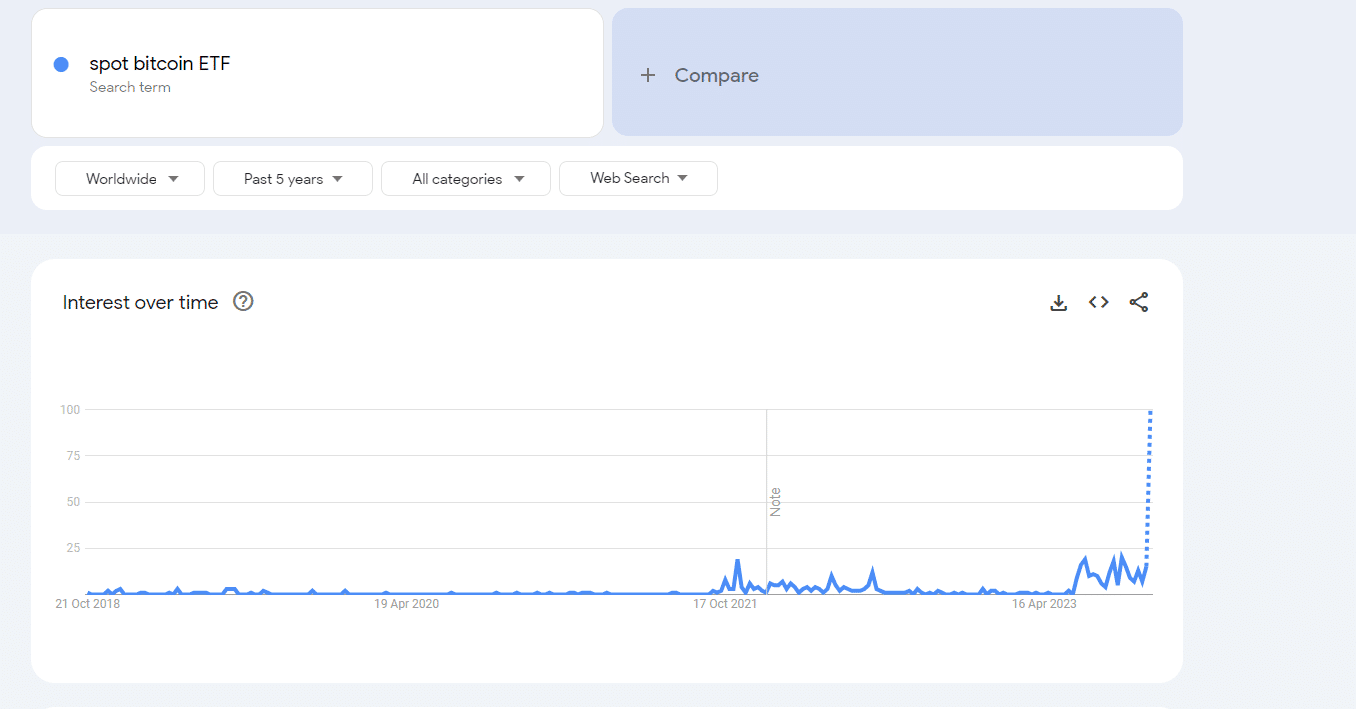

According to data from Google Trends, the global search interest for the term “spot bitcoin ETF” is expected to reach its highest point, indicating a surge in public curiosity.

The value for “bitcoin ETF” has also risen to 39, the highest it has been since the launch of ProShares’ futures-based ETF two years ago, when it also reached a peak of 100 in search interest.

People in the market believe that the U.S. SEC, which recently didn’t meet a deadline for a significant legal challenge, will likely give the green light to a spot ETF in the early part of next year. This approval is expected to bring a substantial increase in available funds and trading activity.

Also Read: What are Bitcoin ETFs? When will the SEC Approve Them?

The idea of getting approval for a Bitcoin (BTC) Exchange-Traded Fund (ETF) has been a consistent topic of discussion in the cryptocurrency industry. Many people view it as a way to measure how widely accepted BTC is becoming in mainstream finance.

Google Trends provides mostly unfiltered samples of search requests made on Google and ranges from 0 to 100, with 100 indicating the highest level of interest at a given time. In the past, when Bitcoin and Solana (SOL) reached a score of 100 on Google Trends, it often coincided with the peak of their price increases during bull markets.

A spot ETF follows the real-time price of Bitcoin and doesn’t involve trading in Bitcoin futures. Instead, the ETF provider buys and holds actual Bitcoins. This is a good option for people who want to invest in Bitcoin without needing to personally own the cryptocurrency.

Also Read: Fidelity Amends Bitcoin ETF Filing