Cryptocurrency derivatives traders experienced massive losses totalling over $300 million in the past 24 hours as digital asset prices saw a sudden and rapid surge, taking many market traders by surprise.

Reports from CoinGlass reveal that the majority of these liquidations amounting to around $235.04 million, targets leveraged short positions, meaning traders who had bet on that price would fall.

This marks the second largest single-day loss from short liquidations since late August.

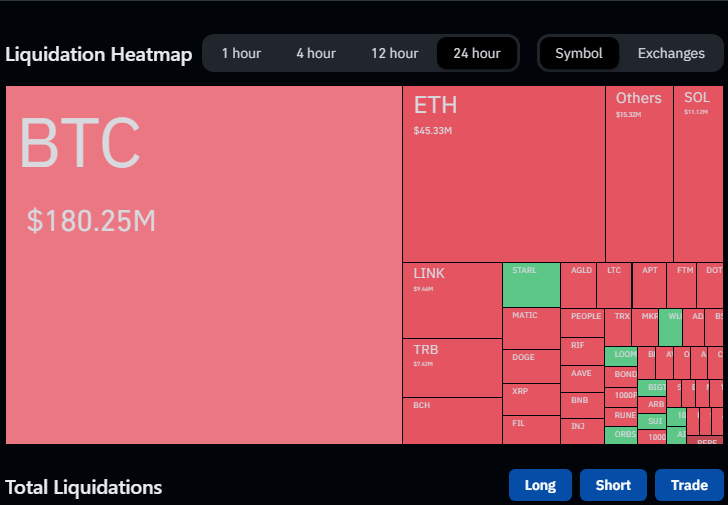

Bitcoin (BTC) traders bore the brunt of these liquidations, with approximately $180 million wiped out, mostly affecting traders who had bet against the price.

Following closely were Ethereum (ETH) traders, who faced roughly $45 million in liquidation.

Chainlink (LINK) speculators also found themselves reeling, as over $9 million worth of LINK positions were liquidated as it reached its highest price point since May 2022 during the rally.

These liquidations occurred in tandem with Bitcoin’s rally, surging 4% and breaking through the $31,000 price level for the first time since July.

The mass liquidations came as most major alternative cryptocurrencies, or altcoins, joined Bitcoin in surging significantly. Chainlink’s LINK token, Polygon (MATIC), and Polkadot (DOT) logged gains ranging from 6% to 10% at one point during the 24-hour period.

Also Read : Moonbeam Surges 50% on Strong Technicals and Upbit Listing