The United States Department of Justice (DOJ) has executed a series of transactions involving approximately 9,825.25 Bitcoin, with a total worth of around $299 million. The movement of these funds, previously associated with the Silk Road seizure, has sparked curiosity and speculation within the crypto community.

The intentions behind these transactions remain unclear, as it is uncertain whether the Bitcoin has been sent for sale on exchanges or remains under the custody of the Justice Department.

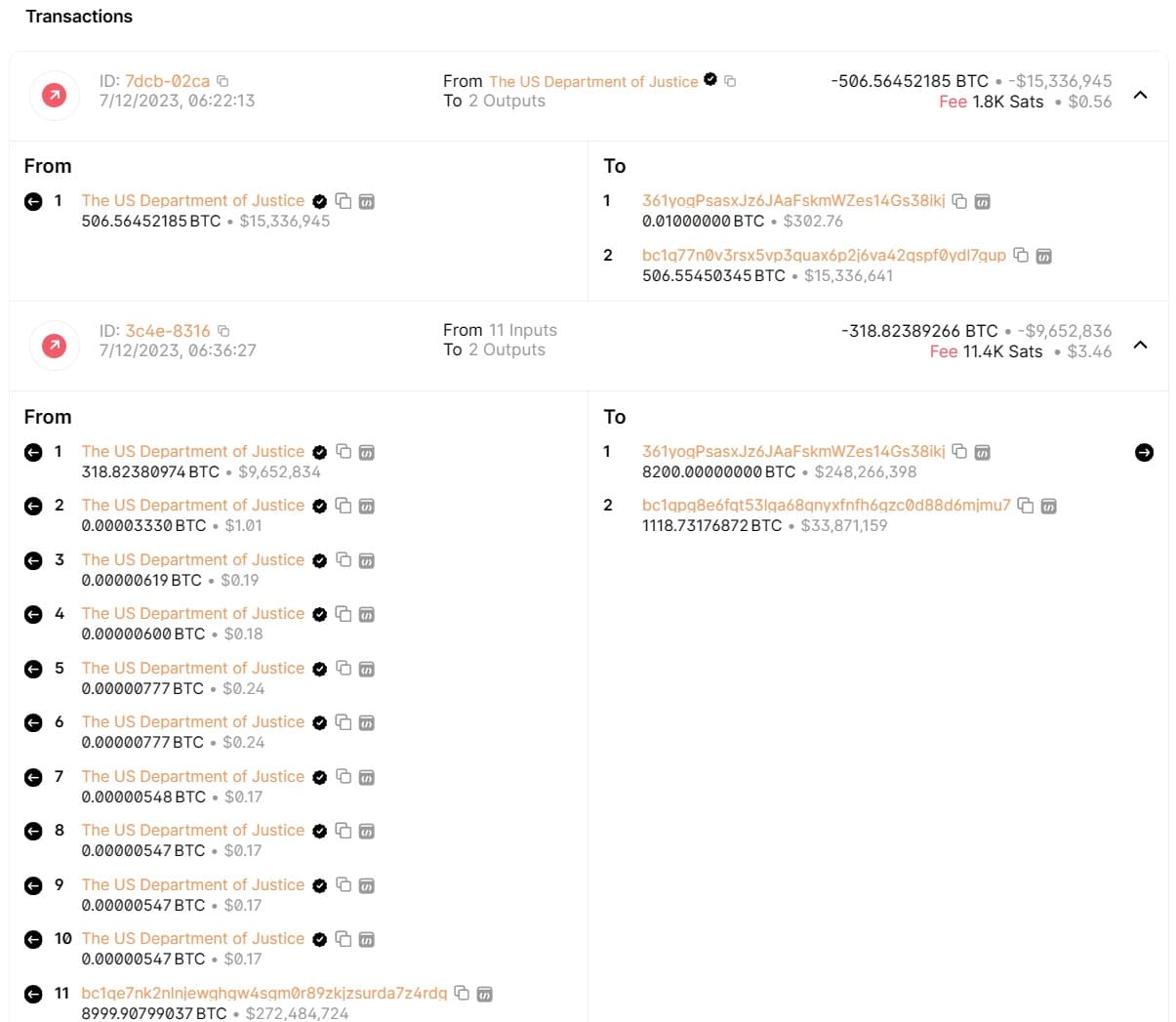

The initial transactions occurred on July 12, when 9,825 Bitcoin were sent to three addresses. The majority of the coins, totaling 8,200 BTC and valued at nearly $250 million, were subsequently transferred to a single address.

Notably, this address divided the funds across 101 separate addresses approximately an hour later, leaving many puzzled about the motive behind such a fragmentation.

The U.S. government previously disclosed its plans to offload the remaining Bitcoin from the Silk Road seizure through four separate batch transactions throughout the year. Presently, the government’s on-chain data suggests potential testing of liquidity strategies.

It is believed that this stash of Bitcoin is connected to the largest seizure yet from the Silk Road marketplace. In November 2022, law enforcement seized $3.36 billion worth of BTC after hacker James Zhong confessed to stealing digital assets from the illegal online platform.

The government has been gradually selling off the seized cryptocurrency, with a previous sale in March amounting to $215 million. They have announced plans to liquidate approximately $1.1 billion more throughout the remainder of the year.

The recent transactions, which involved the movement of 9,825 Bitcoin, have captured the attention of the crypto community. Large movements of funds by well-known holders often have an impact on the price of the asset, according to experts. Indeed, shortly after the transfers, Bitcoin experienced a brief 0.8% drop in value. However, it quickly rebounded, and at the time of writing, it was trading at around $30,777 per coin, reflecting a 0.8% increase over the past 24 hours.

It remains to be seen what the U.S. government’s true intentions are and how these moves will reverberate throughout the cryptocurrency economy. Until then, the crypto community eagerly awaits further updates and clarifications.