Creditcoin, the real-world assets (RWA) network that provides blockchain infrastructure for financial institutions in emerging countries to record their customers’ credit reputation on-chain, has just wrapped up its testnet for the upcoming 2.0+ mainnet upgrade.

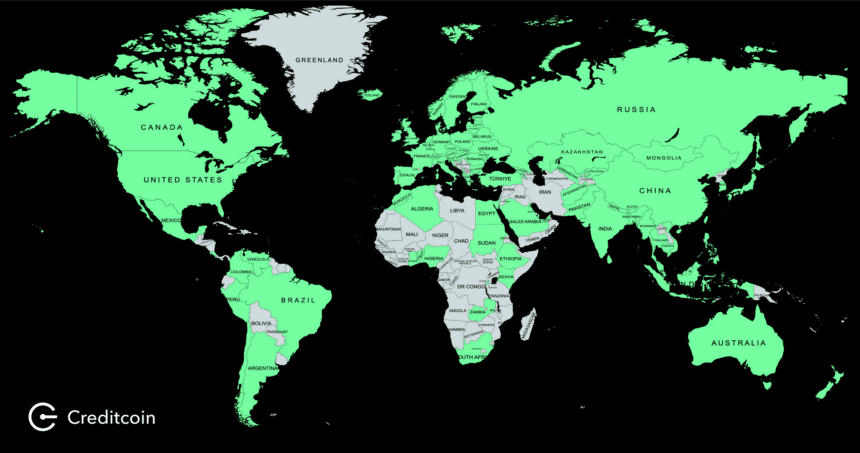

The testnet experienced massive global demand with users from 91 different countries taking part. The total participation details consisted of:

- 9,412 total testnet applications

- 286 active validators responsible for block production and validation

- 2,882 active nominators staking their funds and voting for honest validators

As a result of the enthusiastic Creditcoin community actively participating in the testnet, the development team achieved its primary goal of gaining strong confidence in the network’s transition from PoW (proof of work) to NPoS (nominated proof of stake). The Creditcoin tech team successfully verified assumptions about higher throughput and consistent chain interactions through its testnet stress test.

Alan Kong, Director of Marketing at Creditcoin, commented “We are thrilled by the level of enthusiasm and engagement from our community throughout the testnet. Thanks to the valuable feedback and participation of our validators and nominators, we are highly confident in the stability and performance of the 2.0+ upgrade from PoW to NPoS mechanism.”

What are Real World Assets?

Real-world assets, or RWAs for short, are simply traditional real-world financial assets. They can refer to assets such as property, bonds, commodities, stocks, shares, and more. This is in contrast to the relatively new world of ‘online-only’ digital assets such as Bitcoin, Ethereum, NFTs, and the various other DeFi protocols and tokens.

Setting aside the team’s extensive prior experience in TradFi, what makes Creditcoin’s approach truly unique among other real world assets platform is the operational design of their blockchain solution, which records the loan performance of borrowers, lenders, and investors to increase transparency and security throughout its RWA investment ecosystem. In addition, the network has proof to back up its success: Creditcoin has recorded over 3 million loan transactions at a loan value of over $70 million.

Next year, the milestone Creditcoin 3.0 upgrade is aiming to completely transform the network and redefine what is possible in the RWA space, delivering EVM-compatability and Universal Smart Contracts which aims to deliver a native multi-chain RWA investing experience for Web3 users.

According to the Creditcoin website, the network can:

- Transparently record credit for the world’s 1.4B unbanked: Global Findex Database 2021, World Bank

- Connect DeFi and TradFi ecosystems, creating a new on-chain credit investment market that generates users real-world yield

- Solve DeFi’s under-collateralization requirement, leveraging transparency to improve counterparty trust in credit markets

Tae Oh, Founder of Creditcoin, adds: “Creditcoin creates an open ledger of credit history, enabling the underbanked to build objective credit profiles. This interconnects borrowers and lenders globally, facilitating access to fair credit lines. The result is financial inclusion for those excluded from modern banking.”

What’s next?

The conclusion of the testnet paves the way for the launch of the upcoming Creditcoin 2.0+ update, with the upgrade promising to greatly improve the scalability, security, and decentralization of the network.

By improving the technical performance of the Network, the 2.0+ upgrade will help Creditcoin and its institutional partners further their goal of enabling better global access to capital financing, building credit history and facilitating trust in the unbanked and underbanked throughout emerging markets.

About Creditcoin

Creditcoin is the world’s leading real-world asset infrastructure chain, with over 3 million credit transactions recorded to date. By matching borrowers, lenders and investors on-chain, the protocol is paving the way for a new generation of globally interoperable credit markets.

Having integrated with various fintech lenders and connecting them directly to global DeFi investors, the Creditcoin network has helped thousands of borrowers, businesses, and investors secure capital financing, build credit history, and make global RWA investments.