Blur, a well-known NFT marketplace, introduced an innovative feature on its ETH borrowing platform. Borrowers can now make smaller, periodic payments instead of repaying the entire loan amount in one go, offering them enhanced flexibility.

This new feature applies to both NFTs purchased through Buy Now, Pay Later (BNPL) options and directly borrowed NFTs, providing a convenient payment solution in the DeFi sector. It offers an effective method for repaying loans in the decentralized finance space.

The concept of borrowing at a nearly 0% interest rate to purchase high-value blue-chip NFTs, like BAYC or CryptoPunks, seemed irrational and appeared to primarily serve $BLUR farmers.

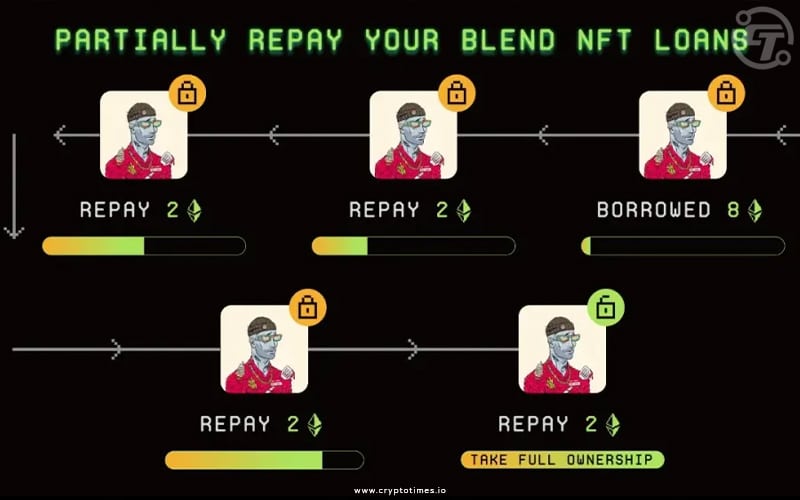

With this new feature, borrowers can initiate their loans with a minimum payment of 0.1 ETH, regardless of the total amount owed. Blur’s announcement introduces an opportunity for borrowers to refinance their loans, potentially obtaining more favorable interest rates.

Borrowers can easily select their preferred repayment amount by dragging the Repay Amount slider, allowing them to customize their loan repayments according to their financial situations and goals. This feature empowers borrowers to align their repayments with their needs and objectives.

This new repayment option improves borrowing and promotes inclusivity in decentralized finance, making it easier for borrowers and contributing to a sustainable and responsible lending system. The platform offers greater flexibility, enhancing the borrowing experience and accessibility.

Also Read: Blur Unveils Blend: NFT Collateral Perpetual Lending Protocol