The British retail bank Chase, owned by JPMorgan (JPM.N.), will forbid customer transactions in cryptocurrency due to an increase in fraud and scams starting on October 16.

On September 25, the spokesperson for the bank clarified that UK customers of Chase Bank will no longer be able to conduct any cryptocurrency transactions using their debit cards or through outgoing bank transfers.

Customers who attempt to conduct a crypto-related transaction “will receive a declined transaction notification,” the bank said in a statement. Chase has decided to enforce the new restrictions because of an “increase in fraud and scams” involving crypto assets.

The banks has requested that customers who still wish to deal with crypto currencies use a different bank or provider instead of them.

As per the data from Action Fraud, Britain’s fraud reporting agency showed that consumer losses in the U.K. resulting from cryptocurrency fraud had increased by more than 40% year over year as of May 2023. As per the spokesperson, the agency estimates that the losses in the United Kingdom exceeded $300 million ($365 million).

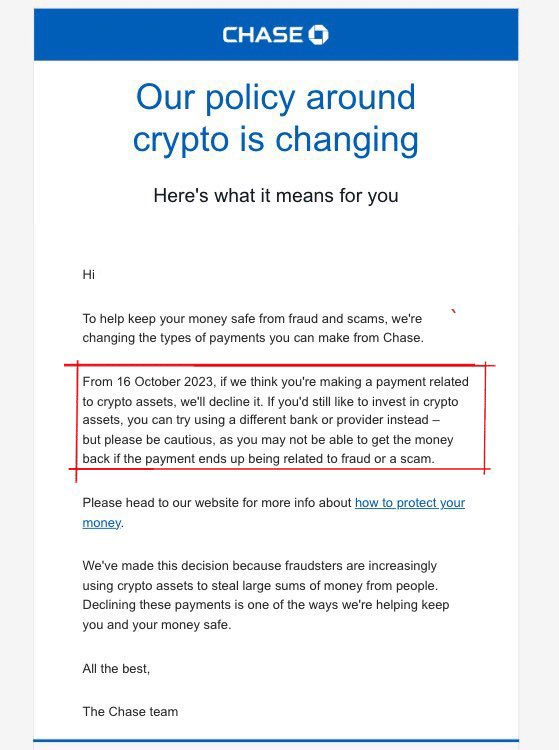

In an email to customers, Chase stated, “If we believe you are making a payment related to crypto assets, we will decline it. If you’d still like to invest in crypto assets, you can try using a different bank or provider instead — but please be cautious, as you may not be able to get the money back if the payment ends up being related to fraud or a scam.”

Also Read: JPMorgan Explores Blockchain Deposit Token