In a surprising turn of events, long-term holders of Azuki NFTs have embarked on a selling spree following the launch of the highly anticipated Elementals collection. This mass sell-off has sparked concerns within the Azuki community and shed light on the impact of recent developments on the digital asset landscape.

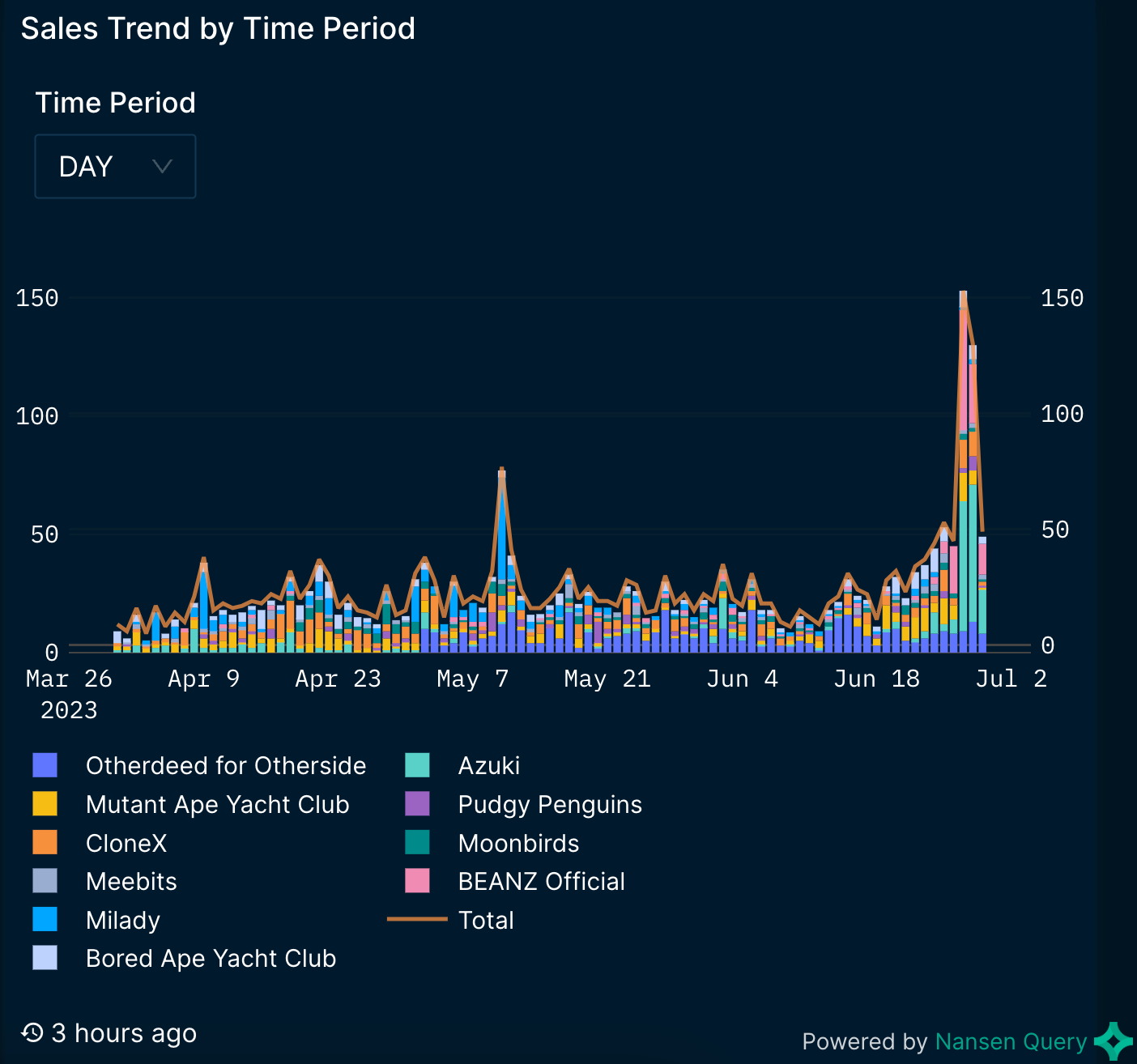

According to Nansen, 132 long-term Azuki holders sold their NFTs during or after the recent Elementals drop, representing an 817% increase compared to previous trends. Azuki’s latest NFT launch sees rapid sell-off and critiquess over ‘replicated’ artwork, stirring unrest in the crypto-art community.

Unfortunately, due to the rapid pace at which the Elementals collection sold out, the general public was left without an opportunity to participate in the Azuki ecosystem.

Simultaneously, Beanz Official NFT holders, acting as “sidekicks” to the human avatars featured in the Azuki collection, were also given the chance to purchase Elementals during the exclusive 20-minute window. Following the Elementals launch, Beanz NFTs experienced a significant sell-off as 89 established owners chose to sell their digital assets. This represents a notable 155% increase in long-term Beanz holders parting with their NFTs.

Analysts have attributed the sell-off to Blur’s lending platform, noting that a considerable number of outstanding loans were liquidated or repaid following the Elementals minting. Despite the subsequent recovery of values to pre-airdrop levels, the increased supply triggered a cascade event.

The Azuki team acknowledged that they “missed the mark” with the Elemental drop and have vowed to improve in future endeavors. As a subsidiary of the Los Angeles-based startup Chiru Labs, Azuki NFTs have gained significant traction since their launch in January 2021.

The aftermath of the Elementals drop and subsequent sell-off highlight the dynamic nature of the NFT market and the importance of delivering novel experiences to satisfy the evolving expectations of digital asset enthusiasts.