Due to the turbulence in the cryptocurrency market, potential investors are struggling to identify compelling reasons to begin acquiring Bitcoin. Consequently, Bitcoin is currently experiencing its lowest level of trading activity in the past five years.

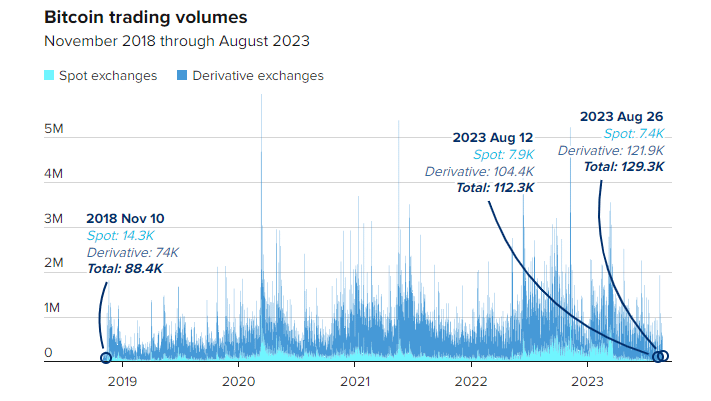

As indicated by a report from CryptoQuant, market speculators have observed an exceptionally low trading volume, with only 112,317 BTC being traded for the renowned cryptocurrency Bitcoin. This figure takes into account data from both spot and derivatives exchanges.

Currently, the trading volume of Bitcoin across all exchanges stands at 129,300 BTC, according to CryptoQuant. This shows a slight improvement from its recent five-year low of 112,317 BTC recorded on August 12th. The last time such a low trading volume was witnessed was five years ago on November 10, 2018.

In the financial world, it’s a widely acknowledged fact that trading volumes tend to decline in bear markets due to the departure of retail investors. Julio Moreno, the head of research at CryptoQuant, emphasized this point, stating, “This happened during 2022 on most exchanges. As we progress further into a bull market, the trading volume may continue to pick up.”

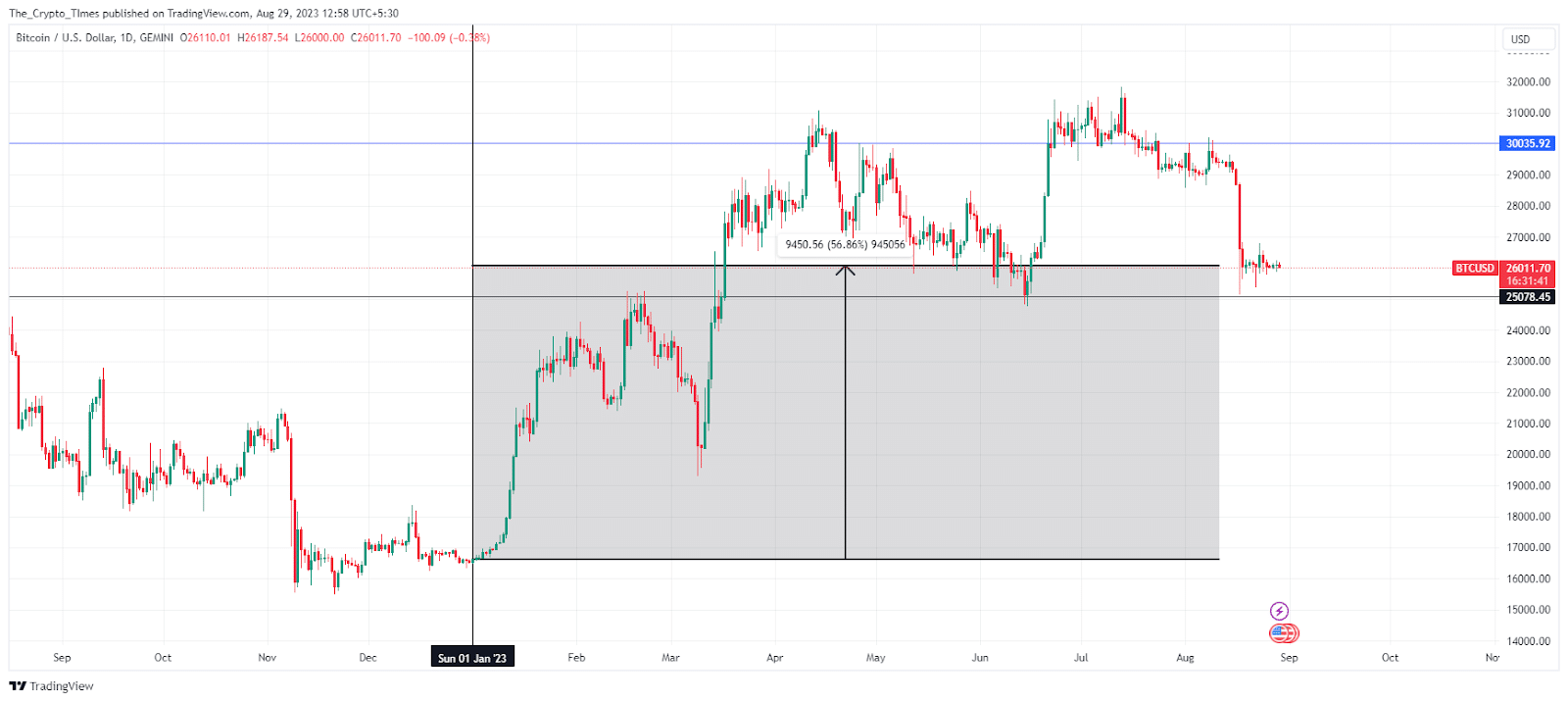

Nonetheless, as of the present moment, Bitcoin is being traded at $26,000, maintaining a remarkable increase of almost 55% over the course of this year. However, it’s important to note that even as the trading volume experiences a decrease, this trend could potentially encourage active sellers to initiate selling actions.

The impact of the U.S. regulator crackdown on the cryptocurrency space has been evident in the departure of market makers and traders. Remarkably, even following the significant sell-off of Bitcoin on August 17th, the market swiftly reverted to a state of calm, underscoring the lack of compelling reasons for investors to rejoin.

Long-term investors, according to data, have demonstrated resilience in the face of recent market weaknesses. In general, the market maintained a subdued stance as it awaited a new catalyst, with overall market liquidity remaining limited,” noted Gautam Chhugani, an analyst at Bernstein, in a recent note discussing the previous week’s crypto trading.

Chhugani emphasized that, regardless of what eventually rekindles market movement, the genuine opportunity for investors lies in remaining committed through the new market cycle, often aligned with Bitcoin halving events. The upcoming halving is projected for the spring of 2024. Cantor Fitzgerald echoed this focus on the long-term strategy.

Also Read: Is September the Month for Bitcoin to Bounce Back?