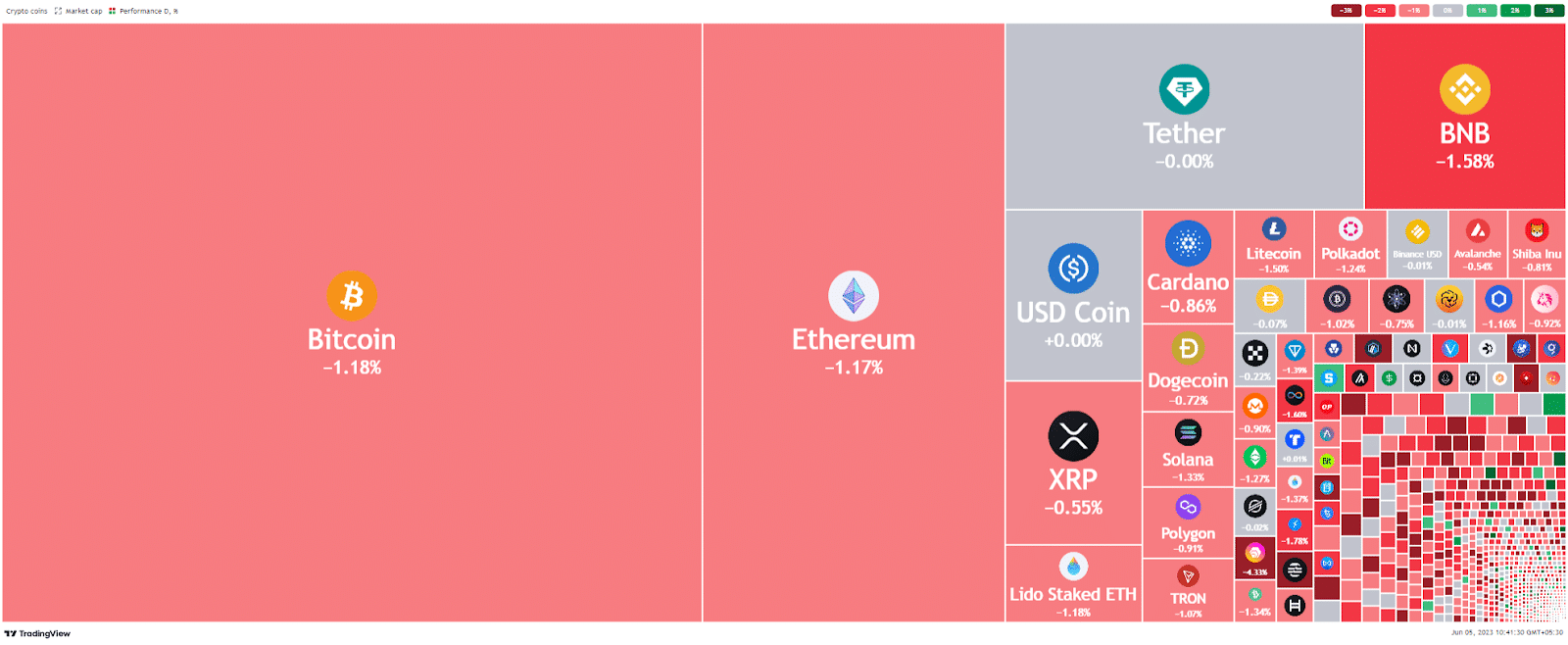

Once again, the cryptocurrency market finds itself painted in red as the price of Bitcoin grapples with the prevailing dominance of bears. After reaching its annual high of $31,170, Bitcoin has entered a retracement phase, causing a setback and prompting concerns among investors. As a result of this market trend, the overall crypto market capitalization has receded to $1.13 billion today.

The recent 1.18% decrease in the value of the leading cryptocurrency, Bitcoin, has sparked unease among investors. At the time of writing, BTC is being traded at $26,810. This decline has ripple effect on other altcoins, with Ethereum and several others following a similar trajectory.

In a repeat occurrence, the bears have exerted their influence on the price of Bitcoin (BTC), causing it to drop below the immediate support zone of $27,000. As a result, the trading volume has witnessed a significant surge of over 35% in the past 24 hours, reaching $11.11 billion, as reported by Coinmarketcap. This notable increase in volume during a crucial breakdown of support indicates a substantial presence of sellers outweighing the number of buyers.

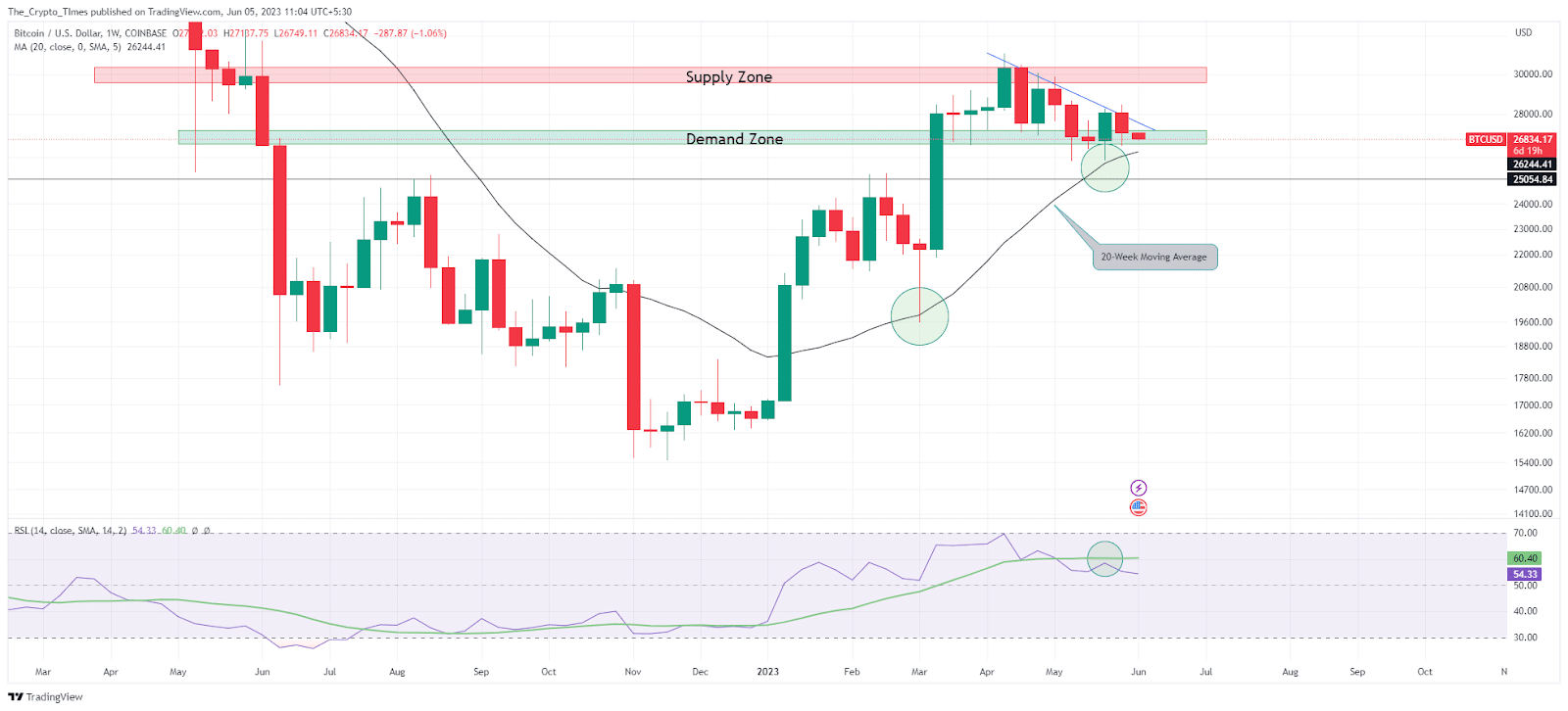

Throughout the previous four months, the price of Bitcoin (BTC) has exhibited a pattern of finding support twice at the 20-week simple moving average on the weekly chart. If the bears continue to sell BTC, it is possible for the cryptocurrency’s value to decline toward the 20-SMA before a potential short-covering rally.

Furthermore, the weekly Relative Strength Index (RSI) is currently trending downwards, approaching the 14-week moving average, indicating a relatively sideways movement for this week.

Bearish Outlook: Potential Price Drag for Bitcoin This Week

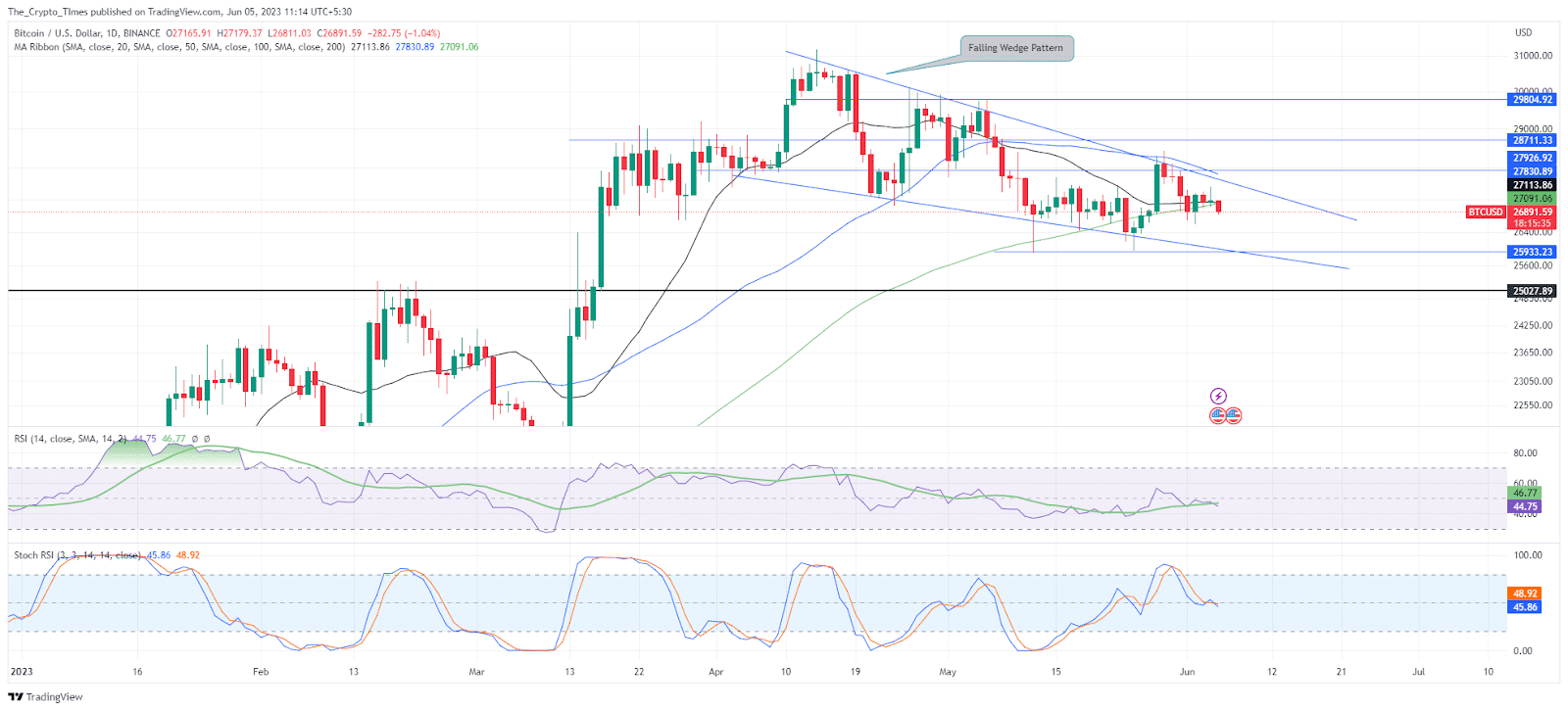

During the previous week, buyers experienced notable selling pressure as the price of Bitcoin (BTC) declined by 3.19%. Unfortunately, this selling pressure has persisted into this week, primarily due to BTC’s price being under the falling wedge pattern. Over the past few weeks, buyers have consistently struggled to overcome this bearish pattern, which has consequently led to sellers pushing the price of Bitcoin below the 20, 50, and 100-day SMAs.

Despite the relatively flat appearance of the simple RSI at the 45 range, it is important to note that the overall sentiment still favors the bears. Moreover, the Stochastic RSI on the daily price chart is trending toward the oversold zone. This indicates that, from a short-term perspective, buyers might expect further price decline during this week.

On-Chain Metrics Point Towards Long-term Bullish Outlook

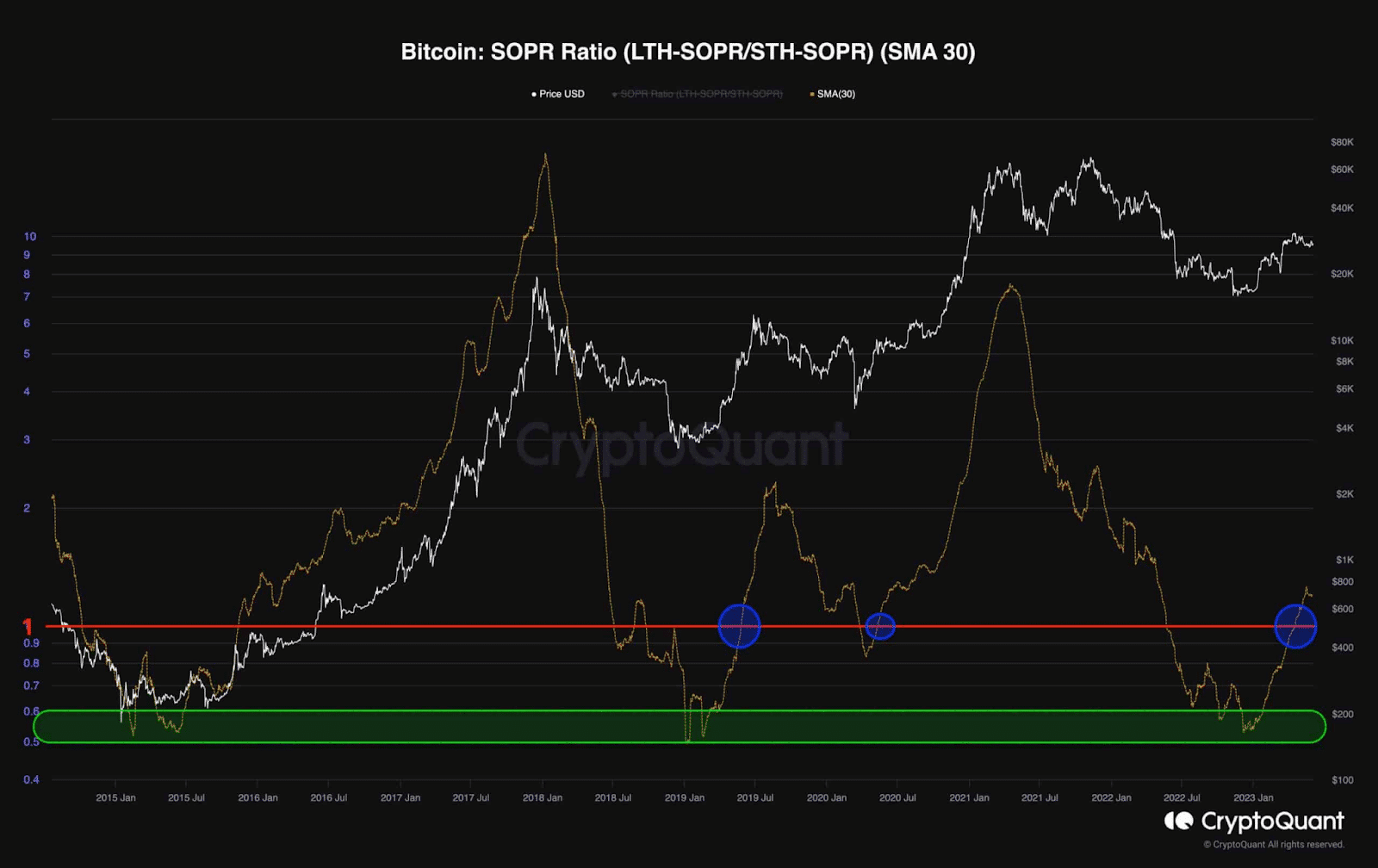

While the short-term outlook appears bearish, on-chain metrics provide a glimmer of hope for long-term investors. The SOPR ratio metric and Bitcoin’s price have historically correlated, indicating long-term investment opportunities during bear markets. The current uptrend, surpassing 1, aligns with successful bull runs in the cryptocurrency market.

Also Read: Now Chat With AI Version Of Bitcoin Creator Satoshi Nakamoto

What does this mean for the Bitcoin Price?

The cryptocurrency market, led by Bitcoin, is currently facing a significant price decline and a bearish trend. The retracement phase has caused concern among investors, with the overall crypto market capitalization receding.

Technical analysis suggests a potential short-term price decline for Bitcoin, as indicated by the support levels, RSI trends, and bearish price patterns. However, on-chain metrics provide a glimmer of hope for long-term investors, with the SOPR ratio indicating potential opportunities in the future.

As always, investors should remain cautious and closely monitor the market for further developments.