Buyers showcased their skills in the battle with sellers last week, achieving a positive weekly closing with a modest gain of 0.29%. However, it’s worth noting that Ethereum (ETH) frequently encounters a barrier at the $1,840 resistance level, which limits further upward movement.

Last week, bulls observed an inside candlestick formation, resulting in insubstantial gains. It still outperformed Bitcoin’s bearish weekend, establishing Ethereum (ETH) as a reliable digital asset in the current market scenario.

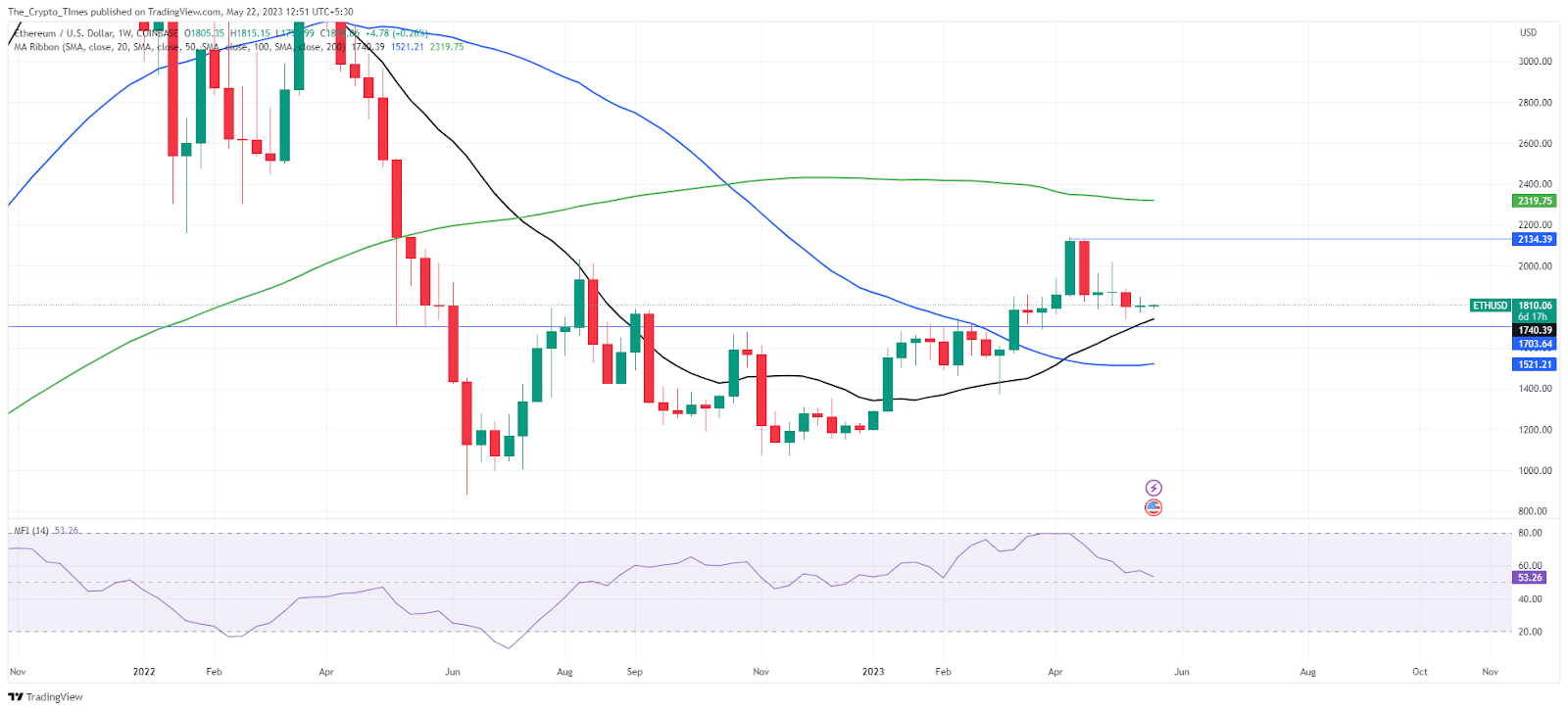

Presently, the Ethereum price remains positioned below the 100-week simple moving average but above the 20, 50, and 200 SMAs. The 20-SMA (black line) serves as an immediate support level for long-term prospects, while buyers can also find support close to the $1,740 mark. Conversely, the Money Flow Index (MFI) reached 53 zones during the decline, indicating a consistent outflow of funds from the market.

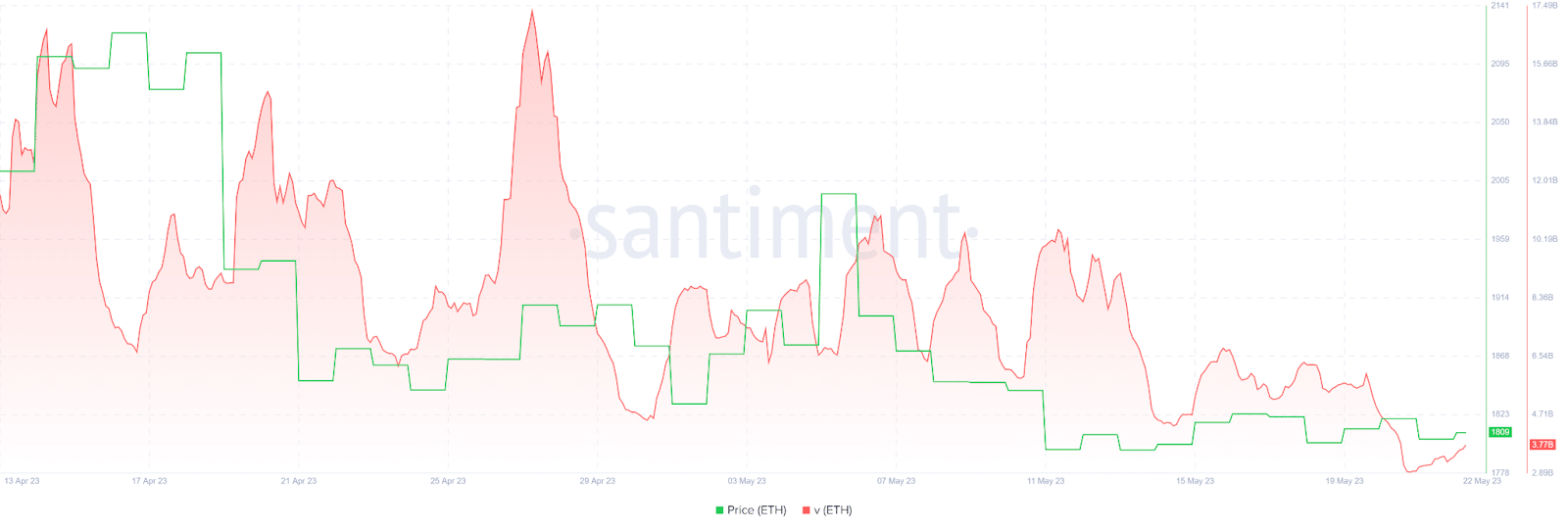

Based on Sentiment Statistics, speculators witnessed the lowest volume of the month on May 20, which amounted to $2.92 billion. However, there has been a gradual increase in volume since then. In fact, the trading volume has already risen by 19.9% overnight, reaching $3.78 billion.

A Closer Look at The Current Market Landscape

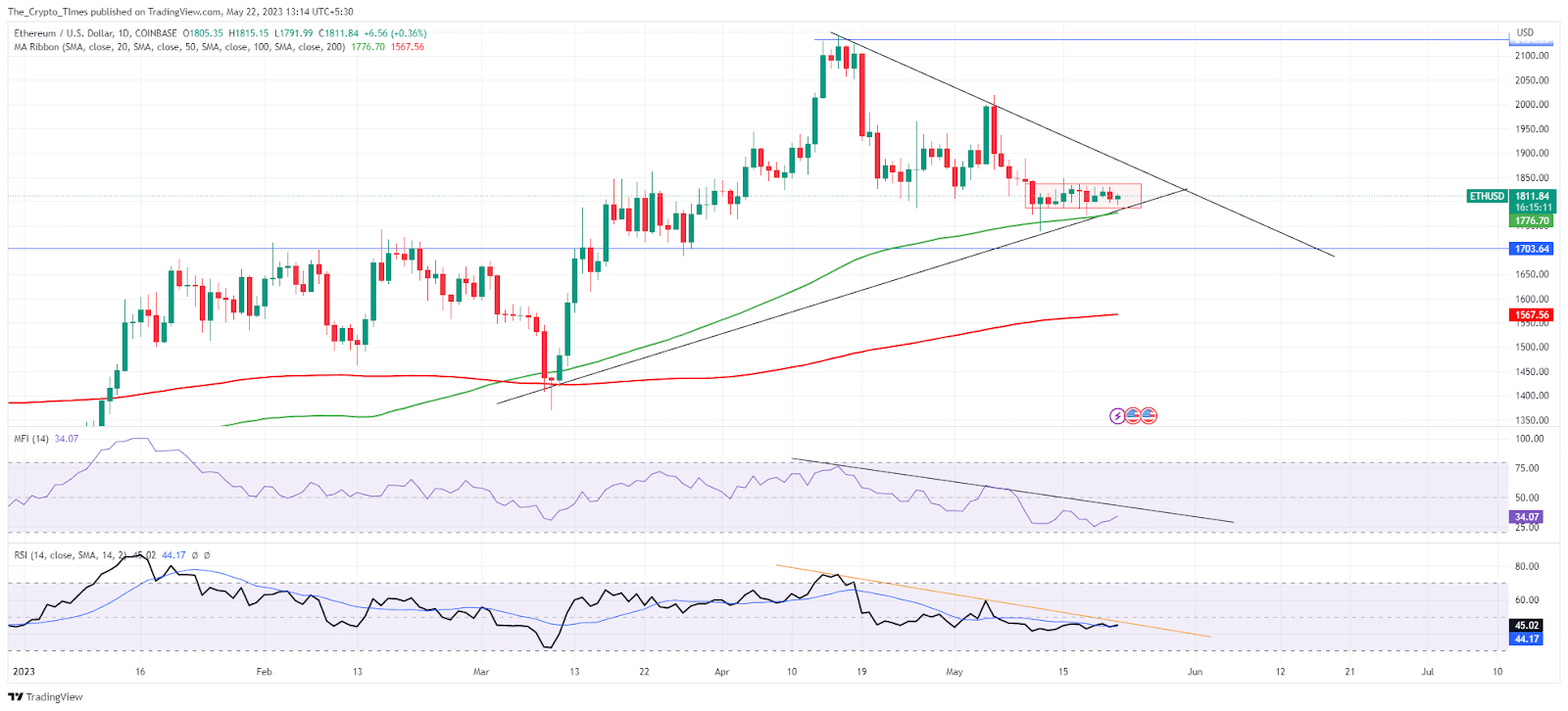

As of now, Ethereum is being traded at $1,810 and has been confined to a narrow trading range. However, the ascending support trendline is poised to provide a boost to the bullish trend if buyers manage to break through the current sideways zone.

The current price of ETH, may cross the resistance trendline, as bulls are exhibiting strong resilience using the critical support level of the 100-day SMA. Once the bullish hurdle at $1,840 is surpassed, the next potential target on the trend is the significant psychological level of $2,000.

When analyzing the daily price chart, we can observe that the MFI is gradually approaching a declining trend line. Simultaneously, the RSI is on the cusp of surpassing the immediate resistance level.

It’s worth noting that the RSI is exhibiting a bullish divergence, indicating a potentially positive signal. As the MFI is yet to shift in favor of the bulls, traders should exercise a cautious stance in the market.

Also read: Warning Signs: Bitcoin Price (BTC) Nears Critical Point, Bloodbath Looms