The mastermind behind MicroStrategy, Michael Saylor, has outlined a persistent and captivating opportunity for investors to engage with the realm of Bitcoin. This vision remains constant, even as the environment of exchange-traded fund approvals (ETF) changes.

Saylor’s unwavering dedication extends to the ambitions plan of strengthening MicroStrategy’s Bitcoin reserve, a commitment he intends to fulfil through a meticulous planned $750 million share sale.

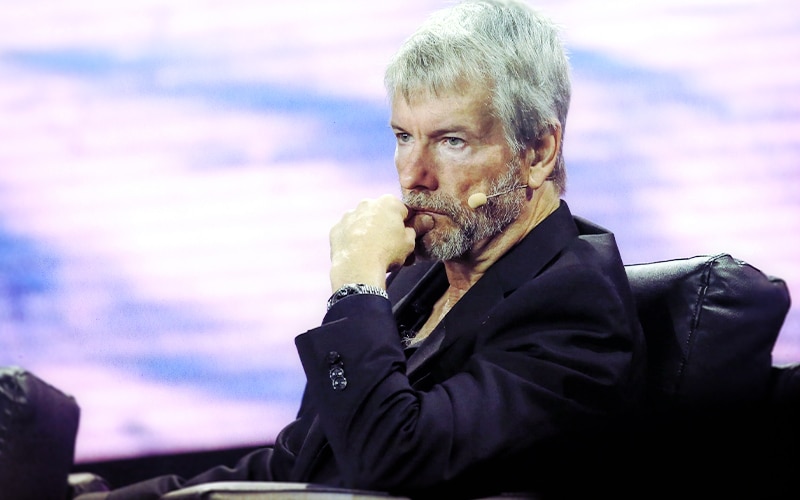

During the interview with Bloomberg on August 2nd, Michael Saylor discussed how an approved spot Bitcoin ETF could affect MicroStrategy’s offerings.

He expressed confidence that, even if spot Bitcoin ETFs are introduced, MicroStrategy will still offer a unique value proposition.

In the earning call on August 1st, Saylor reiterated his belief that MicroStrategy’s approach to Bitcoin will remain distinct despite the arrival of Spot ETFs.

He highlighted that the company’s strategic stance on Bitcoin has led to success, citing a significant 145% increase in Bitcoin value since they started their purchasing strategy in August 2020.

Saylor mentioned their use of leveraged investments to generate profits for shareholders, a strategy that ETFs can’t replicate due to their different operational nature.

Saylor underscored MicroStrategy’s advantage in its operational Model, which allows them to use leverage. He viewed this as a positive for the entire Bitcoin ecosystem.

Nevertheless, he acknowledged that spot Bitcoin ETF might attract considerable investment from large hedge funds and sovereign entities.

According to Saylor, “We are a unique instrument, we are the sportscar whereas the spot ETF is going to be the supertanker.” He believed that “spot ETFs will serve another set of customers in a synergistic fashion to grow the entire asset class.”

Recent developments suggest an increased likelihood of spot Bitcoin ETF approval in the United States, with analysts raising the chance to increase 65% on August 2nd.

When questioned about their future holdings, Saylor confirmed the company’s aggressive goal of continuing to accumulate Bitcoin, building on their current stash of 152,800 BTC. Moreover, he confirmed to sell up to $750 million in Class A common stock, in a recent SEC filing.