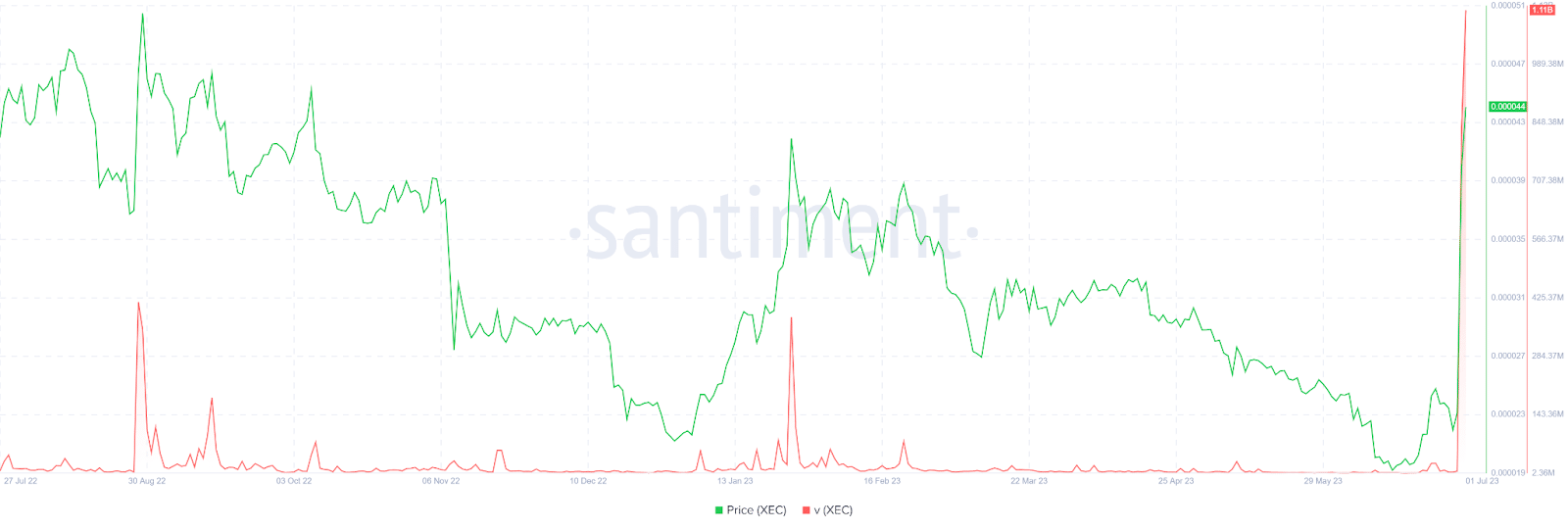

In the past 24 hours, eCash witnessed a significant surge in buying activity, as indicated by data from Santiment. The trading volume of eCash skyrocketed by over 1860%, amounting to a staggering $1.1 billion. As a result, the 1st of July is turning out to be an extremely volatile day in terms of market activity for eCash, marking a notable event in this year’s trading landscape.

XEC Frenzy: Trading Volume Hits $1.1 Billion Overnight

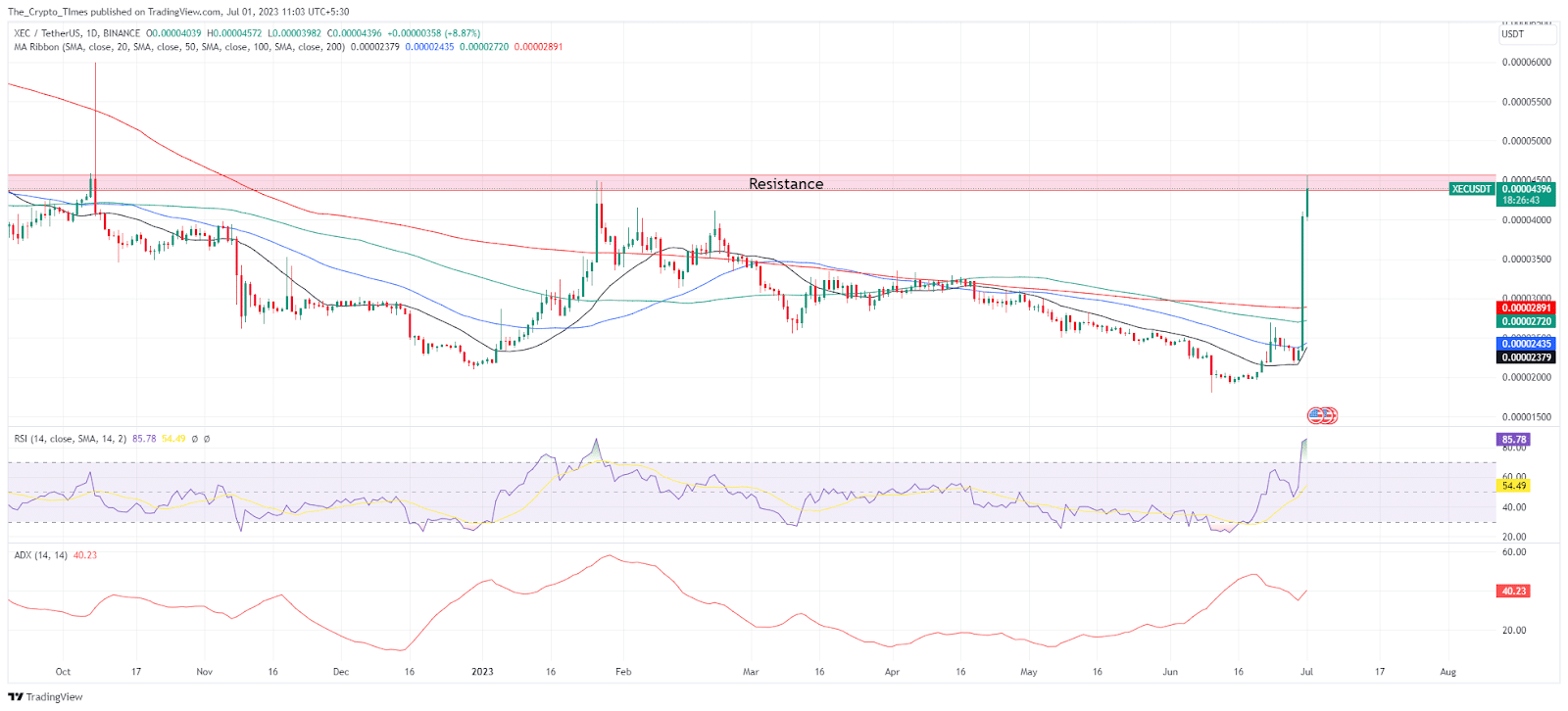

As of the current moment, eCash is being traded at a price of $0.000044, showcasing a noteworthy intraday gain of 8.5% on the 1st of July at press time. XEC is hovering around $0.000045, which previously served as a resistance level. If XEC manages to break through this level, its price could go up by 35% to $0.000055. Though todays trading activity will decide the fate of XEC as a correction is likely to happen.

If the bullish sentiments exist, the price of XEC can possibly surge by over 60% to a price of $0.000065.

The support levels in the form of the 20-day, 50-day, 100-day, and 200-day simple moving averages have experienced a reversal, now acting as crucial support zones. Among them, the 200-day exponential moving average (EMA) holds particular significance as a key area for potential rebounds.

The Average Directional Index (ADX) is indicating an upward trend, suggesting the presence of ongoing momentum. Additionally, the Relative Strength Index (RSI) has entered the overbought zone, reaching a level similar to that seen in January. This could raise concerns at the current price point, as a failure to breach resistance levels may result in a slight retracement in the price of XEC.