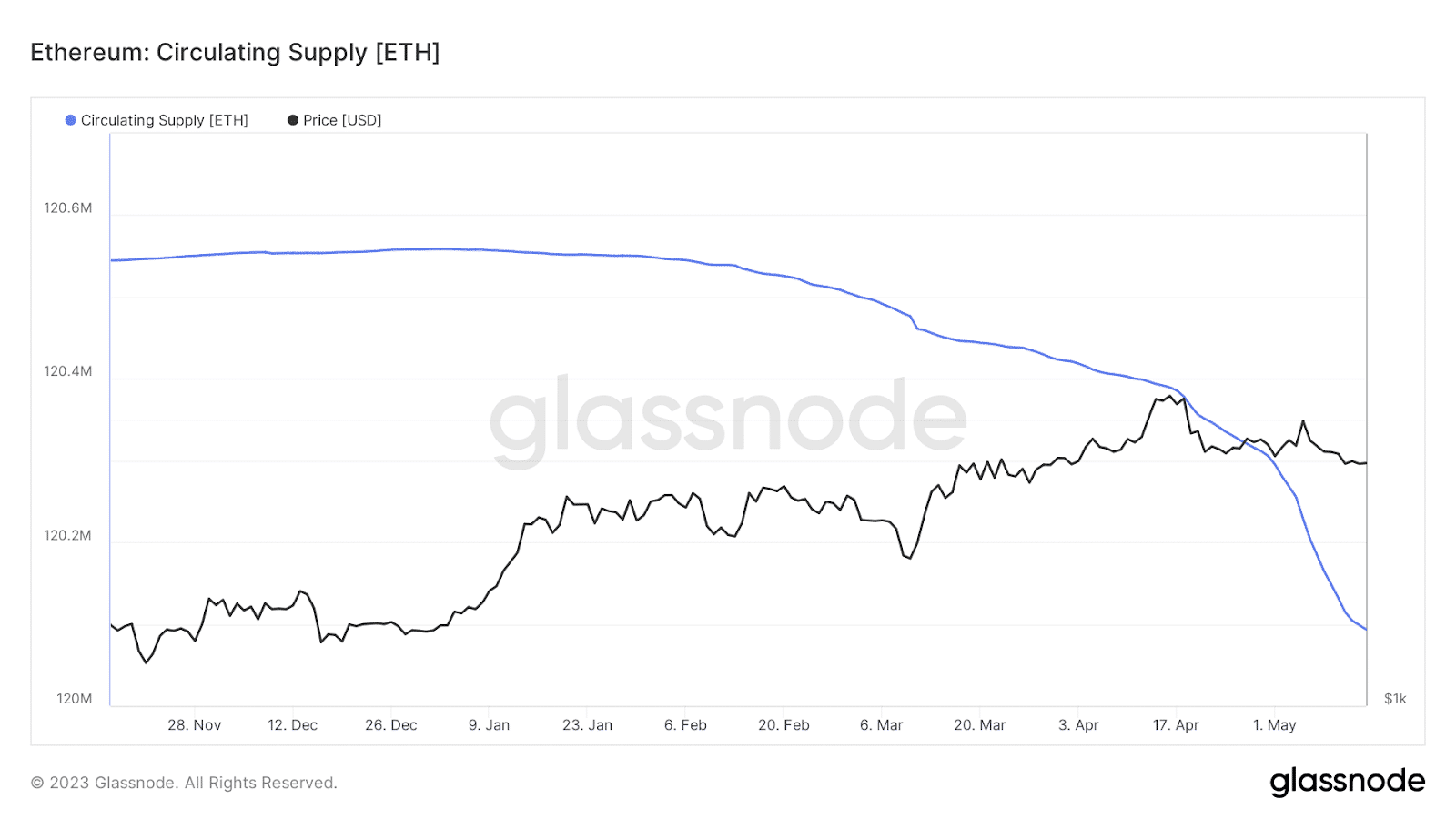

A decreasese In Circulating Supply Affects Bulls

The circulating supply of Ethereum has been on a steady decline for the past few months, according to data from Glassnode. Currently, the circulating supply is at its lowest point this year, standing at 120,093,460.108 ETH. This decrease in supply, coupled with the rising demand, could potentially fuel the recovery of ETH towards the $2,000 resistance level.

MFI Demonstrates Money-Inflow Into Ethereum

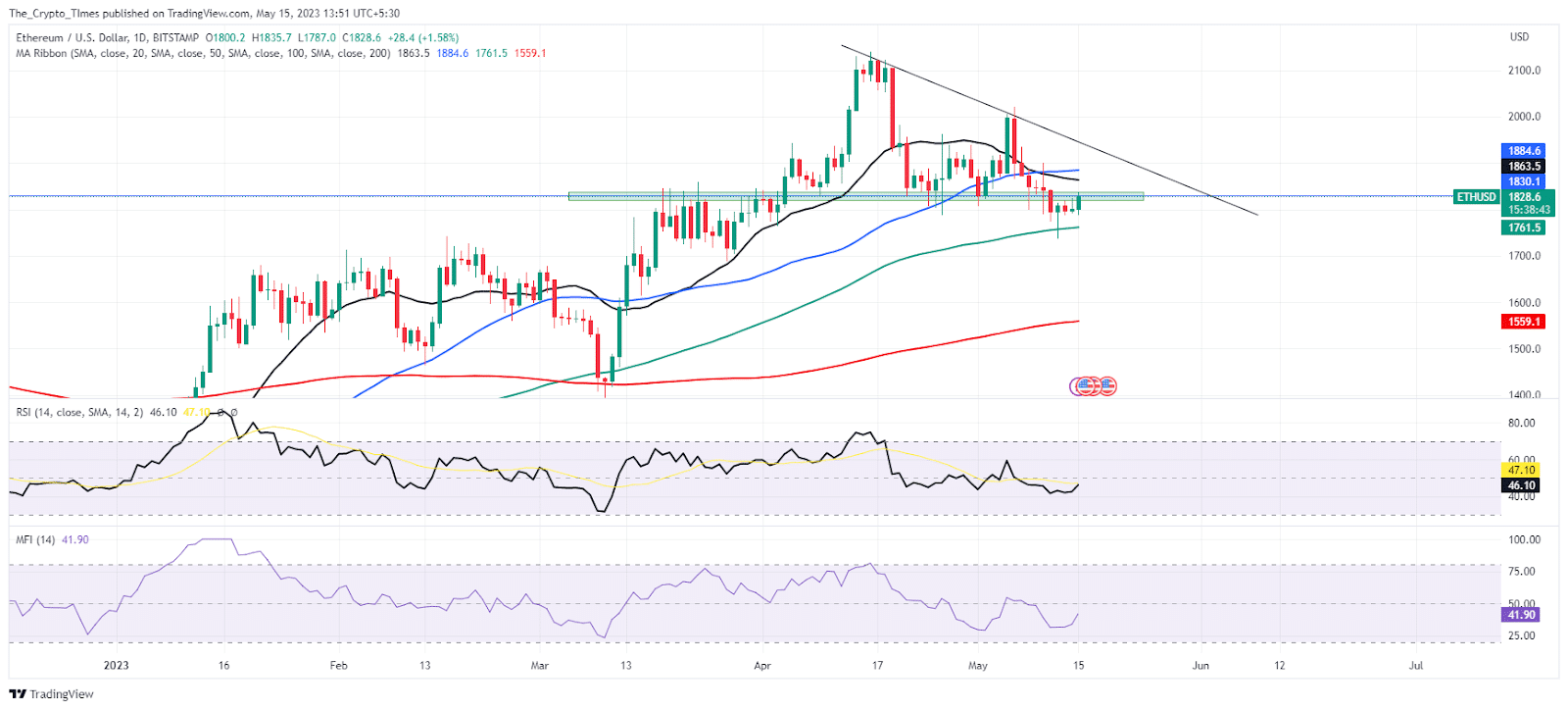

Ethereum’s price action on the daily chart found support at the 100-day simple moving average before bouncing back. However, it’s worth noting that the 20 SMA is currently below the 50 SMA, which could potentially slow down the recovery process.

The $1800 level is an important demand zone to watch, as indicated by the Money Flow Index (MFI) showing money flowing into ETH at this level. Moreover, the RSI indicator is approaching the 50 range, which could serve as a strong bullish signal for a potential continuation of the upward trend.

Also Read: PEPE Loses 60%: Is the Memecoin Trend Over?