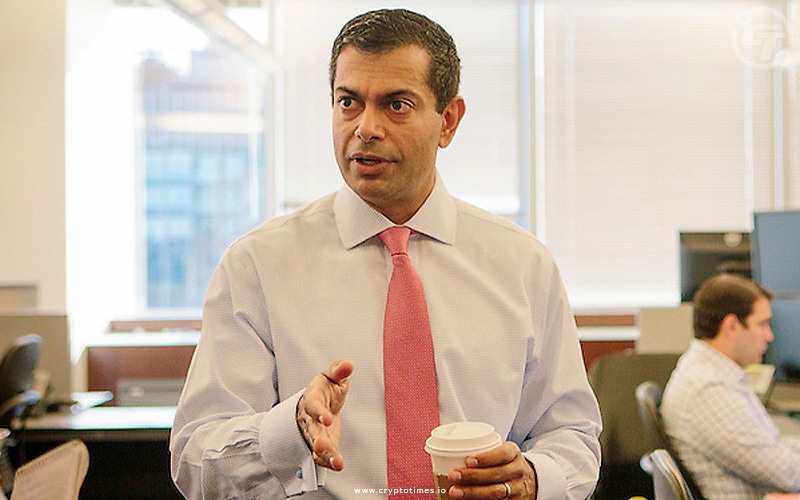

The CEO of the EDX market, Jamil Nazarali on Tuesday, said that Bitcoin might become a global reserve asset.

He added that due to people’s beliefs in Bitcoin and finite supply, the digital asset is highly likely to achieve this feat.

According to him:

“I think that they are here to stay. I think that there are strong use cases for them and I think that there will be greater and greater adoption over time”

In comparison with Gold, he added that Bitcoin’s ability to make seamless transactions give it greater functionality over other physical commodity.

When discussing decentralized finance (DeFi), Nazarali says that the decentralized setting lacks oversight. He further highlights that increasing cases of money laundering is one of its shortcomings.

Nazarali believes there is a dark future for DeFi protocols. According to him, without some central authority, many DeFi platforms might have gone into oblivion.

The EDX CEO however lauded the EDX market for doing a good job bridging the gap between traditional finance and the digital asset world. He said that the EDX market was created to operate as traditional finance but for crypto assets.

Also, while speaking on regulatory challenges, Nazarali emphasised the significance of clear laws and regulations for firms to thrive within when discussing the compliance problems that the digital currency sector in the U.S. faces, contending that a lack of clarity is a huge barrier for many enterprises.

Also Read: EDX Crypto Exchange Launches with Prominent Backing