Amid the smell of bullish momentum in the cryptocurrency market, yet another bullish sentiment has fueled a potential hike in ETH price.

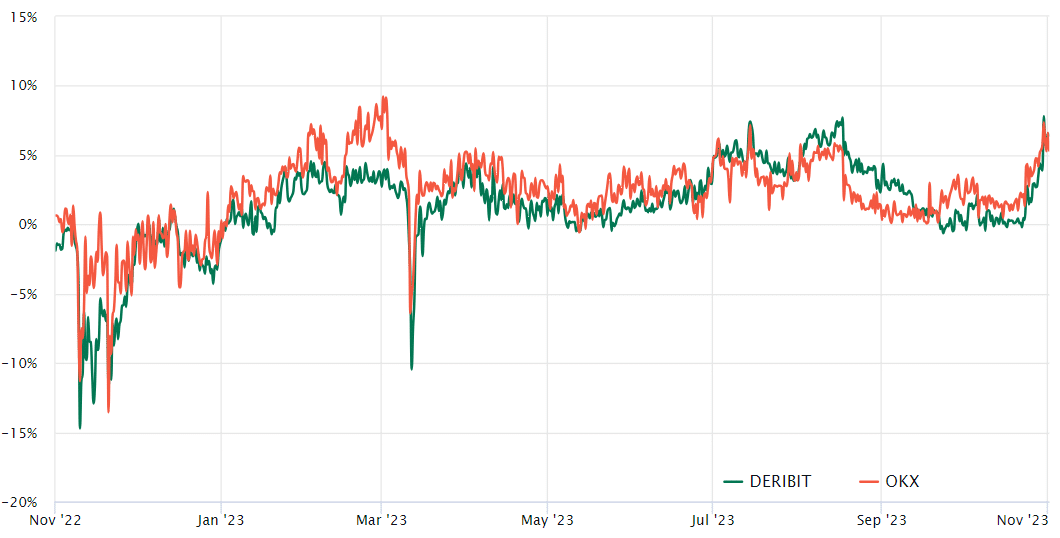

Market data reveals that the Ether (ETH) futures premium has hit its highest level in over a year which has surged from 1% on October 23 to 7.3% on October 30. It suggests that the demand for ETH long positions has grown tremendously over the period.

The bullish sentiment within ETH market has continued to grow despite a decrease of over 14% in its price from the peak of $2,120 in April. However, ETH price has recently seen a gain of 15.7% over the past two weeks.

The futures premium measures the difference between asset’s spot price and two month contracts. The range of 5% to 10% in annualized premium is a sign of healthy market condition.

A driving factor for this hike is expected to be associated with the much manifested approval of spot Bitcoin ETF. The essential increase in BTC price will be also followed by ETH as usual. Several reports have predicted that the spot ETF could lead Bitcoin to new record-breaking highs.

Also Read: Bitcoin Could Hit As High As $150,000 by 2025: Bernstein