The lawsuit between DeFiance Capital and Teneo, 3AC’s liquidator company, has leaned towards DeFiance following the former 3AC Director’s statement.

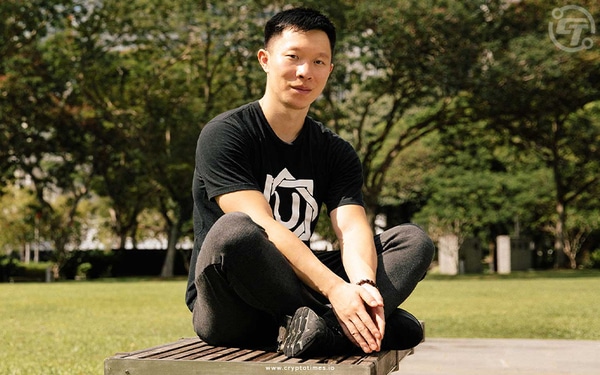

Su Zhu, the co-founder and former Director released a note regarding the ongoing liquidation of his infamous hedge fund Three Arrows Capital (3AC). Zhu said that DeFiance Capital should be treated as a segregated entity as 3AC did not actively manage the fund.

Teneo is the firm responsible for liquidating insolvent 3AC capital’s estate. It claimed that DeFiance Capital, a child company of 3AC, should be included in the liquidation. DeFiance said that it is operating as a separate entity thus not an estate of 3AC.

“It is our understanding that DeFiance Capital (DC) and Starry Night Capital (SNC) funds were always managed separately from other pools of capital at Three Arrows Capital Ltd (TACL).” said Su Zhu in the statement.

Zhu further said that ‘Teneo is overreaching’ in an attempt to seize other investors’ funds. Teneo was assigned by the British Virgin Islands’ Court in liquidating insolvent 3AC’s assets.

On the 15th of August, the DeFiance Capital and Teneo’s legal conflict was reportedly registered in SIngapore Court alongside the already running lawsuit in the British Virgin Islands.

While the dispute is leading both DeFiance and Teneo in the Court, Zhu said, “We expect in the due process of law that both DeFiance Capital and Starry Night Capital investors should retain ownership of their respective assets.”

Also Read: Dubai Authority Fines OPNX Founded By Three Arrows Creator