The cryptocurrency exchange FTX and its creditors filed a motion in the Delaware bankruptcy court to approve the sale of some trust assets, including funds held by Grayscale and Bitwise, with an estimated total value of $744 million.

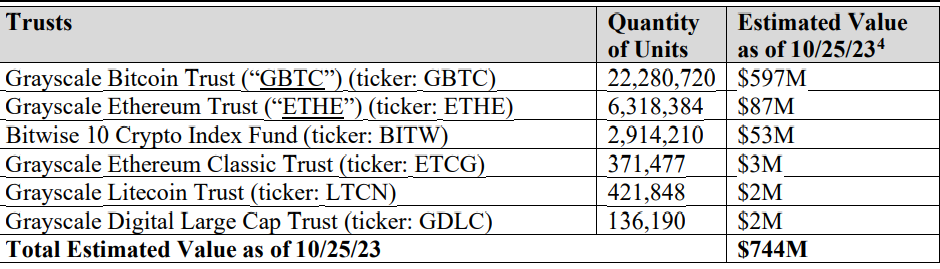

The “trust assets” are composed of holdings in five Grayscale Trusts, with a combined estimated value of $691 million, and one trust managed by Bitwise, valued at $53 million, as of October 25, 2023. The trusts allow investors to gain exposure to digital assets without direct ownership.

“The Debtors’ proposed sale(s) or transfer(s) of the Trust Assets will help allow the estates to prepare for forthcoming dollarized distributions to creditors,” the filing reads.

“The debtors’ judgment is that proactively mitigating the risk of price swings will best protect the value of the Trust Assets, thereby maximizing the return to creditors and promoting an equitable distribution of funds in the debtor’s’ plan of reorganization.”

FTX’s recent request to sell trust assets follows a prior court approval for the liquidation of approximately $3.4 billion in cryptocurrency assets. The court ordered the sale of these assets in batches of $50 million and $100 million to prevent any adverse market impact from a sudden, large sell-off.

Last week, FTX founder Sam Bankman-Fried was found guilty of defrauding his customers and lenders by a jury. A tentative sentencing date has been scheduled for March 28, 2024. In theory, he could potentially face a sentence of 115 years in prison, but experts suggest that in practice, the actual sentence could range between 20 and 25 years.