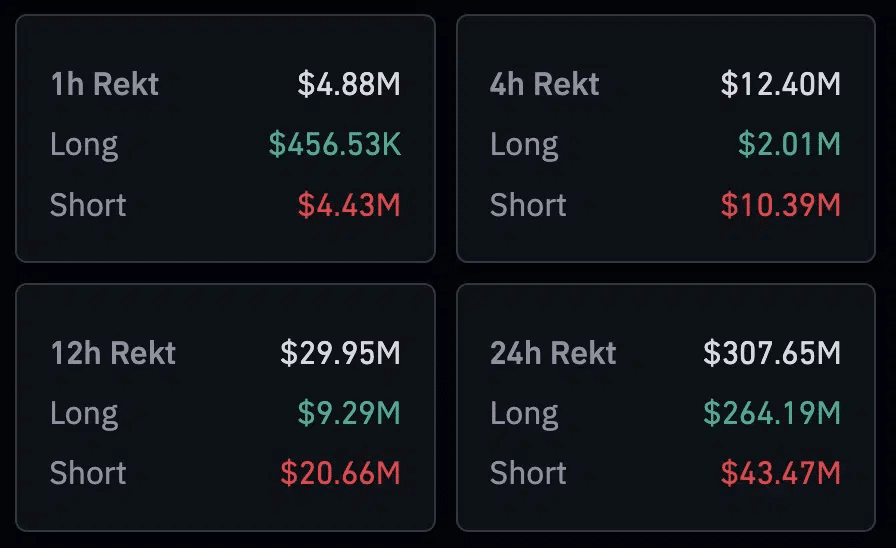

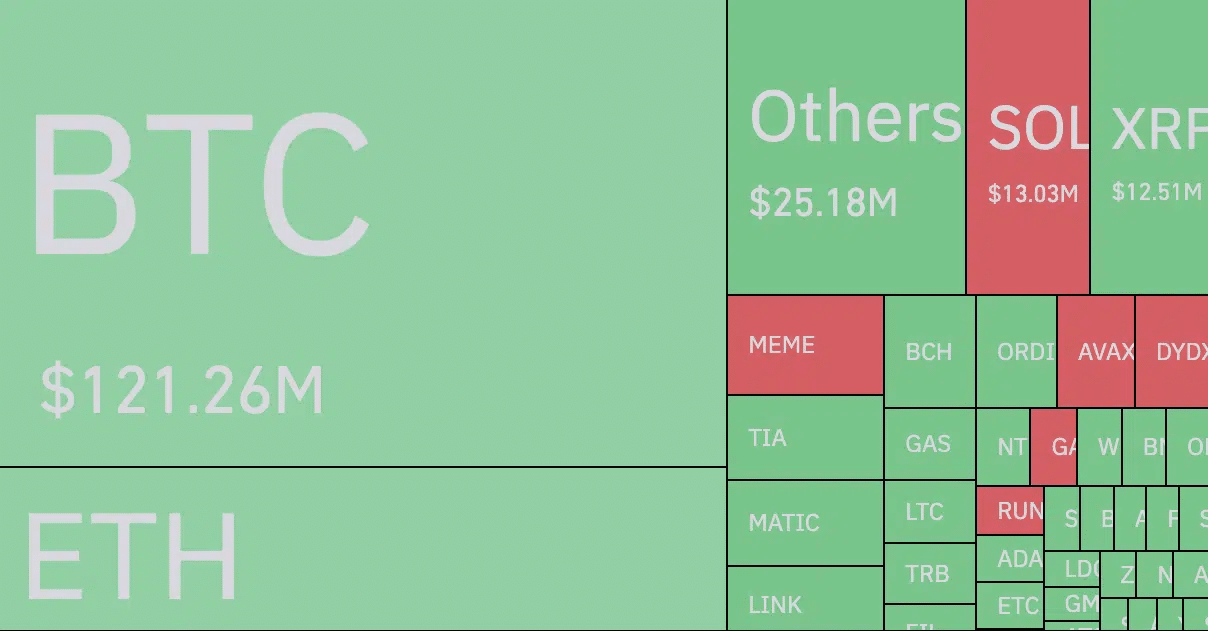

Over $300 million worth of leveraged positions were forcibly closed on cryptocurrency exchanges in the past 24 hours, as Bitcoin and Ether saw steep declines. The massive liquidations were triggered by Bitcoin suddenly dropping below $35,000, down over 5% from recent highs. This price swing liquidated $121 million in Bitcoin trades alone.

Ether, the second largest cryptocurrency, fared even worse, with its dip under $2,000 leading to $64.1 million in liquidated ETH positions. Solana’s native token SOL saw the most liquidations among altcoins, totaling $13.03 million. Exchanges OKX, Bybit, and Binance accounted for over 90% of the total liquidations.

Moreover, OKX executed the largest single liquidation, closing a long Bitcoin trade worth $9.45 million. The flash crash comes right after US inflation data was released, likely sparking fears of further Federal Reserve rate hikes.

Though traders remain overall bullish on Bitcoin, the massive liquidations serve as a reminder of the market’s continued volatility. With long positions still dominating, the road to recovery for Bitcoin and Ether prices remains uncertain in the short term.

Also Read: Binance Halts Russian Ruble Deposits and Withdrawals