In a turbulent turn of events, the widely recognized frog-themed memecoin known as PEPE took center stage amidst a wave of pessimism, witnessing a staggering 20% drop in its price over the past 24 hours.

The drop in Pepe’s price aligned with recent adjustments made to a multisig wallet, along with concerns sparked by a $16 trillion tokens transfer that raised worries about potential developer misconduct, commonly referred to as a “rug pull.”

Meanwhile, the broader cryptocurrency market displayed a slight negativity, experiencing a 1.6% decrease in its market cap.

The analysis highlights that this opportune ‘short gift’ involving PEPE coin occurred within the market as approximately $16 million worth of Pepe tokens were dispatched from the developers’ multisig wallet to several big cryptocurrency exchanges, including Binance and OKX, on August 24th.

The $16 trillion Pepe coin constitutes approximately 3.8% of the entire supply of PEPE cryptocurrency. During the substantial token transfer, roughly $8.36 million worth of PEPE was sent to OKX, $6.6 million to the biggest exchange – Binance, and $438,000 directed to Bybit. Notably, the remaining $400K was transferred to a wallet of unidentified origin.

PEPE Token Reaches 2 Months Low

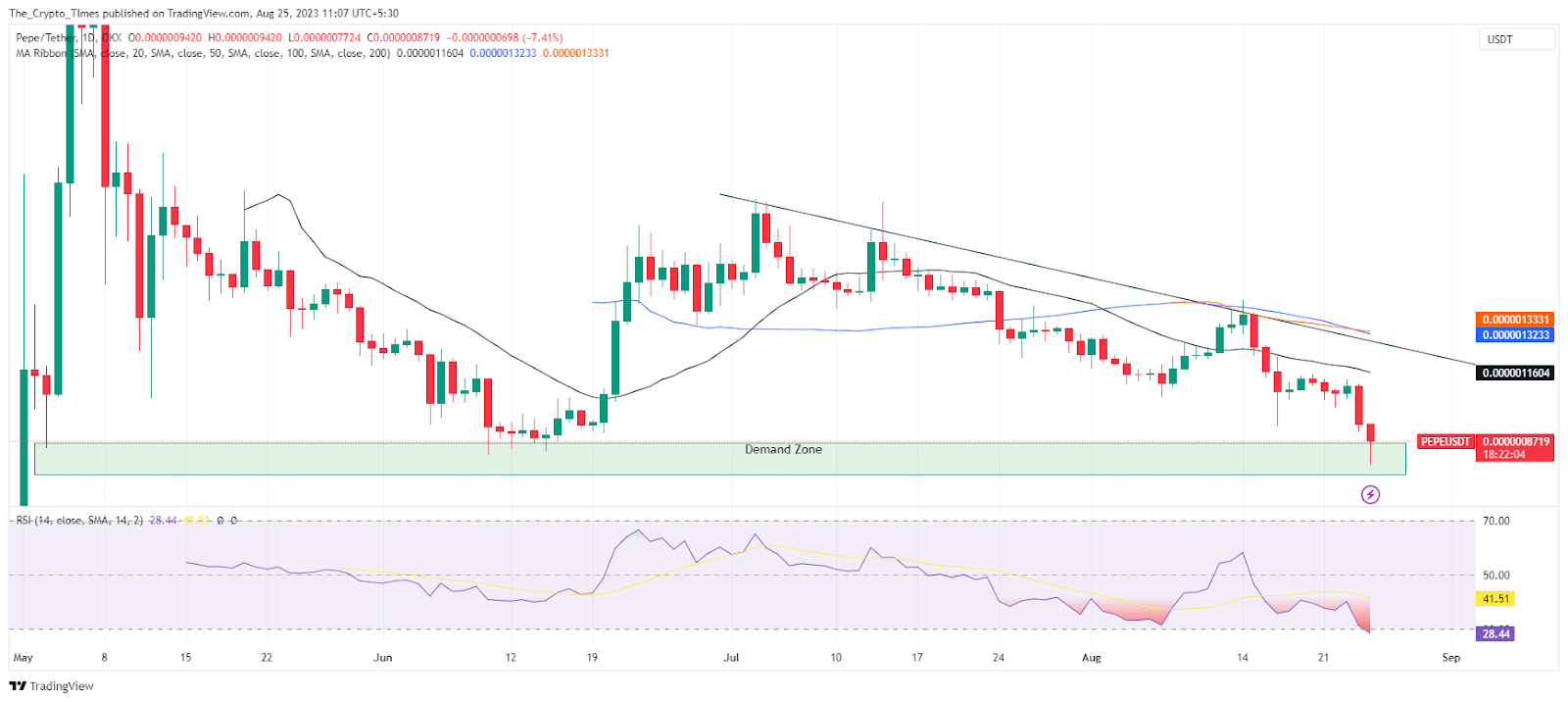

Amidst persistent declines in PEPE tokens over the preceding weeks, the price of the memecoin finds itself situated within a robust demand zone, closely hovering around the range of $0.00000082.

Worth highlighting is the present trading value of PEPE tokens, currently standing at $0.00000087, although this figure accompanies a significant overnight plummet of 20%.

In the aftermath of the recent crash, investors holding PEPE tokens were confronted with a new low spanning a period of two months, marked at $0.000000772 on August 25th.

Prompted by the recent sell-off in PEPE tokens, speculators have been spurred into action, resulting in a remarkable 180% surge in trading volume overnight, reaching a substantial $206.7 million, according to CoinMarketCap.

Nonetheless, it’s worth noting that the daily RSI indicator is currently situated within the oversold zone, with a reading of 29.

Additionally, key moving averages, including the 20, 50, and 100 SMAs, are currently positioned above the present price level, potentially serving as resistance.

Moreover, if the price of PEPE tokens falls below the demand zone, it could potentially revert to its initial trading price.

Also Read: PEPE Coin Down 50% From ATH; Concerns Rise for Investors