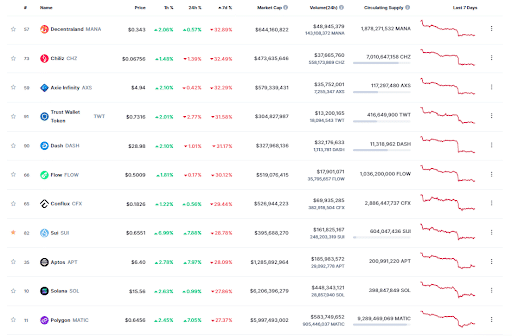

Since the SEC’s move of classifying 61 altcoins as securities, the altcoin market faced a significant crash, with major cryptocurrencies like Algorand (ALGO), Cardano (ADA), Polygon (MATIC), Solana (SOL), Litecoin (LTC), and many more experiencing a sharp decline of over 20% in their trading prices within a 24-hour period.

Despite a slight recovery early on Monday morning, the overall crypto market saw a modest increase of 0.84%, reaching a market capitalization of $1.06 trillion. However, altcoins continue to face a significant decline in the range of 20-30% over the past seven days. Blue-chip cryptocurrencies like SOL, MATIC, Cardano (ADA), BNB, and SHIB have all witnessed losses exceeding 20%.

A wave of uncertainty swept through the altcoin market as 61 prominent cryptocurrencies, including BNB, SOL, ADA, MATIC, ATOM, SAND, MANA, and several others, found themselves classified as securities in two recent lawsuits filed by the SEC.

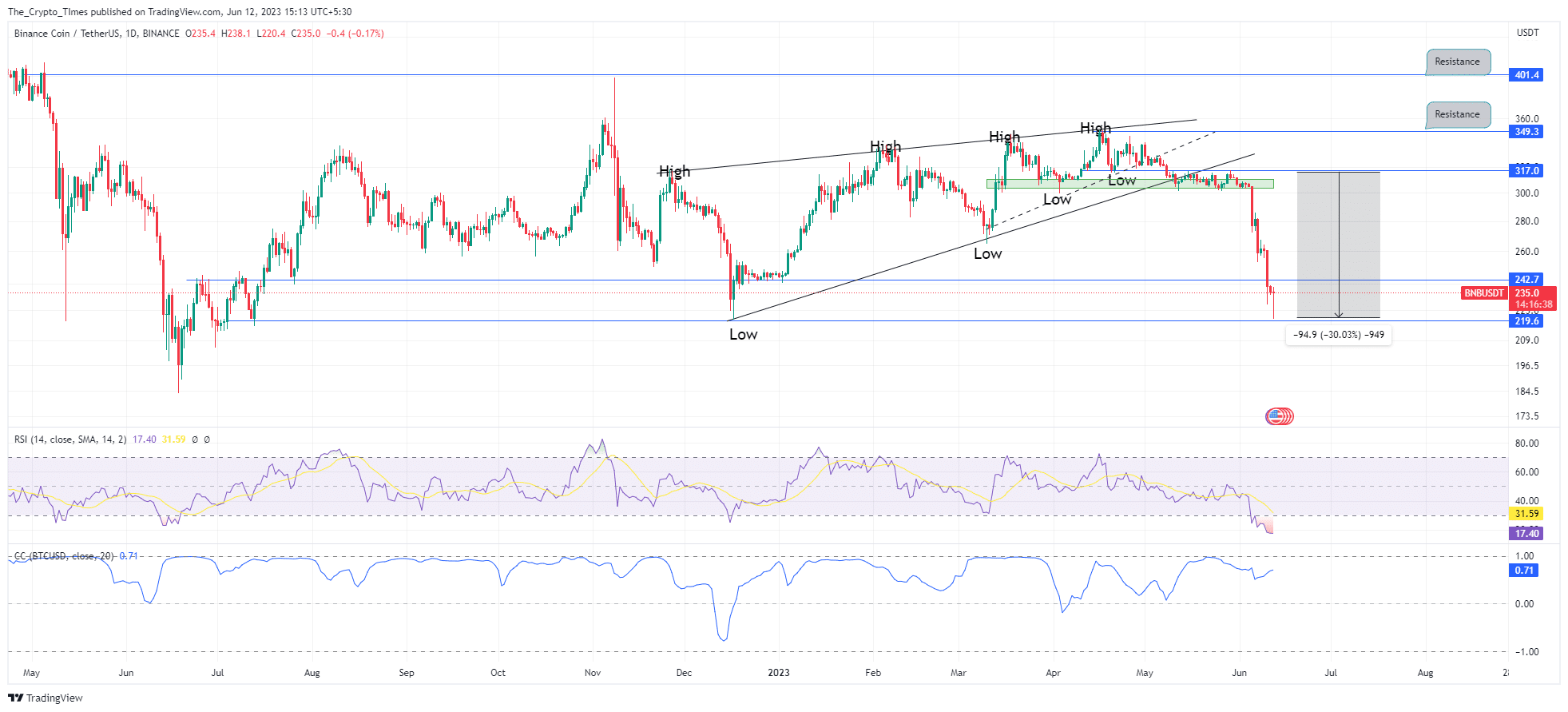

SEC’s Battle Against Binance Causes BNB to Plummet by 30%

The crypto market experienced a selling frenzy following the SEC’s lawsuit against Binance and its CEO Chengpeng Zhao. This led to a substantial decline of 22.8% in Binance’s BNB token, marking one of the most bearish weeks in 2023.

During this period, the BNB token broke below a crucial support level of $300 and plummeted over 30% in just a few days. Currently trading at $235 after hitting a new annual low of $220, the RSI indicates an extreme oversold condition due to the strong correlation between BNB and BTC.

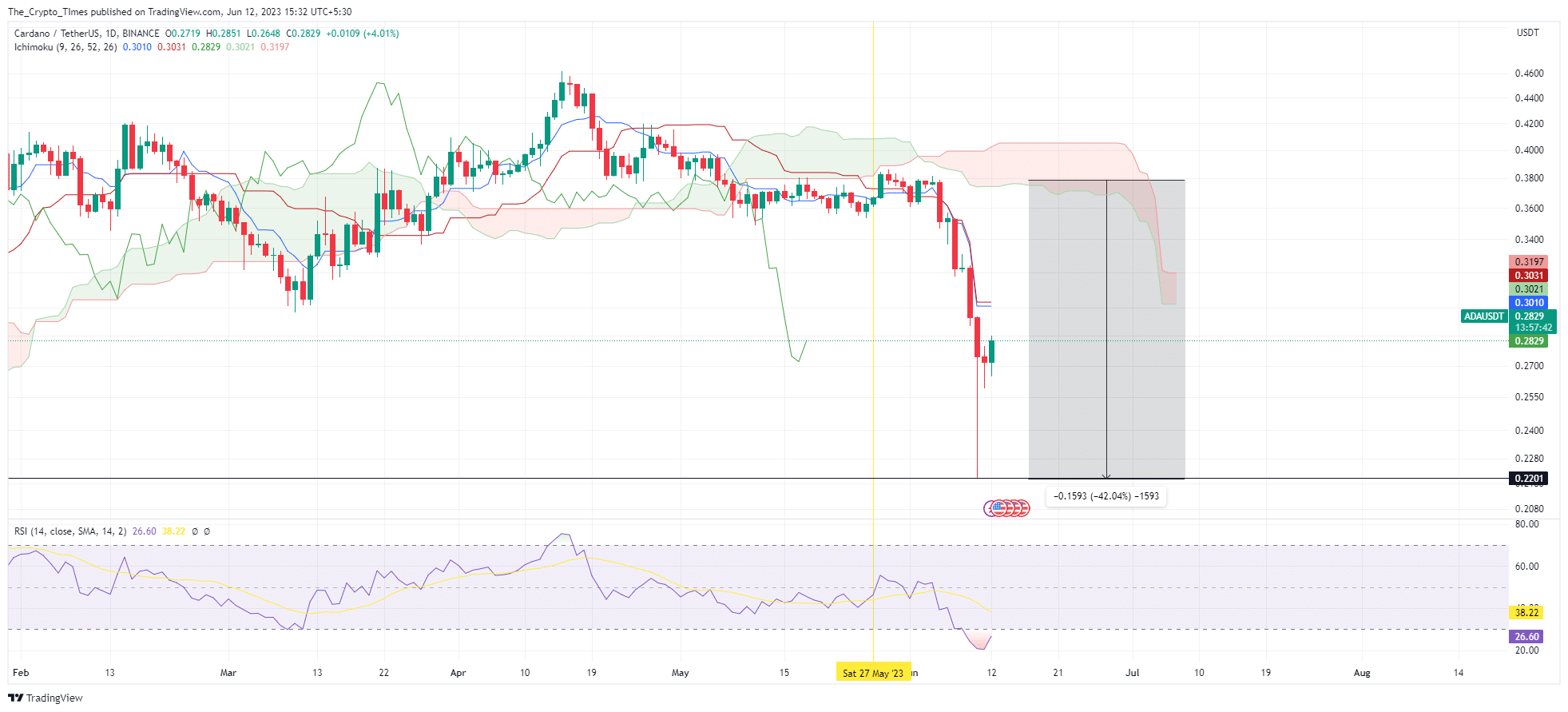

Cardano (ADA) Drops Nearly 40% in Recent Sell-off

Cardano (ADA) mirrors the recent trajectory of the renowned cryptocurrency Bitcoin, experiencing a substantial decline of almost 40% from $0.379 to $0.22 last week. It concluded the week with a notable 27.9% downturn.

Nevertheless, ADA has shown some signs of recovery today, managing to make modest gains above the $0.22 support level. At present, it is being traded at around $0.287, with the Relative Strength Index (RSI) gradually moving out of the oversold territory.

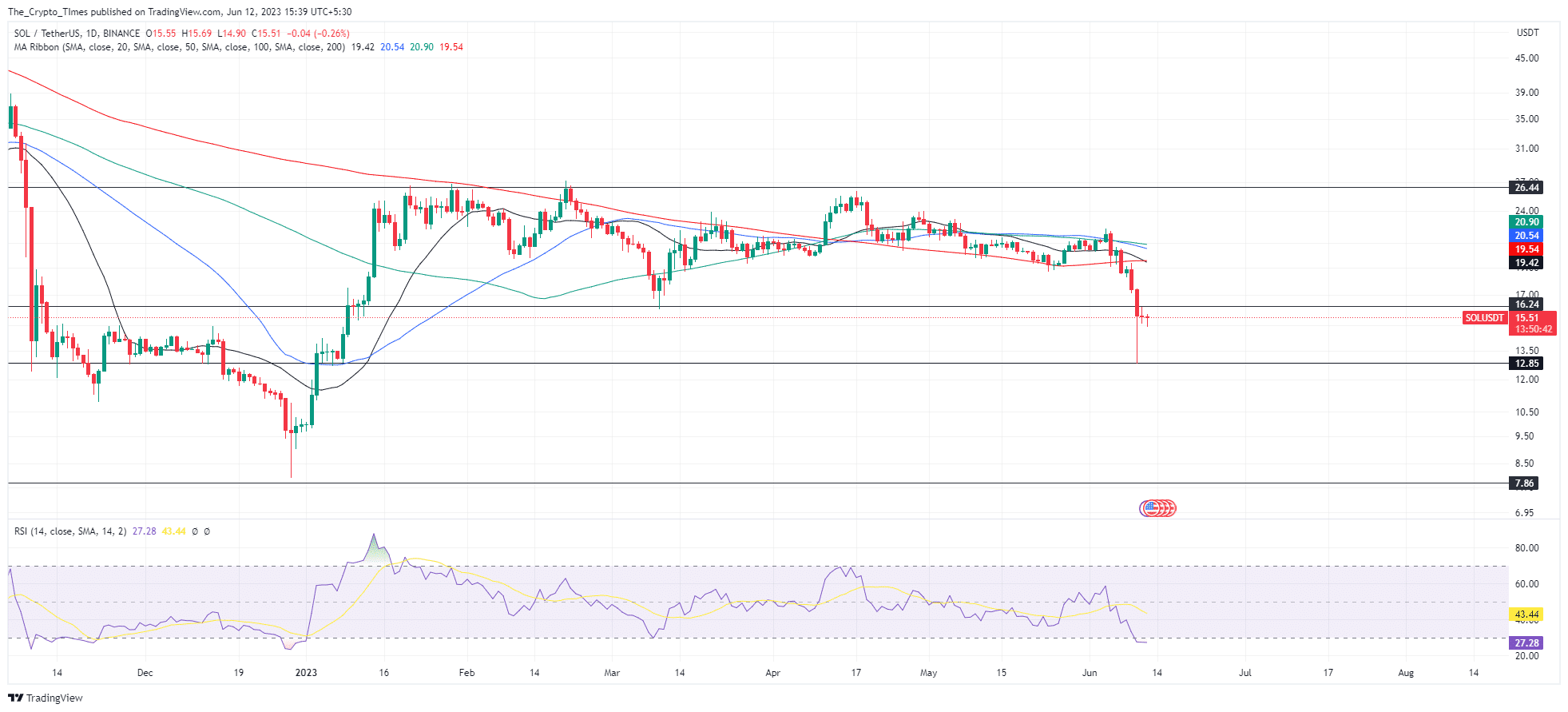

Solana (SOL) Plummets by Nearly 30% in Recent Market Dip

The price of Solana has been significantly impacted by the ongoing conflict between the SEC and two major cryptocurrency exchanges. Adding to the challenges, Solana (SOL) has been classified as a security by the SEC in a recent lawsuit, resulting in a sharp 28% decline in the past seven days.

As of now, SOL is trading at the $15.5 level, reaching a two-month low. The situation remains tense for Solana amidst these developments.

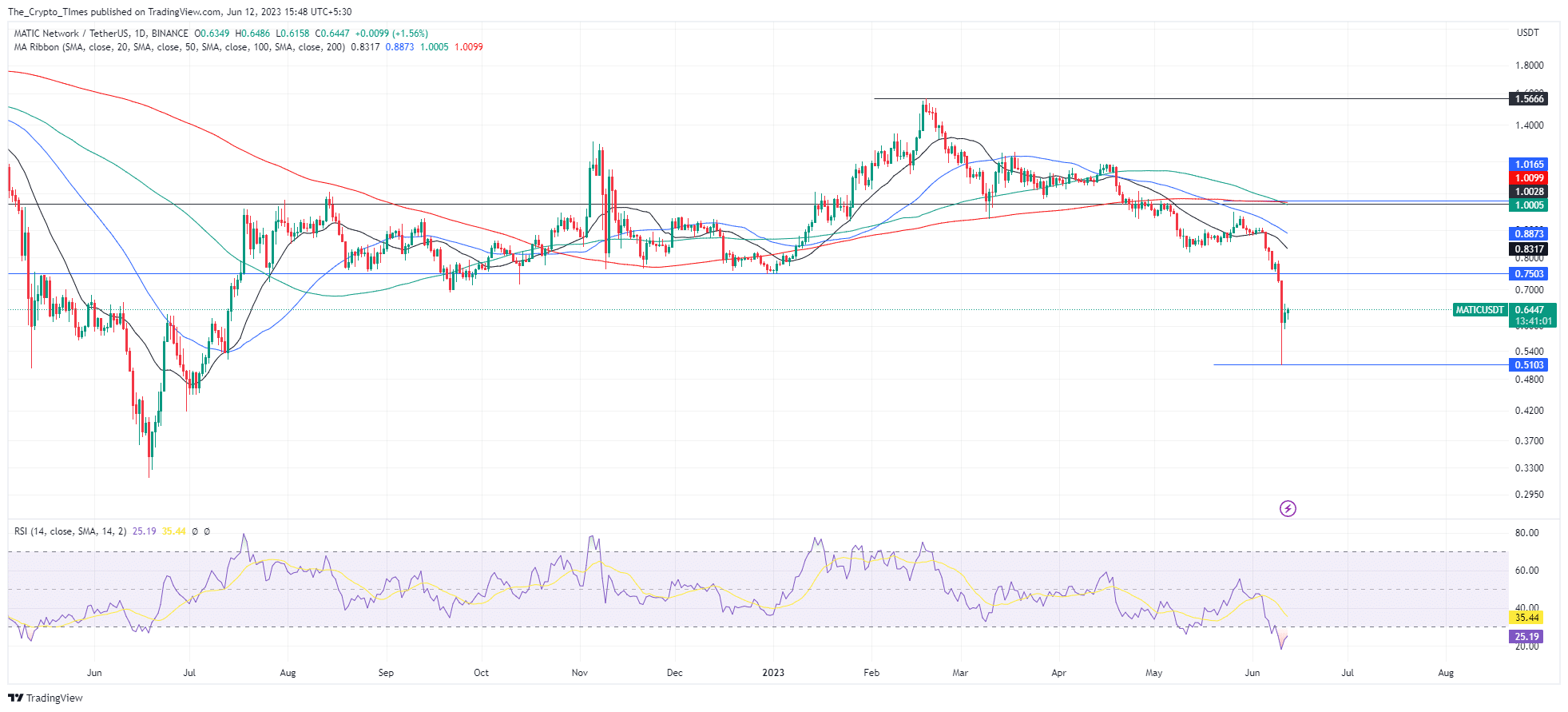

Polygon (MATIC) Plunges in Parallel with Solana (SOL)

SEC’s classification of MATIC as a security sent shockwaves through the Polygon (MATIC) community, resulting in a significant price collapse. MATIC plummeted to a six-month low of $0.508, experiencing a nearly 28% decline over the past week. However, today buyers managed to find some respite as the price saw a slight increase, with the current trading price at $0.64. The situation remains uncertain for MATIC as investors closely monitor its price movements.

The recent sell-off in the cryptocurrency market has not spared numerous altcoins, including several blue-chip ones. These prominent altcoins have experienced a significant surge in selling pressure, leading to the draining of billions of dollars from the overall crypto market. The market turmoil has left investors and traders closely monitoring the situation as they assess the impact on their portfolios.