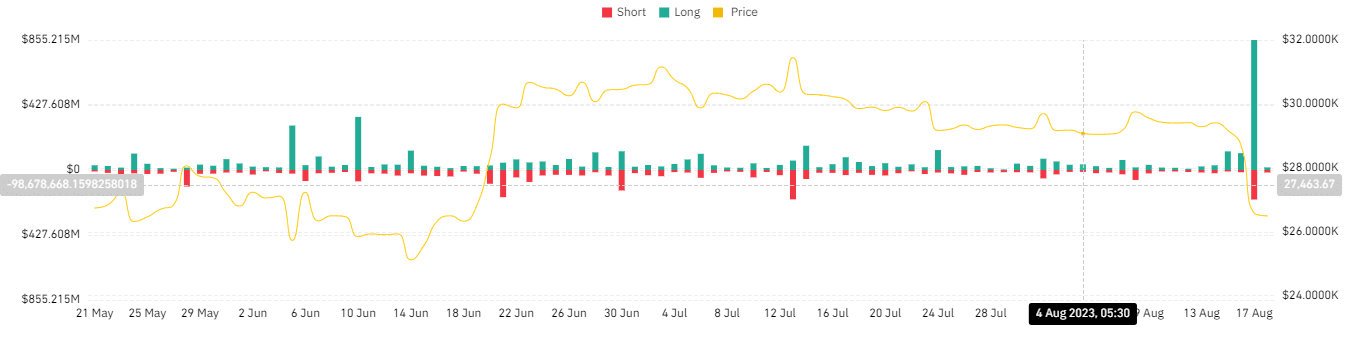

The major cryptocurrency Bitcoin has experienced a significant collapse, triggering nearly $1 billion in market liquidation. This sharp decline has been accompanied by a series of unfavorable developments, raising concerns about potential ongoing market pressures.

According to Coinglass data, the cryptocurrency market has undergone approximately $1.04 billion worth of total liquidations, with a substantial $835.8 million attributed to long positions within the past 24 hours. This period saw a significant downturn in the crypto market, marked by one of the most severe sell-offs of the year, leading Bitcoin’s price to hit a two-month low within the $26,100 range.

Bitcoin’s bearish trend since the start of the week possibly influenced by the report indicating that Elon Musk led SpaceX sold its Bitcoin holdings by a total of $373 million in both the previous year and 2021.

Bitcoin Hits Lowest in Two Months – Where’s the Rebound?

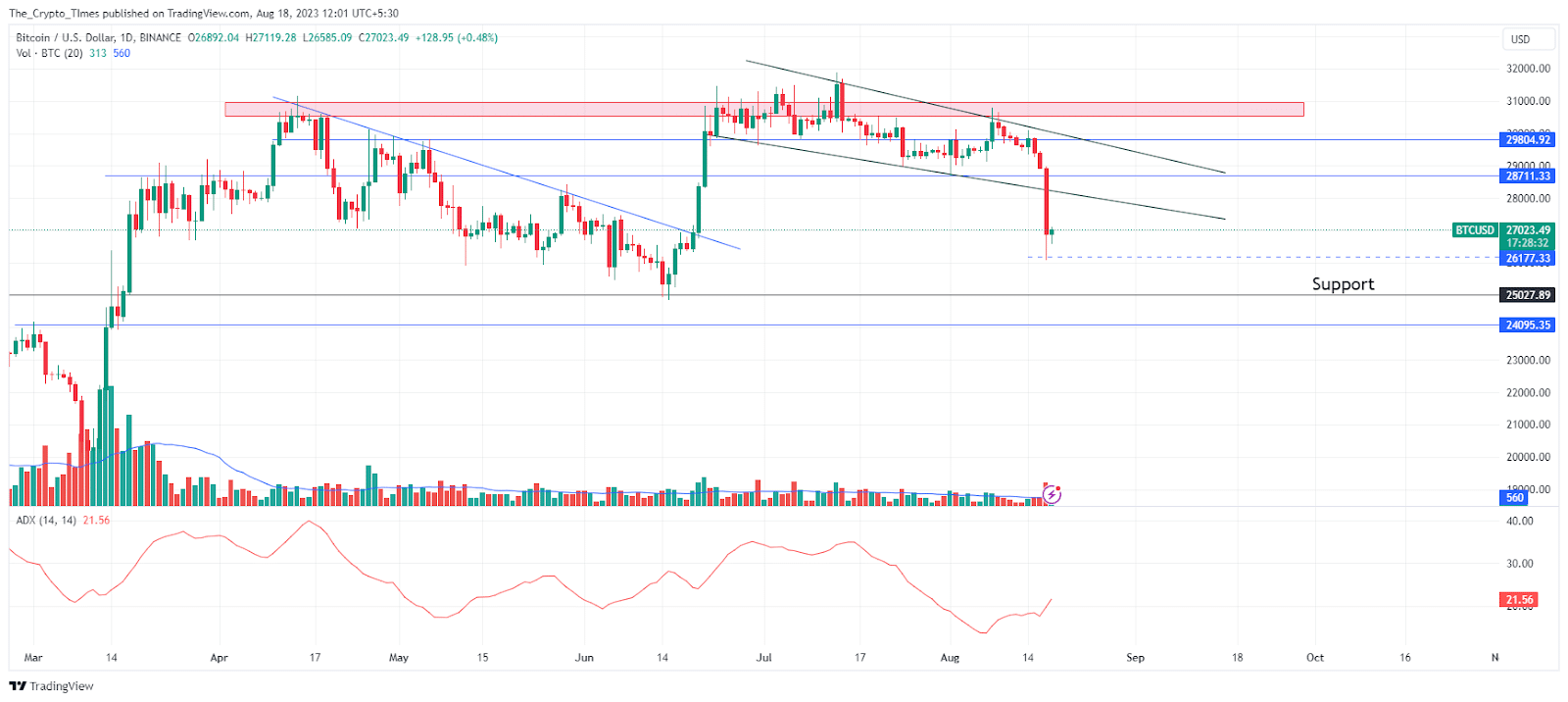

There was an aggressive sell-off in Bitcoin, causing its price to plummet well below the confines of the descending wedge channel.

Bitcoin encountered a substantial liquidation totaling nearly $498.6 million overnight, with a significant portion of $386.6 million attributed to the liquidation of long positions.

Consequently, this led to a 7.4% decline in Bitcoin’s market capitalization, bringing it to $516 billion. At the time of writing, Bitcoin’s price appears to exhibit a slight positive movement, currently hovering around $26,510.

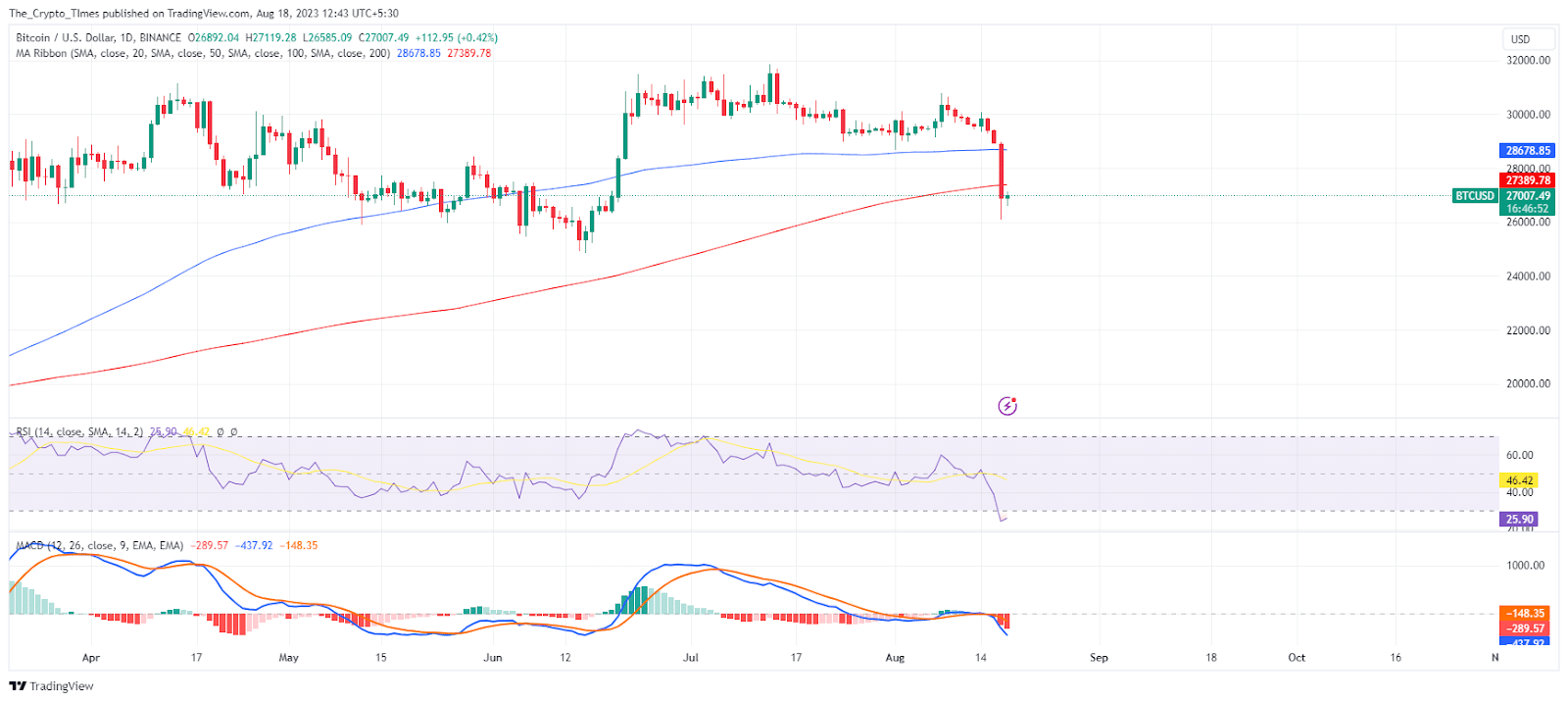

Buyers are displaying activity around the $26,000 support level, potentially setting the stage for a rebound. Despite this, BTC has now descended beneath both the 100 and 200 Simple Moving Averages (SMAs) due to the ongoing sell-off.

Should Bitcoin’s trading persist below the 200-SMA, it could prompt further selling pressure until it reaches the robust support zone at $25,000.

Nonetheless, the RSI has entered an exceedingly oversold territory, indicative of significant bearish sentiment prevailing in the market. Furthermore, the Moving Average Convergence Divergence (MACD) indicator is trending downward into the negative realm.

In order to safeguard against further selling pressure, buyers need to effectively maintain the Bitcoin price above the $26,000 mark.