This week, the XDC Network, an open-source blockchain protocol previously referred to as XinFin, experienced significant buying pressure. This surge in interest comes at a time when prominent cryptocurrencies such as Bitcoin and Ethereum are currently undergoing a retracement phase.

Following a successful collaboration on May 31st, the XDC Network witnessed a sudden influx of funds. This development was a result of their partnership with SBI VC Trade, a subsidiary of the Tokyo-based financial holding company SBI. The collaboration aims to establish a strong presence in the Japanese market.

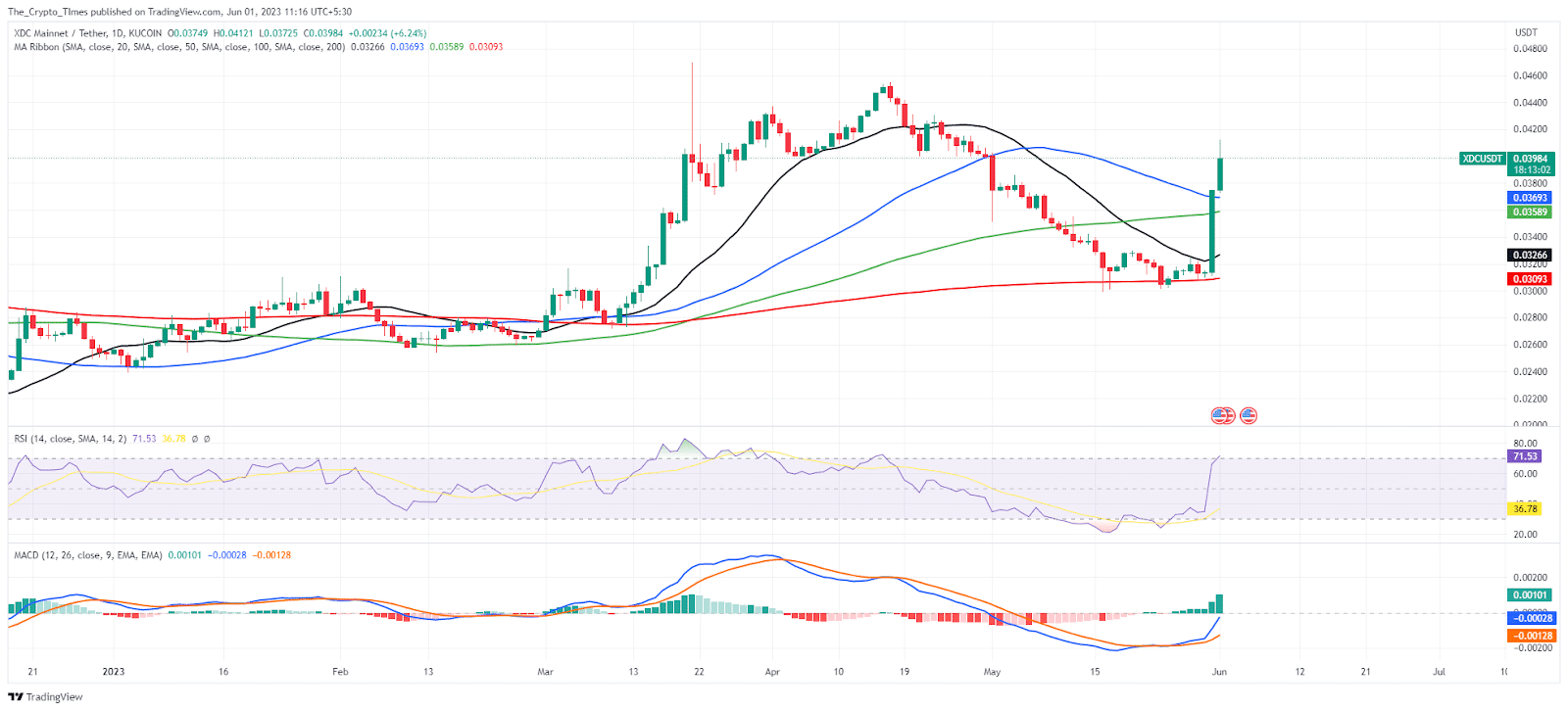

The recent announcement had a significant impact on the XDC token, the native cryptocurrency of the XDC Network. Within a span of just two trading sessions, the token surged by over 30%, rising from $0.0311 to $0.0412.

Can Positive Developments Propel XDC to Annual High?

As of the time of writing, the XDC token is currently trading at $0.03938, showing an impressive overnight gain of 25%. This remarkable performance has positioned the XDC token as the top gainer of the day, as reported by CoinMarketCap.

At present, the XDC/USDT pair is making efforts to conclude the daily price candle above the $0.618 level of Fibonacci retracement. This particular level serves as crucial immediate support going forward.

An interesting observation is that the Money Flow Index (MFI) indicates a notable surge in buying pressure. This signifies a positive environment that buyers can capitalize on, leveraging this encouraging indicator.

The price of XDC has successfully surpassed several important moving averages, including the 20, 50, 100, and 200 periods. Among these, the 200-period Simple Moving Average (SMA) has emerged as a significant support level, while the bulls have established the 50-period SMA as an immediate demand zone.

The Relative Strength Index (RSI) is approaching the overbought territory, currently residing in the 71 range. Meanwhile, the MACD indicator is on the verge of entering the positive range. These indicators collectively suggest a positive outlook, which could potentially fuel a rally in XDC’s price, with the target set at its annual high of $0.047.

Also read: Hedera Network Hits 10B Transactions: HBAR Price Under Pressure