Investors have been grappling with profit-making challenges as selling pressure persists in the crypto market. In the past week, Bitcoin witnessed a short 3.9% decline, whereas Ethereum, the second-largest cryptocurrency, experienced a comparatively negligible drop of 1%.

As per the present price momentum, Ethereum (ETH) has dipped below the critical support level of $1,900 and is currently trading at $1,870, reflecting a 1.8% overnight decrease. CoinMarketCap data indicates a significant 43% surge in trading volume overnight, amounting to $4.81 billion, indicating a growing interest from bearish traders.

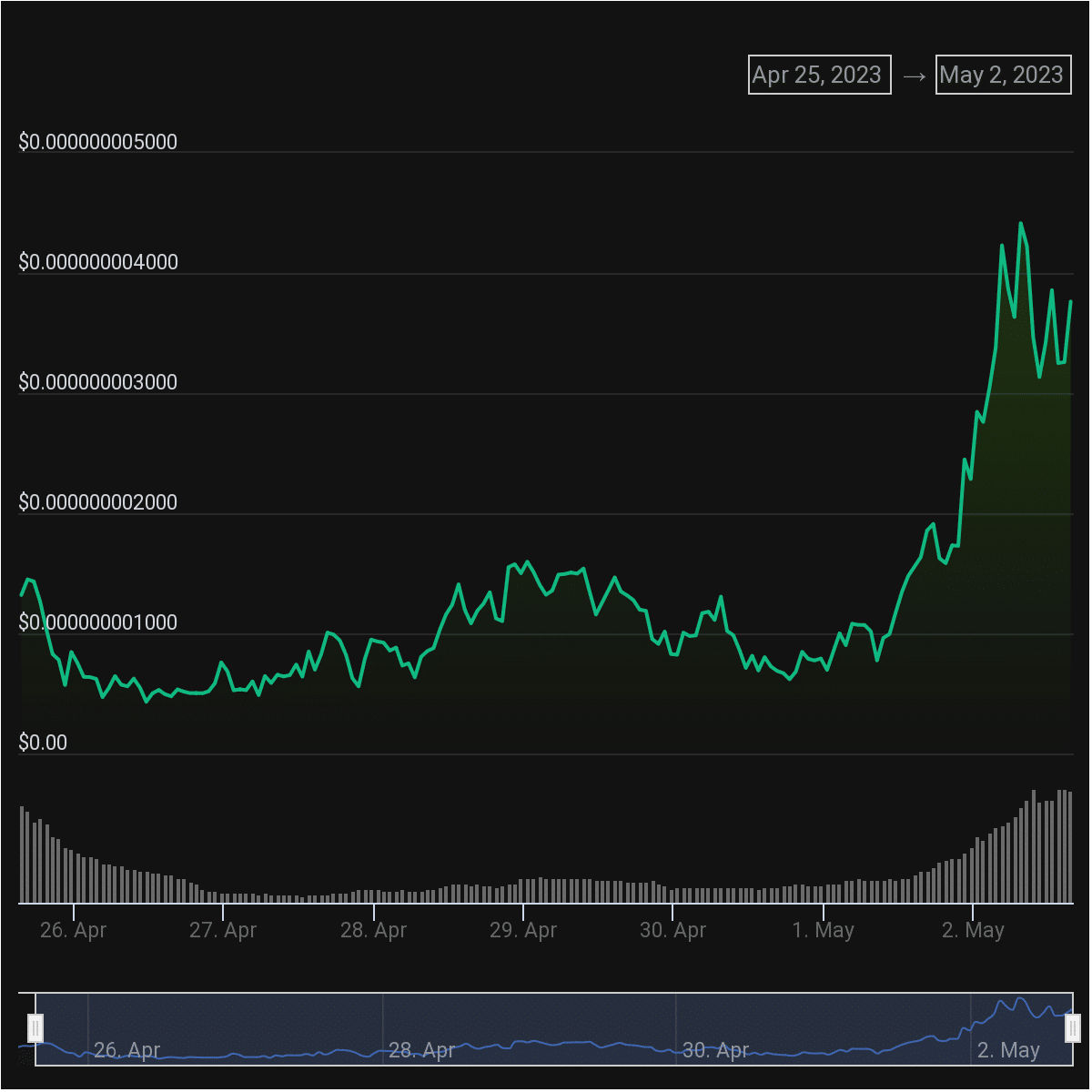

Santiment’s data reveals a gradual surge in volume during the retracement phase, raising concerns about intensified selling pressure. Notably, the line chart exhibits a double top pattern, suggesting the possibility of a price decline towards the 30-day Moving Average (depicted in blue)

Weekly Price Chart Signals Potential 5% Decline for Ethereum

Similar to Bitcoin, the second-largest cryptocurrency, Ethereum (ETH), is mirroring its counterpart’s trajectory on the chart. After a short 1% price decline last week, ETH is encountering bearish sentiment in the opening session of this week, though experiencing only a 1.08% drop.

ETH is currently struggling at the 0.618 level of the Fibonacci retracement, priced at $1,910, which has served as a strong resistance zone for bears over the past two weeks. The 20-week SMA sits at $1,775, acting as a crucial support level. If buyers fail to orchestrate a swift recovery, ETH may potentially see a further 5% decline towards this support level.

Ethereum (ETH) is currently trading within the confines of a narrow range, forming a triangle pattern. The direction of ETH’s next move, whether upwards or downwards, remains uncertain. However, the 20-day Simple Moving Average (SMA) is in close proximity to the current price, which could potentially act as a catalyst for ETH’s recovery.

The daily Relative Strength Index (RSI) is indicating a bearish crossover below the moving average, although the RSI itself is holding steady around the 51 range. Meanwhile, the Moving Average Convergence Divergence (MACD) is continuing its upward movement within the positive region. The breakout from this symmetrical triangle pattern will likely provide a clearer directional view for Ethereum’s next move.

Also Read: Tron Price Soars 10% as it Expands to Ethereum Blockchain