Investors were taken aback this week by the unexpected integration of the web3 move-to-earn game, STEPN, with tech giant Apple Pay. This surprising development has acted as a catalyst for STEPN’s native token, GMT, causing its price to soar throughout the week.

On Monday, the Australian blockchain fitness app STEPN announced the integration of Apple Pay as a fiat onramp for in-app purchases, aiming to improve accessibility and expand their user base.

According to Jerry Huang, the Co-founder of Find Satoshis Labs (FSL), the company behind STEPN, “the integration of Apple pay propels web3 technology into mainstream adoption.”

As a result of this significant development, STEPN’s GMT token experienced a notable boost, leading to an impressive overnight increase of nearly 13% in its price. At present, the GMT token is valued at $0.302, reflecting the positive impact of these recent developments.

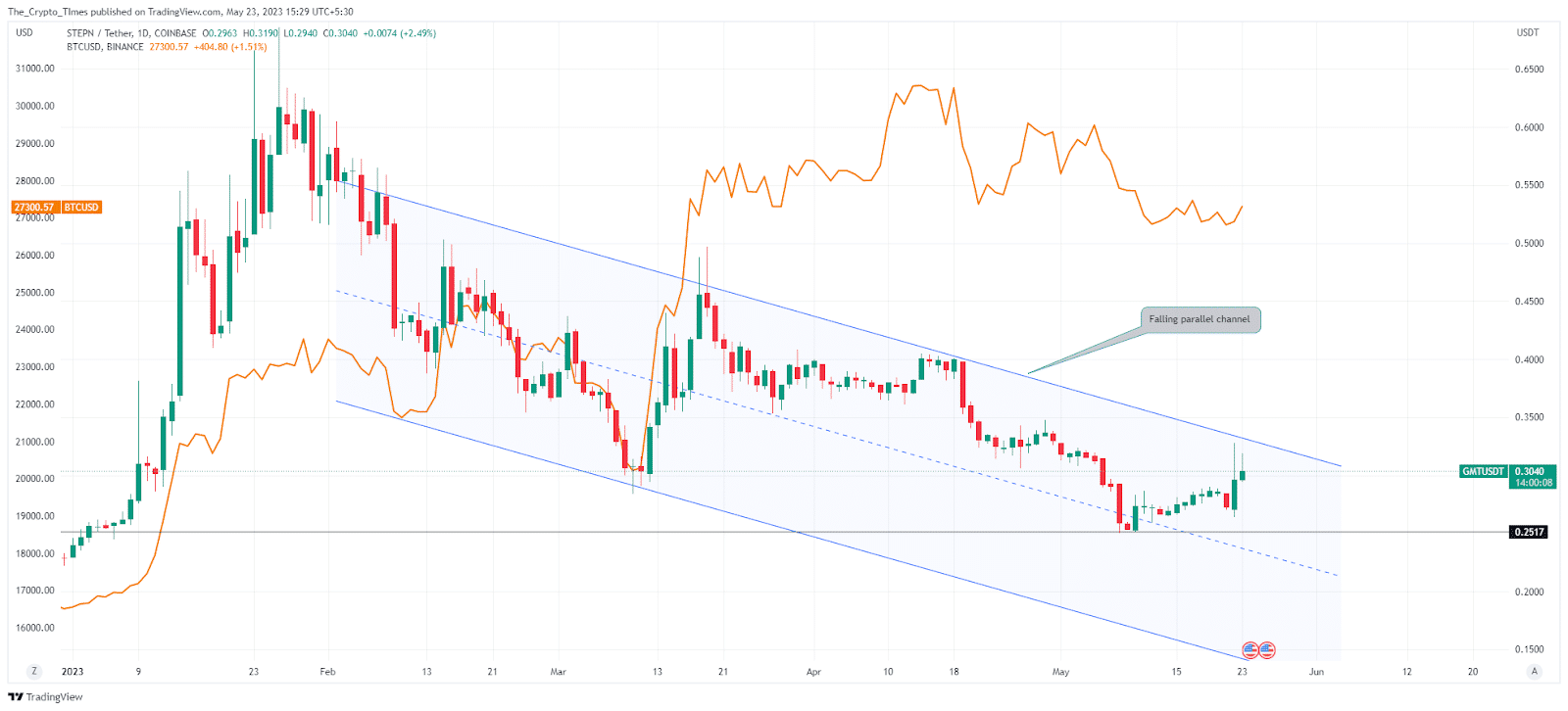

Over the past few weeks, STEPN has shown underperformance on the daily price chart, consistently staying within a falling parallel channel. Interestingly, the price action of STEPN (GMT) appears to closely mimic that of the prominent cryptocurrency, Bitcoin, as depicted above in the chart. If Bitcoin once again approaches the resistance zone around $30K, it could potentially provide an opportunity for STEPN investors to break free from this bearish range.

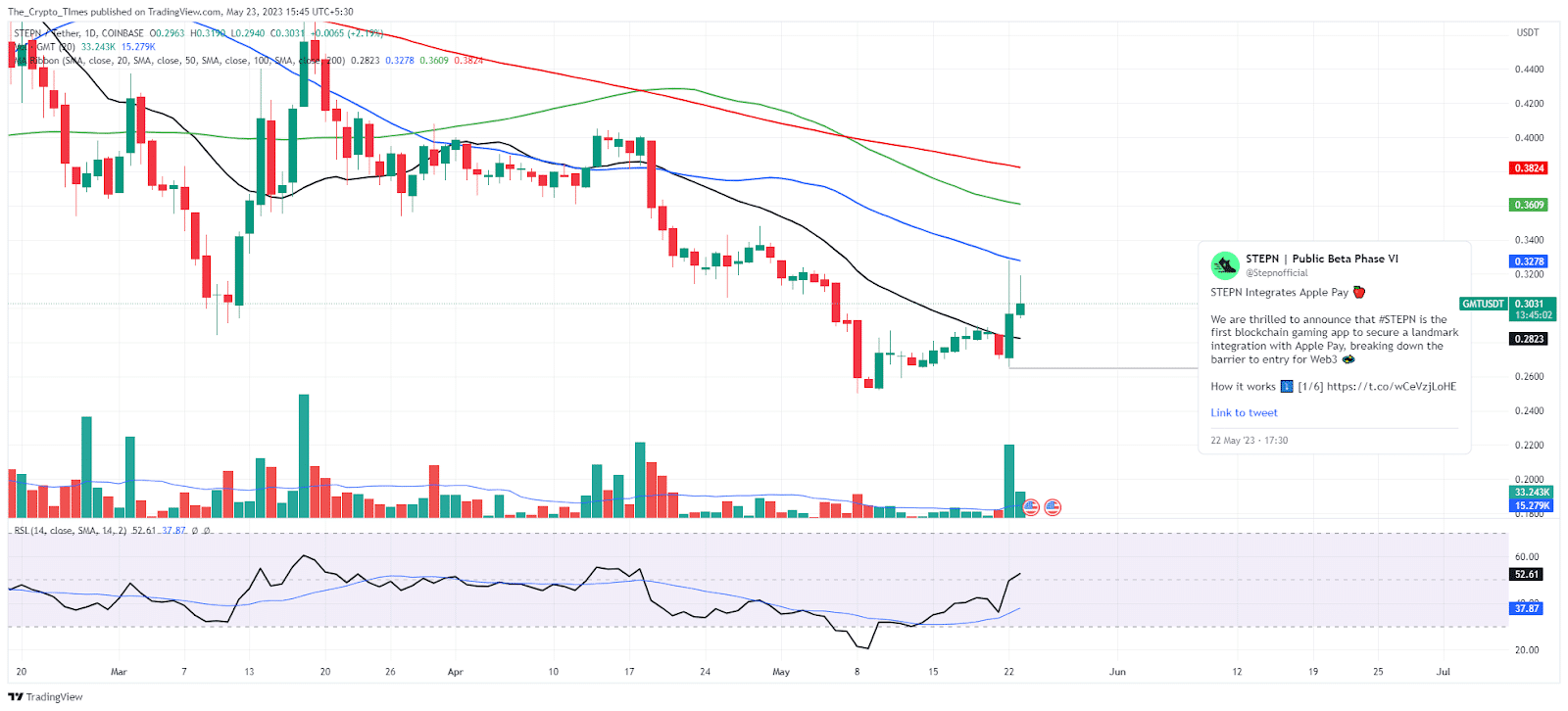

The recent integration news of Apple Pay has propelled the price of STEPN (GMT) closer to the 50-day simple moving average, positioned at the $0.33 level. This moving average serves as an immediate bullish obstacle for the price to overcome.

Notably, significant buying and selling activities were witnessed last night, as indicated by the volume bars. However, there has been a slight decrease in trading volume, which currently stands at $234.2 million over the past 24 hours.

Following 30 trading sessions, the daily RSI indicator has surpassed the 50 mark, indicating a positive outlook with a reading in the 52 range. The 50-day simple moving average (50-SMA) continues to pose an immediate hurdle, but if the price manages to rise above that zone, bulls could potentially witness an additional 10% gain.