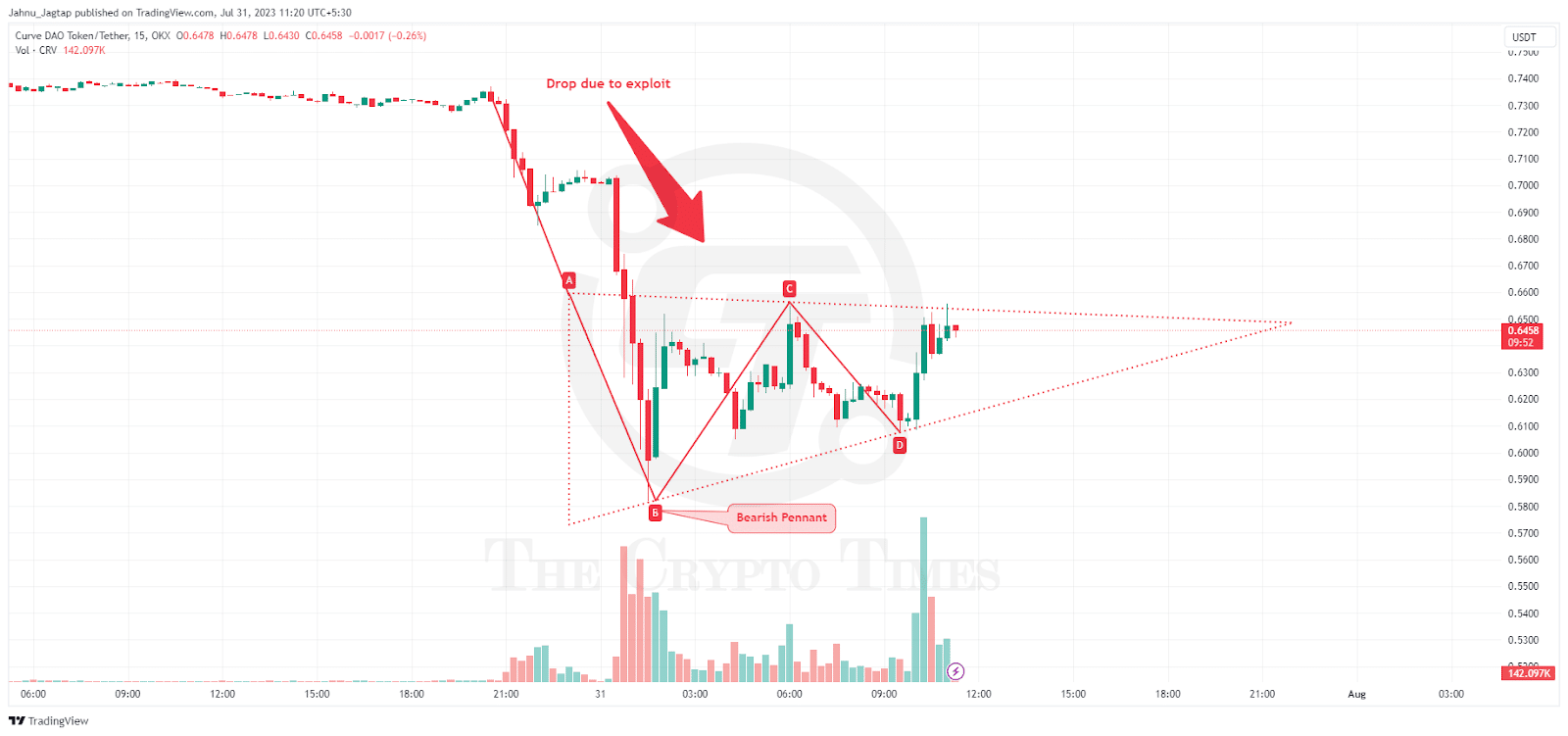

In a recent tweet, Curve, a prominent stablecoin exchange in the world of decentralized finance (DeFi) on Ethereum, confirmed that it fell victim to an exploit. the news of the exploit created panic among investors, and in just 5 hours, the price of CRV dropped 20% and reached $0.58 from $0.72.

The hackers managed to exploit a vulnerability in the Vyper programming language, which powers certain parts of the Curve system. This security flaw risked over $100 million worth of cryptocurrencies across various stablecoin pools on the platform.

The situation prompted swift action from the Curve team, who found that the affected pools were either drained or secured through a white hack. However, the total extent of the damage remained uncertain at the time of reporting.

The aftermath of the hack had significant repercussions on the trading markets, as the native CRV token of Curve DAO suffered a 20% decline in its price. Prior to the exploit, CRV was trading above $0.72 in a sideways pattern.

Following the sudden dump, the price did move up a bit but was rejected again at $0.65 and dropped down to $0.6. The current price of the token is $0.65 as per CoinGecko, which has created a bearish flag.

If a further downturn is seen we may find CRV token around $0.55. This downturn also posed a potential threat to the founder of Curve, who held a $70 million borrowing position on Aave, leading to concerns about possible liquidation.

As the situation developed, it became evident that other projects utilizing Vyper programming might also be susceptible to the same vulnerability. This hack has brought to light the critical vyper vulnerability that exposed the Defi ecosystem to threats.

The Curve team was proactively working together with the impacted projects to evaluate and resolve the issue