The USD pegged stablecoins, USDC and DAI have been more prone to depegging among other leading stablecoins.

According to a report by S&P Global, both these stablecoins were trading below $1 frequently compared to other stablecoins over the past two years. The report is prepared on the basis of valuation and depegging for leading five stablecoins – USDT, USDC, BUSD, USDP and DAI.

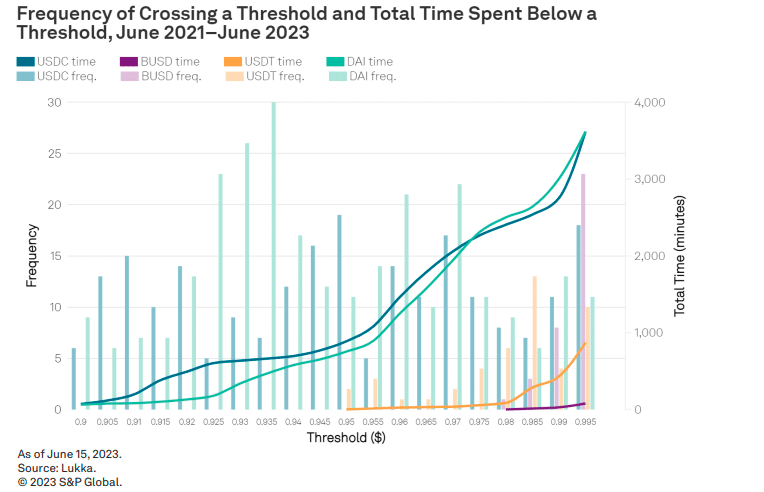

S&P analysts Dr. Cristina Polizu, Anoop Garg, and Miguel de la Mata found that the frequency of USDC and DAI’s depegging is higher than of USDT and BUSD, during the past two years of period. In a longest and deepest de-peg event, USDC has been below $0.90 for over 23 minutes while DAI being there for over 20 minutes.

Tether’s USDT went below $0.95 ($0.945) for one minute only during June 2021 and June 2023. In the same period, Binanec’s BUSD price has never been down below $0.97.

The report is researched and prepared by – Cristina Polizu, Anoop Garg and Miguel de la Mata, with they cites that, “We [ ].. noted that USDT and BUSD did not depeg below $0.90, while the price for USDC, DAI and USDP remained below $0.90 for a total of 73 minutes, 63 minutes and 82 minutes, respectively.”

It also highlights the major de-peg occurring in March 2023, when USDC dropped following the collapse of Silicon Valley Bank. Consequently, DAI also followed USDC depeg as MakerDAO had over half of its collateral reserve in USDC at that time.

The authors note that one-minute depeg which moves closer around $1 events can be identified as ‘noise’ while longer and much deeper price differences are more likely to be considered a significant depeg.

Also read: Bitcoin User Pays $500k In Fee For A Single Transaction