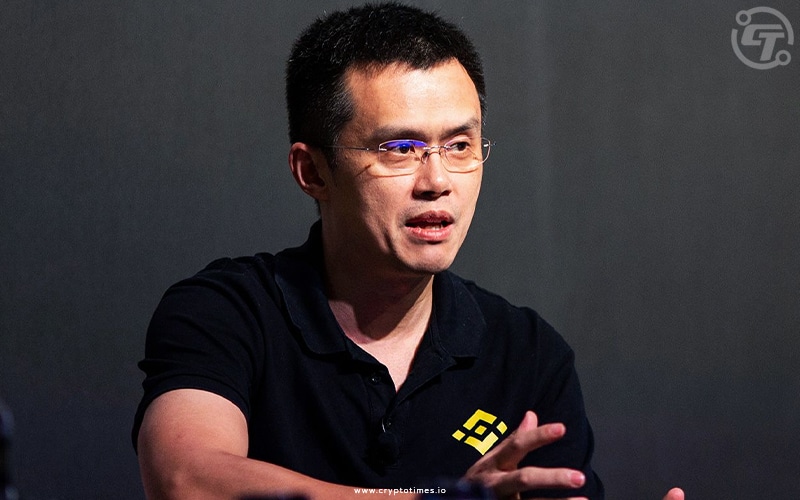

A class-action lawsuit was filed against Binance.US and its CEO, Changpeng Zhao, on October 2 in the Northern California District Court by Nir Laav, a California resident. A lawsuit alleges that Binance.US and its CEO violated federal and California laws on unfair competition by trying to dominate the cryptocurrency market and damaging their competitor, FTX.

On the eve of FTX’s collapse, Zhao made posts in conjunction with the decision by the defendant to liquidate their holdings in FTX utility token FTT on Nov. 6. The plaintiffs’ estimation suggests that Binance owned approximately 5% of all FTT tokens.

According to Zhao’s post the next day, Binance had signed a letter of purpose to acquire FTX, but it withdrew from the agreement a day later. As per the lawsuit, “Zhao publicly disseminated this information [on the withdrawal of the acquisition offer] on Twitter and other social media platforms to hurt FTX entities, which ultimately led to a rushed and unprecedented collapse of FTX entities.”

On November 6, Zhao made a post citing that they planned to liquidate any remaining FTT on their books due to a revelation. However, this statement was false and misleading because Binanae had already sold its FTT holdings, and the post was “intended to cause the price of FTT in the market to decline.”

The plaintiffs interpreted the latter sentence as an indication that Binance was against the “regulatory efforts” of FTX CEO Sam Bankman-Fried.

According to the lawsuit, “Zhao’s tweet resulted in the FTT price declining from US 23.1510 to US 3.1468. This significant drop plummeted FTX Entities into bankruptcy without giving an opportunity or chance to FTX Entities’ executives and board of directors a chance [sic] to salvage the situation and put in safe guards to protect its clients and end-users.”

As per the lawsuit, the plaintiff estimates that the proposed class has thousands of members. The plaintiff has proposed a nation wide class including all persons or entities in the United States, who, within the applicable statute of limitations period, had any fiat or cryptocurrency deposited or invested through an FTX trading platform during the time period of volatility starting before November 6, 2022 and ending after November 8, 2022.

The lawsuit filed seeks seven counts of monetary damages, court costs, and the return of illegally acquired wealth while the SEC is currently taking action against both FTX and Binance.

Also Read: Floki Sent 15.8B Tokens To DWF Lab Linked Binance Address