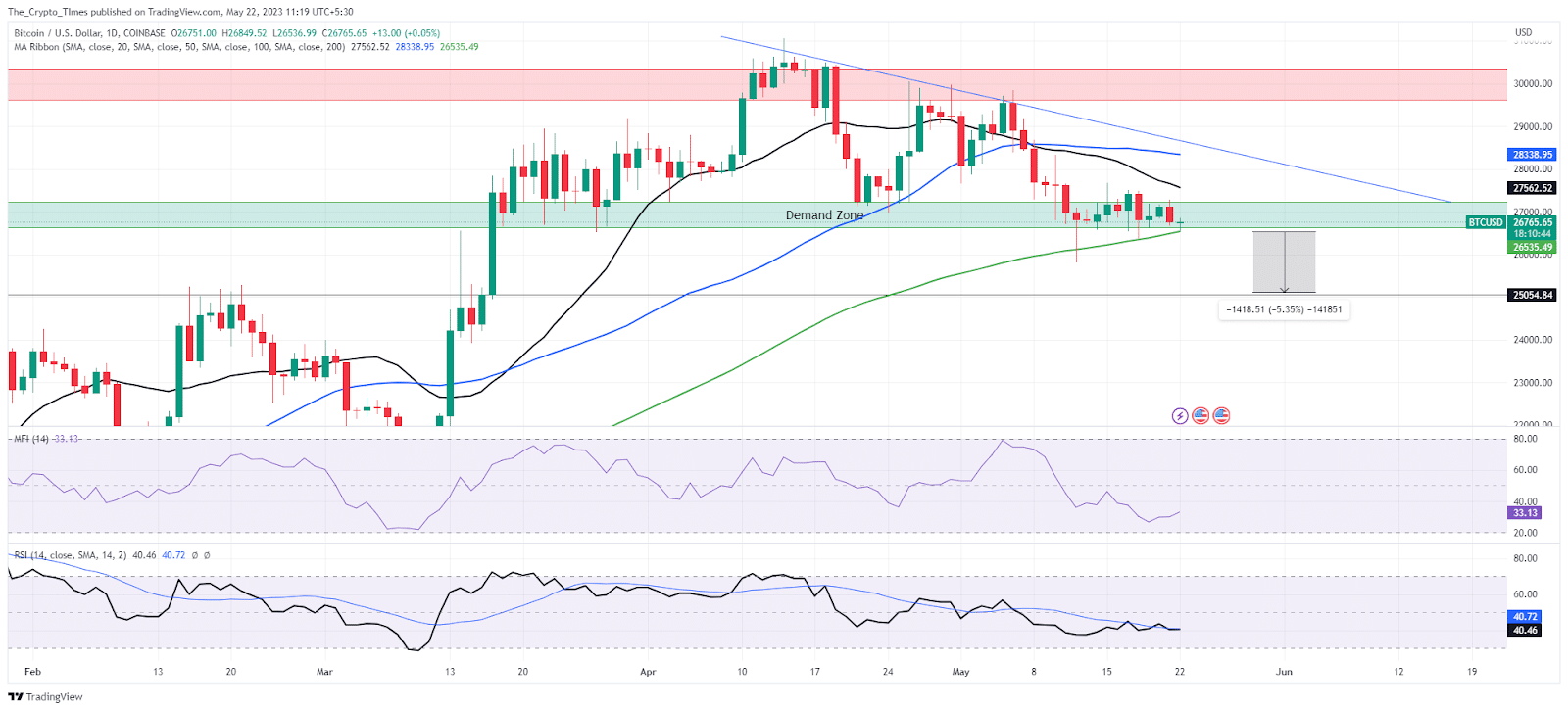

Without indicating any clear dominance between buyers and sellers, Bitcoin has been experiencing constant fluctuations within a narrow range since the previous week. This strong consolidation, occurring closer to the demand zone, presents an opportunity for accumulation at a discounted price.

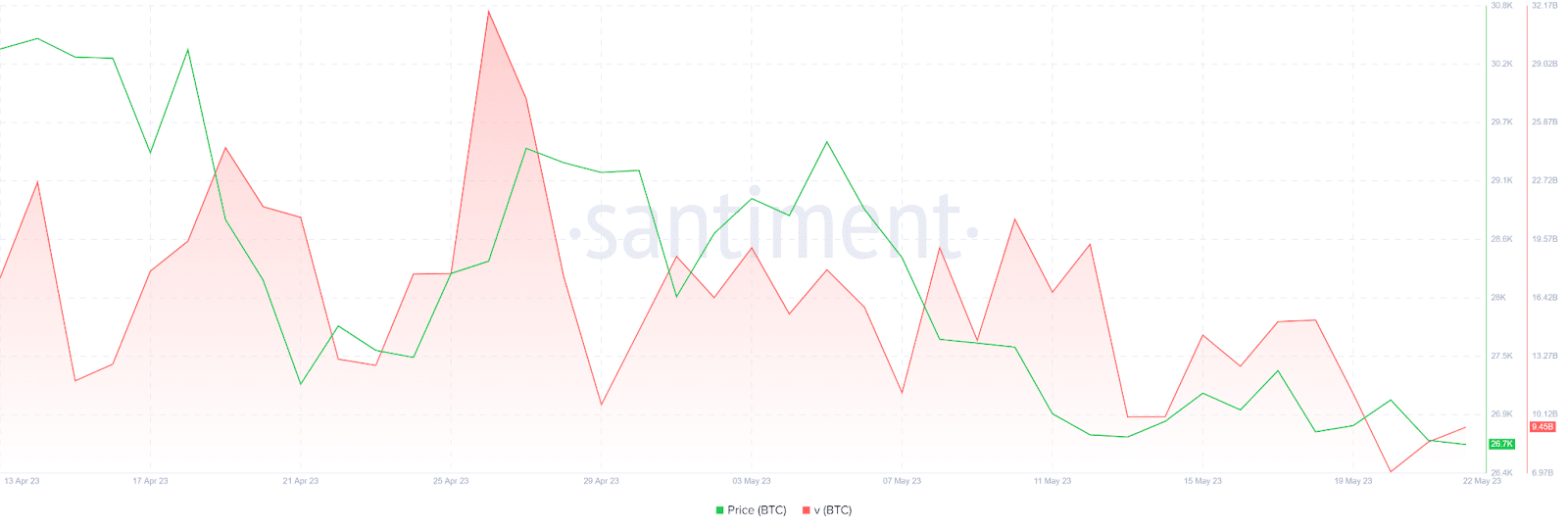

Based on Santiment data, the trading volume began to decline on May 18 and hit its lowest point of the month on May 20, reaching $7.04 billion. This decrease in trading volume indicates a lack of confidence among traders during a time of market uncertainty last week. However, with the start of the new week, bullish participation emerged, leading to a subsequent increase in volume. As a result, the volume has remained at $9.4 billion in the past 24 hours.

Bitcoin Price Teetering on the Edge of a Bloodbath: Market Fears Intensify

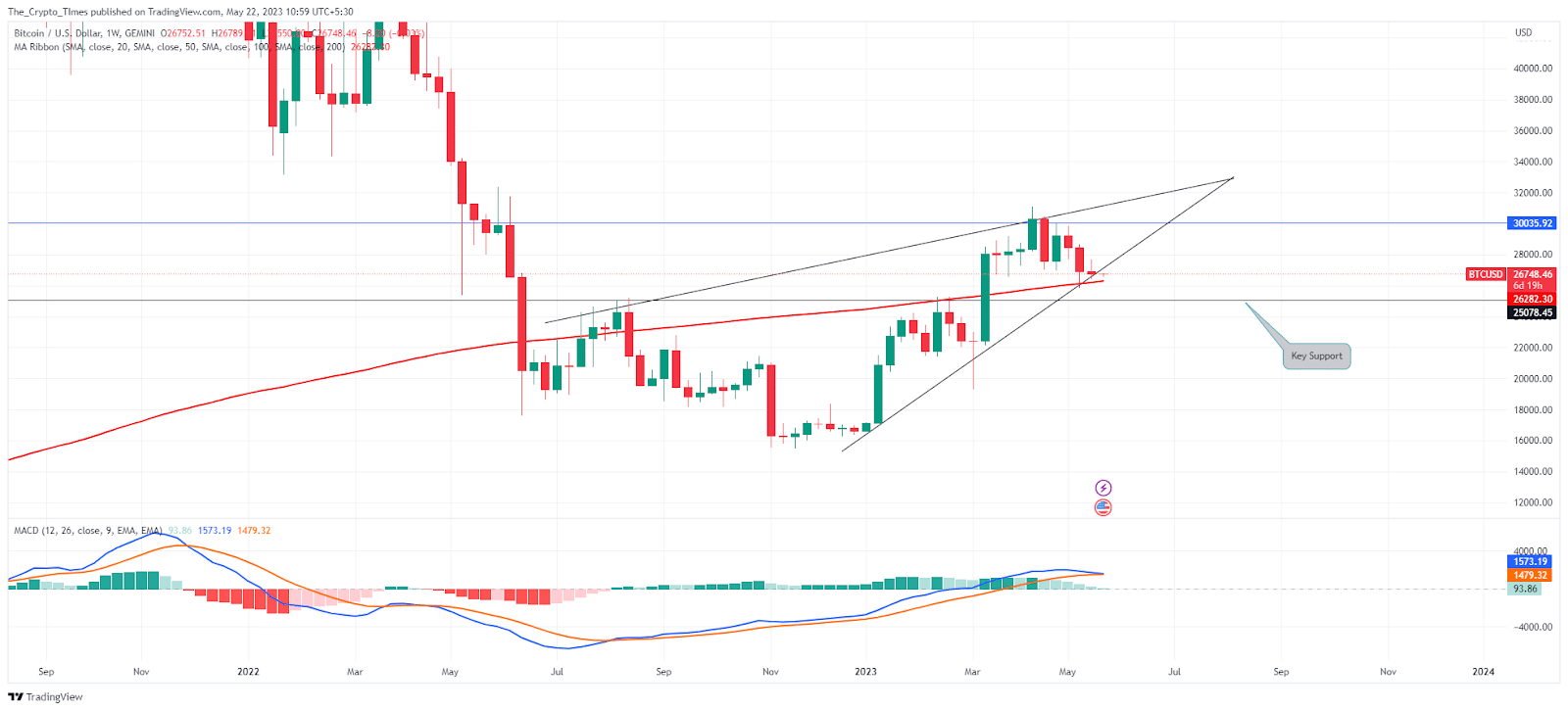

Bitcoin’s weekly price chart reveals a concerning trend, as it has recorded three consecutive bearish candles, bringing it closer to the ascending support line of the symmetrical triangle pattern. This indicates that bears are growing more confident in their dominance of the market, and if the price continues to decline, bulls could find themselves in significant trouble.

Currently trading at $26,787 with a 1.23% overnight drop, Bitcoin’s bulls are making a feeble attempt to defend themselves by managing the 200-week simple moving average. However, a potential bloodbath looms as the price hovers dangerously close to this critical level. Furthermore, the MACD indicator is on the brink of a bearish crossover, suggesting that the price may approach the $25,000 support level if the situation worsens.

Last week, Bitcoin’s price exhibited a narrow fluctuation range of just under 1300 points, ranging from a high of $27,678 to a low of $26,361, due to the demand zone indicating greed in the market. Despite this, the bulls have shown resilience by accumulating Bitcoin in anticipation of a bounceback. Additionally, the 100-day simple moving average aligns with this price point, serving as a supportive factor that enhances the likelihood of a recovery towards the 50-SMA.

As the Money Flow Index (MFI) gradually increases and reaches the 33 range, it indicates the growing participation of bulls in the market. Conversely, the Relative Strength Index (RSI) remains stagnant at the 40 levels, contributing to the prevailing uncertainty among traders.

While it is evident that bears are showing signs of exhaustion within the demand zone, they still maintain a presence in the market. It is crucial to keep in mind that a slip below the 100-SMA could potentially result in a 5% price decline for buyers.

Also read: SingularityNET’s AGIX Rose 15%: Bulls Take Charge in Crypto Market