Ethereum, the second-largest cryptocurrency, has struggled to cross the psychological mark of $2000. Ethereum shows a 9% decline over a month amid positive news of PayPal’s Ethereum stablecoin launch and soaring interest in Ether-based ETFs.

Ethereum is facing the challenges of high gas fees and scalability. Is it the right time to invest in ETH? We will tell you about different aspects of Ethereum; continue reading.

Ethereum Price Analysis

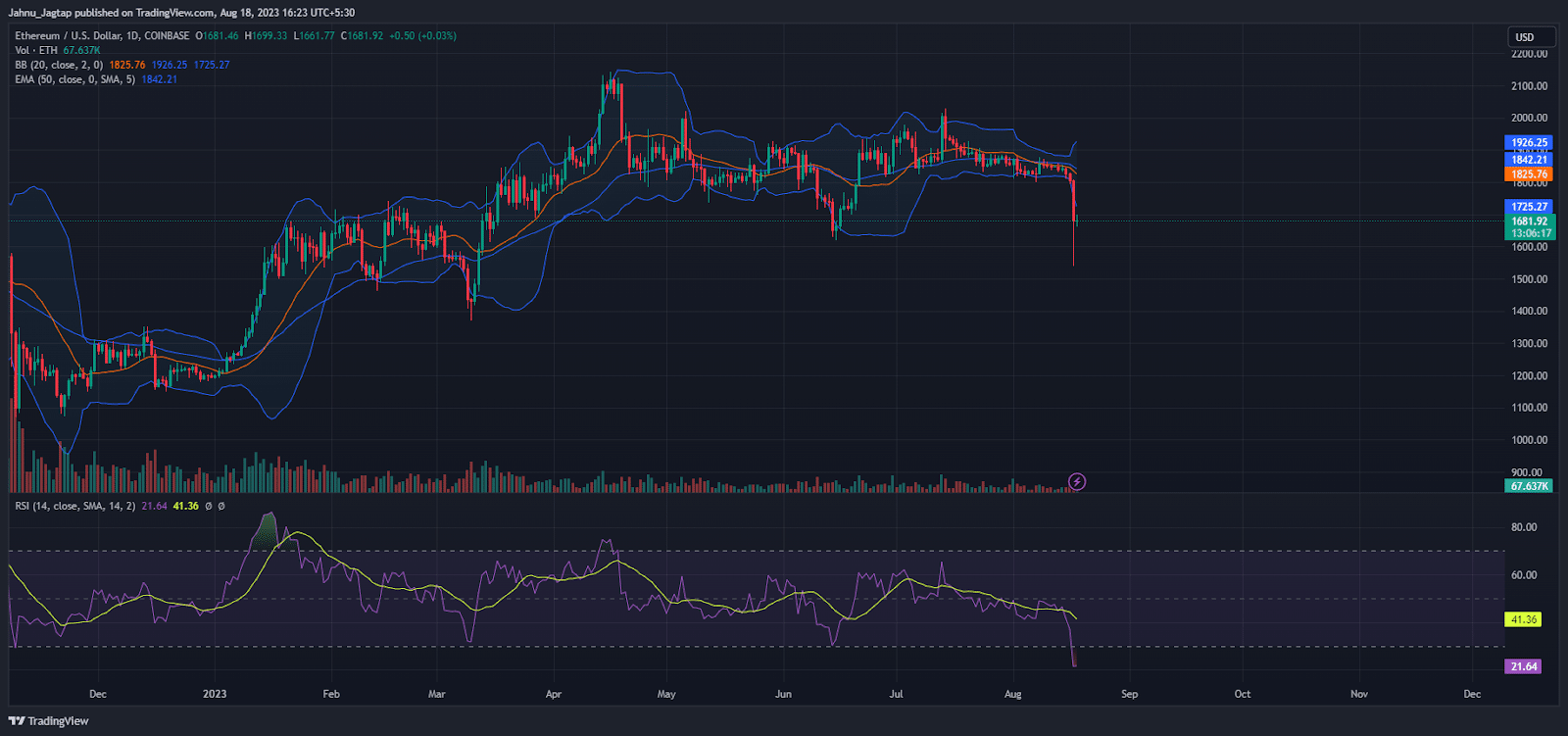

At the time of writing this post, ETH/USD is trading around $1,657.22. The Bollinger Bands downside breakout suggests a bearish direction on the daily chart. The candlesticks are forming below the 50-day, which indicates short-term bearishness. Moreover, the RSI is also around 22, which does not suggest positive momentum in the market.

Based on the daily chart analysis, $2000 is the resistance, and $1700 and $1500 are the supports for the long term. Since Ethereum has broken the support of $1700, which also indicates ETH may be short-term bearish until it finds support, you should consider other aspects to find momentum.

Our future ETH prediction suggests the price will trade between $1600 and $3500 in 2023, but it will cross $5000 in the second half of 2024. You can expect a 400% return in the next two years, around $6500.

Also Read: Ethereum Price Prediction 2023: Can ETH Hit $2500?

Navigating Challenges Amidst Innovation

Despite recent developments like the introduction of PYUSD and the emergence of Ether-based exchange-traded funds (ETFs), the Ethereum network grapples with challenges.

PYUSD and the Exploding Stablecoin Market

The stablecoin market has been buzzing with excitement and for a good reason. A research report by Bernstein has painted an optimistic outlook for stablecoins, projecting a remarkable surge in their market value over the next five years. With regulatory uncertainties, Bernstein’s report forecasts a staggering growth potential, estimating that the stablecoin market could balloon to $2.8 trillion. This projection represents a jaw-dropping 22-fold increase from its current valuation of $125 billion.

The report also highlights a compelling trend – the expectation that major global financial and consumer platforms will jump into the stablecoin arena, issuing co-branded stablecoins to facilitate value exchange on their platforms. This is precisely where PayPal’s recent development, PYUSD comes into play. As the stablecoin landscape evolves, PayPal aims to carve out its own niche, competing with established players like Tether and Circle.

Ether-based PYUSD’s primary target is the US market, while Tether’s USDT strongly focuses on emerging markets. The real clash, industry insiders predict, will unfold between PayPal’s PYUSD and Circle’s USDC, which has already established a robust presence in the US.

The Ethereum ETF Revolution

In the crypto realm, Volatility Shares, a trailblazer in the ETF arena, has announced plans to introduce the Ether Strategy ETF on October 12, 2023. If all goes well, this ETF could be the pioneering Ethereum-based exchange-traded fund in the US market.

Unlike other ETFs that directly invest in ETH, the Ether Strategy ETF revolves around Ethereum futures contracts. While Volatility Shares lead the charge, it is essential to note that they are not alone in this endeavor. A lineup of 13 heavyweight financial institutions, including Bitwise, VanEck, Valkyrie, ProShares, and Roubhill, are actively seeking approval from the US SEC. However, the SEC has yet to show any green signal for opportunities.

In the face of these recent developments, the Ethereum network faces challenges. The emergence of PYUSD and the potential for Ethereum ETFs signal growth and innovation. Still, challenges like regulatory uncertainties, higher gas fees, and competition also impact the future of Ethereum and the broader cryptocurrency ecosystem.

Bulls vs. Bears

The bulls, or Ethereum whales, are like the optimists in the room, cheering for rising prices and believing in the limitless potential of cryptocurrencies. On the other side, we have the bears, the skeptics who foresee price drops and are cautious about market euphoria.

The whales are active due to technological advancements, partnerships with big players, and positive news as indicators of a brighter future for Ethereum. Still, bears are raising the alarm concerning market bubbles, low volatility, and regulatory challenges.

Indeed, a tug-of-war between the bulls and bears will be essential for a healthy market. It has already started- the competing forces keep each other in check, preventing extreme price swings in either direction. Exploring various cryptocurrency predictions before investing amidst such significant market uncertainty is advisable.

Also Read: 5 Shocking Chatgpt Crypto Predictions For Next 10 Years

Conclusion:

The future price action of Ethereum shows bearish sentiment. You can expect a bearish pattern as the $1700 support is breached, potentially triggering a downward momentum. However, a more optimistic scenario unfolds if Ethereum surges past the $2500 resistance. This breakthrough might spark a rally on the upside. Amidst these potential trajectories, whales have accumulated ETH at a lower price, while Ethereum enthusiasts keenly await signals for momentum.

Whether you have a high ETH investment or want to start your investing journey, remember that rallies and dips are all part of the game between the bulls and bears. It helps us make more informed decisions and navigate the turbulent waters of the crypto market.