In a recent turn of events, enthusiasts of Bitcoin (BTC) are expressing their elation over the remarkable upward surge of the cryptocurrency, as its price successfully maintains its position above the significant $30,000 threshold for the first time since April. With the bulls taking charge once again on June 15, a wave of optimism has swept through the market.

As per TradingView data, the price of bitcoin has experienced an impressive surge of almost 23% in just seven trading sessions, climbing from $24,840 to $30,840. The bulls now appear poised and self-assured in their anticipation of surpassing the $30K mark, a feat not accomplished since April 26.

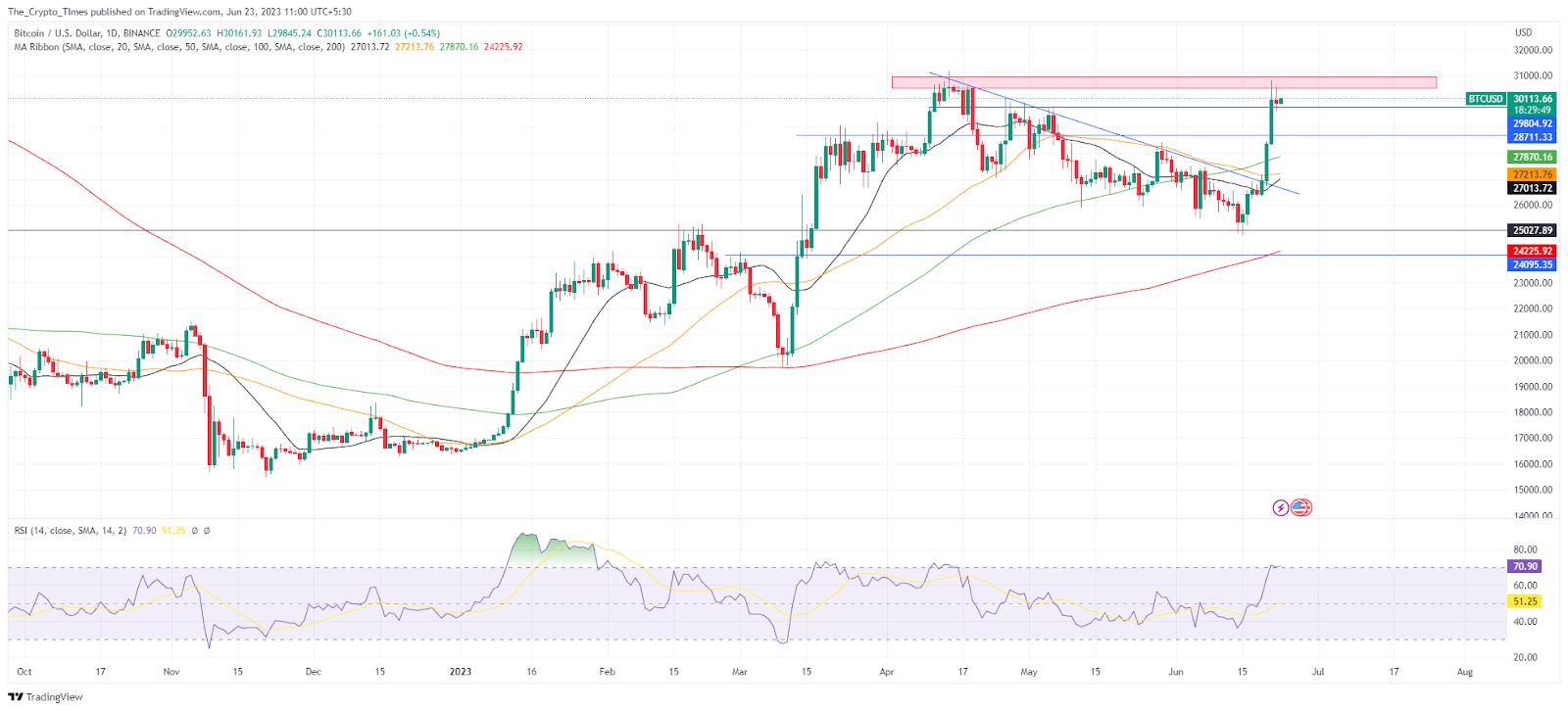

Before the unexpected short covering took place in the market, the price of Bitcoin (BTC) had been under the control of market sellers, with a prevailing downward trendline. However, a notable shift occurred when an assertive buying force emerged following a bullish breakout on June 20. This bullish breakout acted as a catalyst, ultimately leading to Bitcoin experiencing a remarkable gain of nearly 14% within this week.

As of the current moment, the price of Bitcoin (BTC) is exhibiting a relatively low level of volatility, standing at $30,060 with a minor intraday decline of 0.8%, as reported by CoinMarketCap.

Upon examining the daily price chart, it becomes apparent that all major moving averages, namely the 20, 50, 100, and 200, are significantly lower than the current trading price of Bitcoin (BTC). However, it is worth noting that the 20-day Simple Moving Average (SMA) has now transformed into a crucial level of immediate support.

In a similar vein, the RSI indicator is currently indicating a bullish trend, as its peak remains within the extremely overbought zone of 70. The price range between $30,500 and $31,000 is crucial, serving as a significant bullish hurdle. If buyers manage to break through this range in the near future, there is a strong possibility of a 2000-point rally, potentially reaching up to $32,000.

Bitcoin ETF Frenzy: Will it Fuel More Explosive Rallies?

BlackRock, the largest asset management firm globally, has filed for a Bitcoin ETF, which has effectively shifted its dominance away from bearish sentiment in the BTC market. The Bitcoin ETF frenzy has initiated a remarkable rally of 5000 points, despite the ongoing conflict involving the SEC and the two leading cryptocurrency exchanges.

In light of market analysis, it is believed that the approval of BlackRock’s exchange-traded fund (ETF) application by regulatory authorities has the capacity to entice a notable influx of institutional investors, which could lead to more 2000 points rally ahead.

Bitcoin Dominance Surges to 51% in Impresssive Bullish Run

Bitcoin dominance has successfully crossed the significant milestone of 50% this week. In the early hours of Wednesday, June 21, Bitcoin dominance surged 51.7%. As of the present moment, based on information gathered from Tradingview, it currently stands at 51.4%.