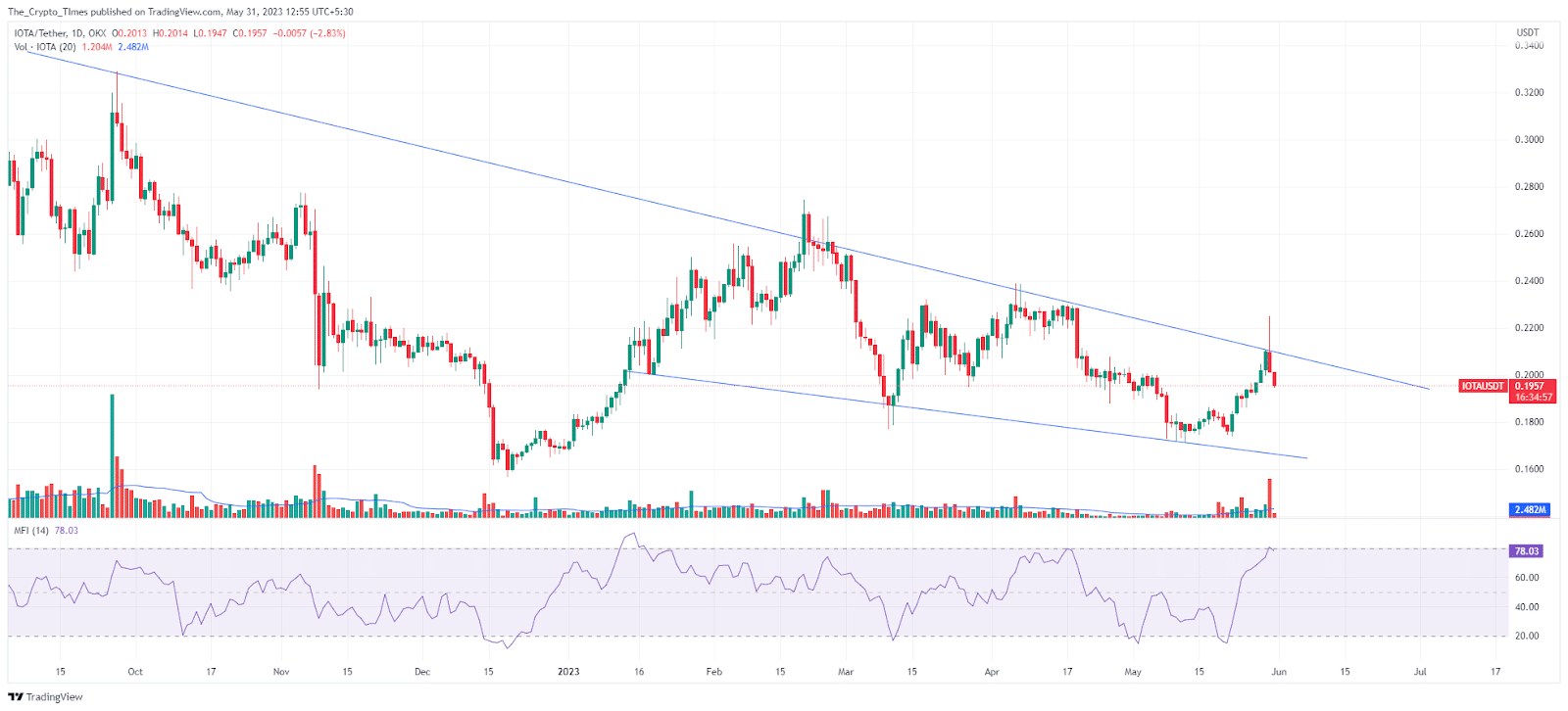

Over the past few days, the price of IOTA has displayed significant volatility with frequent fluctuations. Notably, the token experienced a downturn, reaching a low of $0.1715 over a 90-day period. This decline coincided with a retracement phase in Bitcoin’s trading.

Over the course of the past nine trading sessions, MIOTA, the native cryptocurrency of IOTA, has experienced a significant surge of over 30%, moving from 0.1740 to $0.2250. This increase occurred despite the presence of selling pressure on several other prominent cryptocurrencies. As a result, the IOTA/USDT pair reached its highest level in the past 30 days, reaching $0.2250 last night.

Currently, the IOTA/USDT pair is trading at the $0.1961 level, exhibiting an overnight decline of 11.2%.

Since October, the price structure of the IOTA cryptocurrency has consistently been forming higher-low patterns. This particular price structure seems to be a crucial zone predominantly controlled by bears, as evidenced by their aggressive selling of the IOTA/USDT pair last night. Remarkably, this selling pressure persisted despite the strong buying pressure exhibited by the bulls.

According to CoinMarketCap, the trading volume skyrocketed to $30.4 million within the past 24 hours. Traders experienced an exceptionally volatile day on Tuesday. Notably, the Money Flow Index (MFI) has entered the higher zone, suggesting the possibility of an impending price decline.

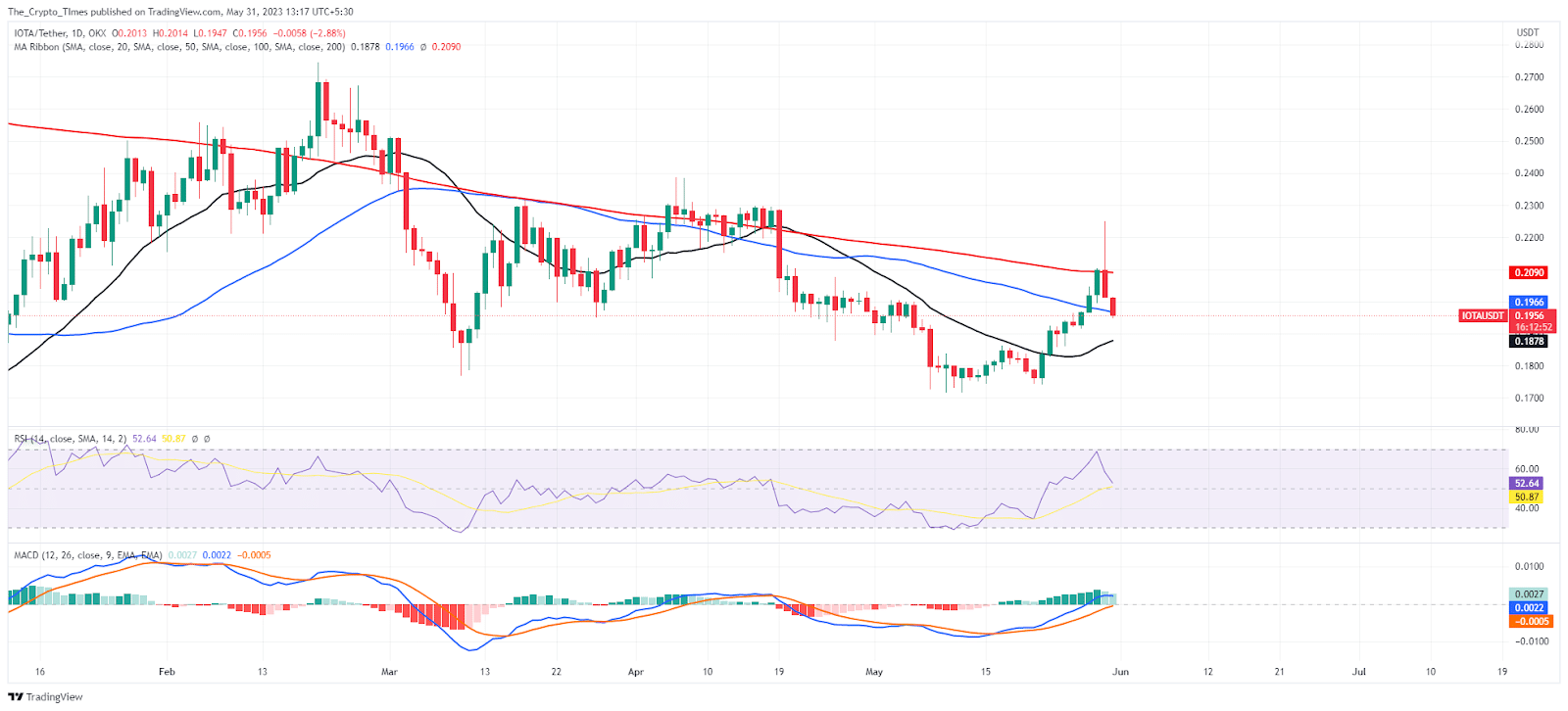

The 200-day simple moving average is serving as a significant resistance level for bears, causing the IOTA price to approach the 50-day simple moving average (SMA), which is acting as immediate support.

However, the RSI indicates a potential decline after reversing from its peak. Conversely, the MACD is still displaying a slightly positive outlook on the daily price chart. If the IOTA/USDT price falls below the 50-SMA, buyers might face an additional 5% decline in the near future.

Also Read: Bitcoin’s Price Rebounds, Bulls Targeting $30,000 Resistance