A somber atmosphere envelops the Multichain (MULTI) cross-chain bridge as ominous clouds gather overhead. Investors find themselves grappling with the aftermath of a brutal market downturn, witnessing a drastic 50% price plummet within a mere five days. The outlook remains grim as technical indicators point towards a continuation of selling pressure, painting a picture of unfavorable circumstances for Multichain’s future.

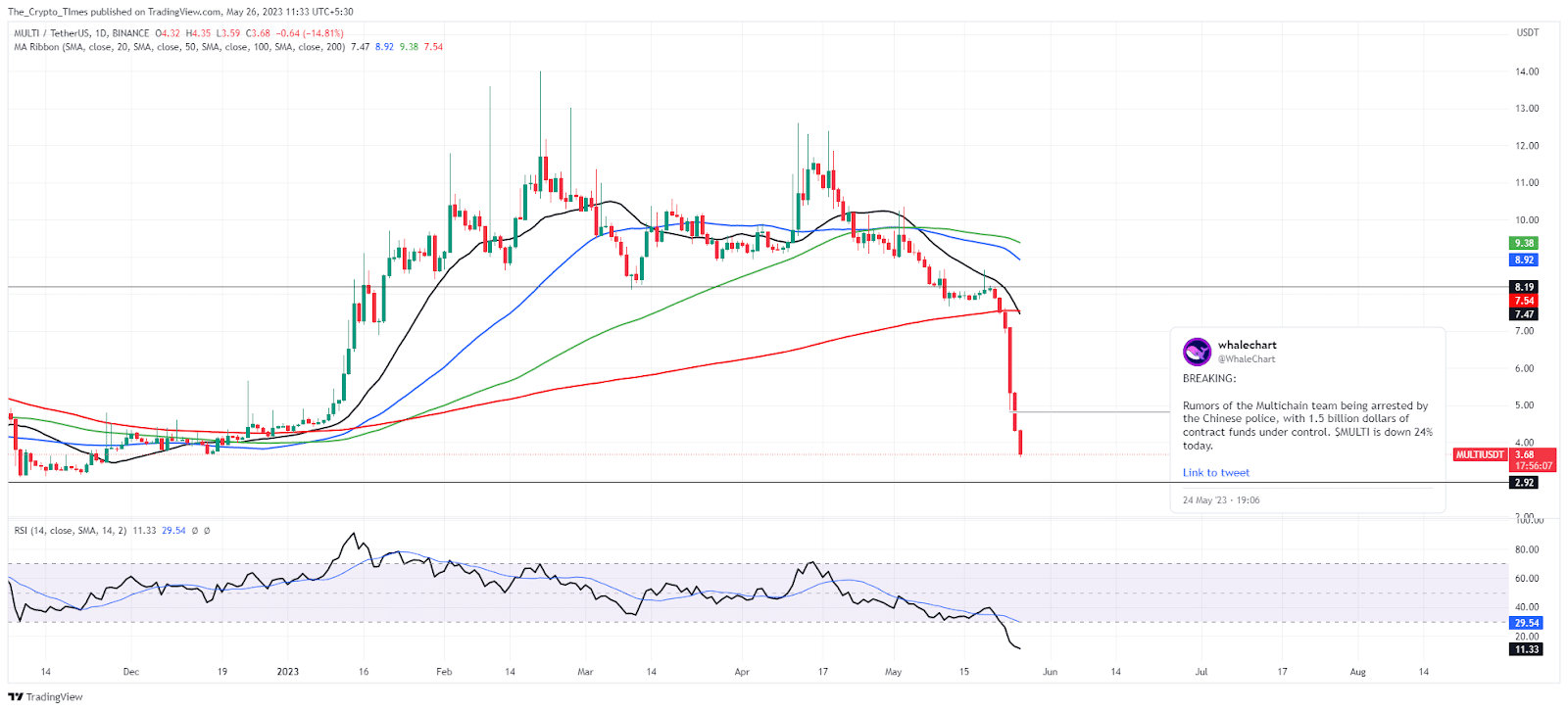

During the course of this week, Multichain (MULTI) experienced a significant decline in its price, plunging by over 50% from $7.9 to $3.59. This substantial drop has unleashed a wave of intense selling pressure within the market.

The catalyst for this aggressive sell-off was the influx of user complaints surrounding transfers and stuck transactions that inundated MultiChain’s Telegram group on Sunday, acting as a clear indication of the issue’s onset.

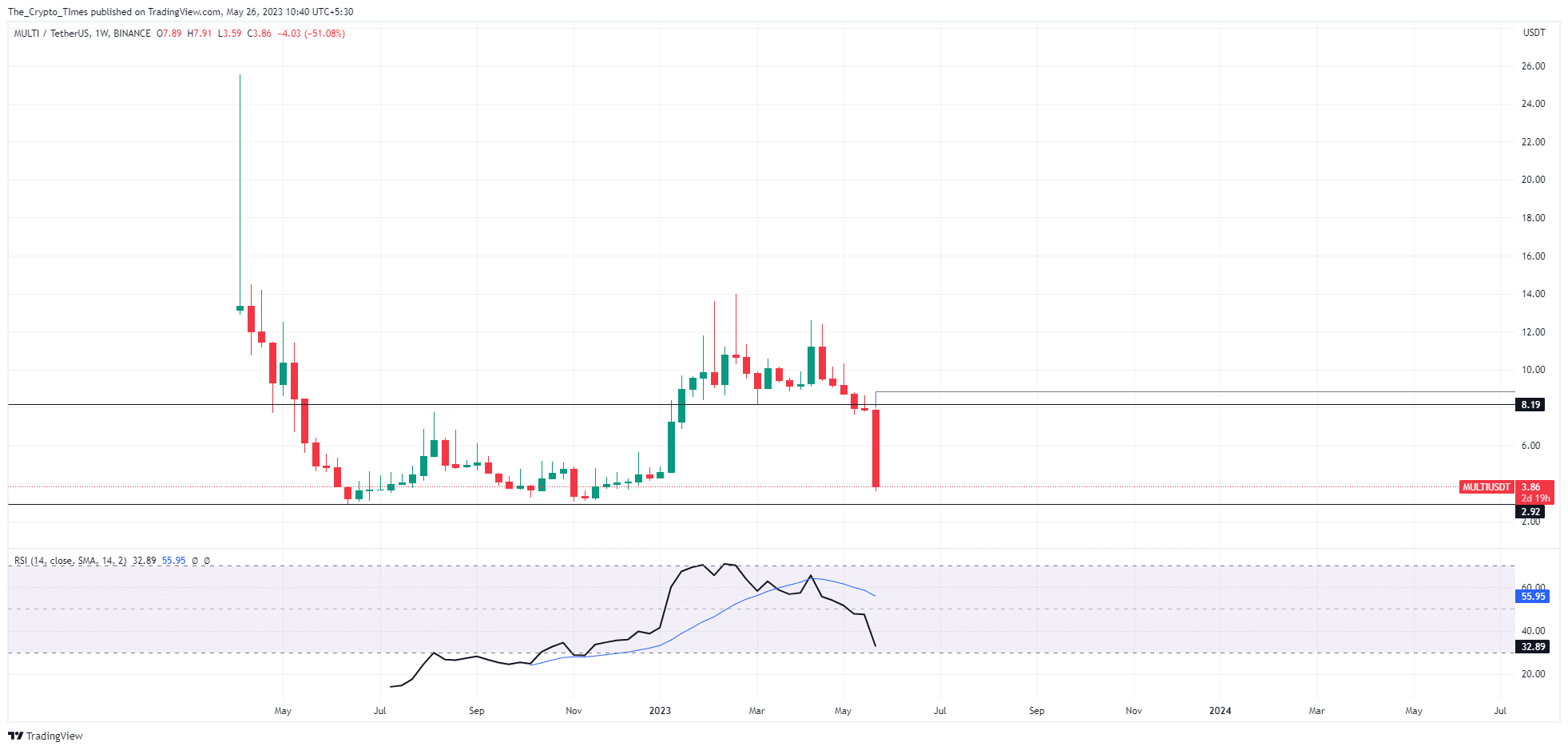

Weekly Chart Indicates Further Drop Ahead For MULTI Token

The MULTI token has been grappling with persistent selling pressure over the course of the past six weeks. Adding to the turmoil, the aggressive selling witnessed this week has pushed the asset price perilously close to its 52-week low of $2.9.

As of the time of writing, Multichain’s (MULTI) price stands at $3.72, accompanied by an overnight drop of 28.16%, based on data sourced from CoinMarketCap.

The weekly Relative Strength Index (RSI) has been on a steady decline, currently residing within the 32 range. This downward trend in the RSI indicates the possibility of further decline in MULTI’s value in the days to come, until it approaches the threshold of the overbought zone.

The Multichain team remains steadfast in their efforts to resolve the issue and alleviate the turmoil. In a recent update, the Fantom Foundation provided some relief by stating that “The Multichain bridge with Fantom is operating as normal.” However, even with this reassurance, the market has yet to find healing, as investor sentiment continues to be affected.

Consequently, the daily Relative Strength Index (RSI) plummeted to exceedingly oversold territory, hitting a low of 11. Simultaneously, the MULTI token broke through multiple crucial support levels, encompassing various moving averages.

Presently, investors are pinning their hopes on the yearly low of $2.9, which stands as their final ray of optimism amidst the challenging circumstances.