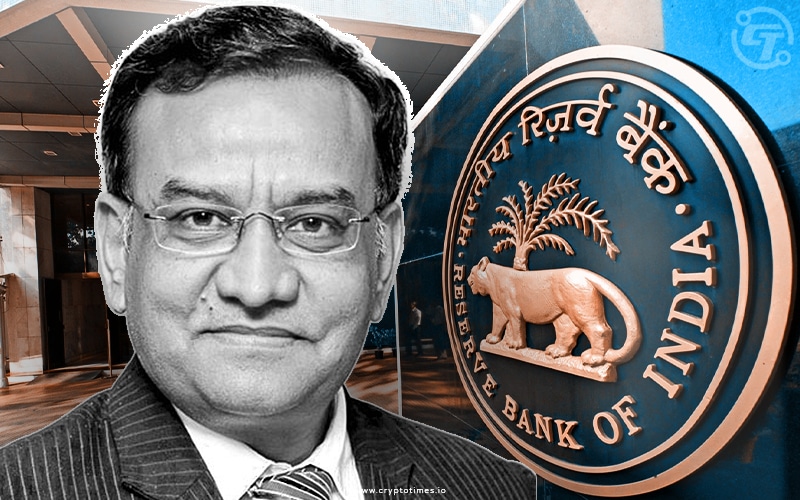

In a recent conference organized by the Reserve Bank of India (RBI), Deputy Governor Mahesh Kumar Jain emphasized the need for Indian banks to adopt artificial intelligence (AI) and blockchain technology to ensure sustainable growth and stability.

Addressing the directors of Indian banks, Jain highlighted the evolving risks faced by the banking sector, including technological disruptions, changing customer expectations, and cybersecurity threats.

Jain stressed the significance of effective corporate governance and robust governance structures and processes as essential components of risk management. To tackle the challenges posed by these emerging risks, he recommended a strong focus on technology adoption.

In particular, Jain advised Indian banks to embrace innovative technologies such as AI and blockchain, while also prioritizing digital transformation, enhancing customer experience, and investing in cybersecurity measures.

The deputy governor’s recommendations align with the RBI’s commitment to promoting technological advancements and digitalization within the banking sector.

India’s central bank had previously launched its central bank digital currency (CBDC) on November 1, 2022, and began testing its functionality in March.

Ajay Kumar Choudhary, RBI executive director, had earlier expressed India’s intention to establish the CBDC as a medium of exchange.

Also Read: Digital Rupee: What Indians Need to Know

By embracing AI and blockchain, Indian banks can leverage the potential of these transformative technologies to streamline operations, enhance risk management, and provide innovative financial services to their customers.