On November 14, Marathon Digital Holdings, a leading Bitcoin mining company, unveiled its comprehensive operations update, shedding light on the company’s expansive strategies in anticipation of the forthcoming Bitcoin halving scheduled for early 2024.

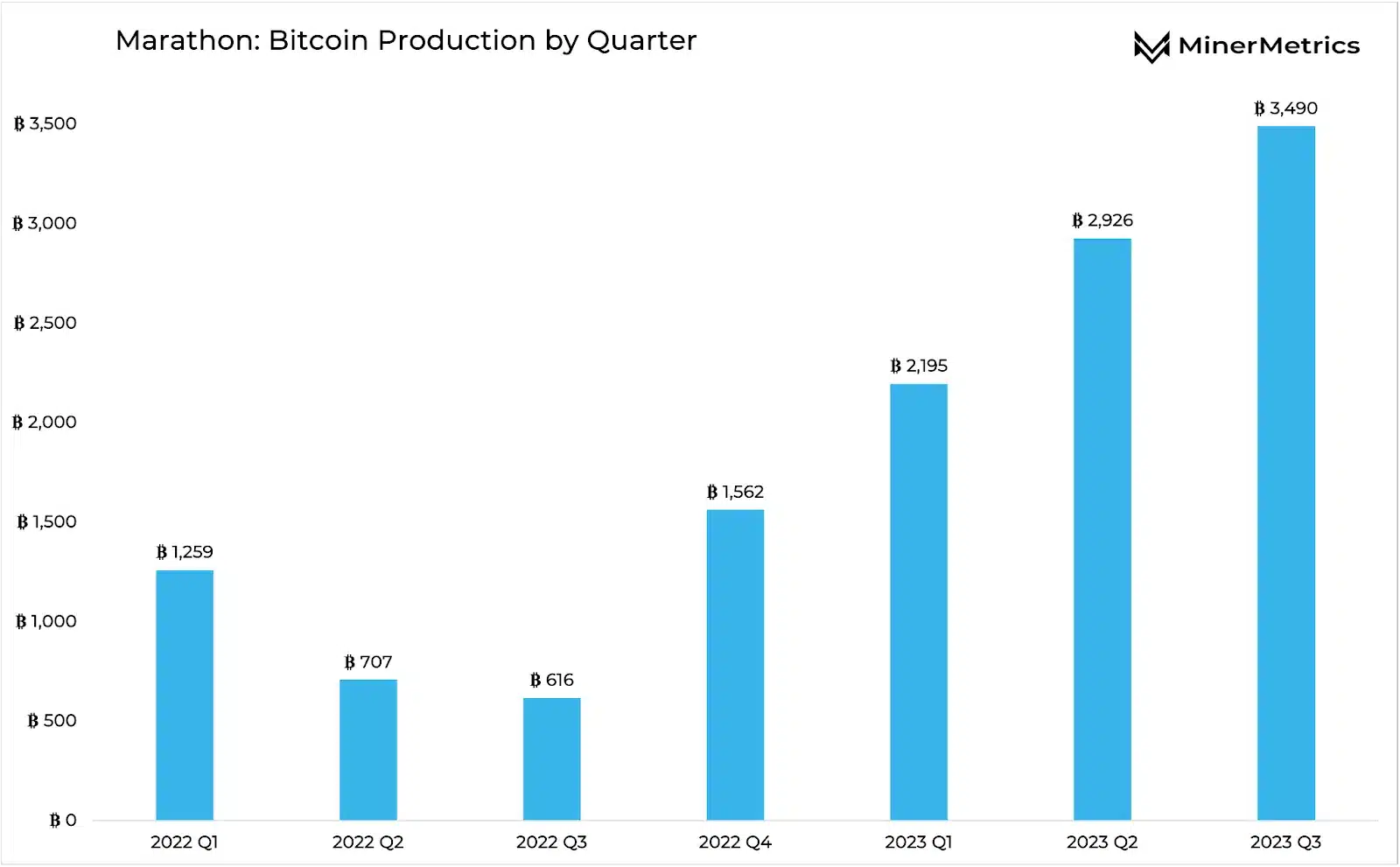

As the largest publicly traded miner by hash rate and Bitcoin reserves, Marathon has demonstrated a remarkable 467% surge in Bitcoin production over the past year, culminating in an impressive 3,490 BTC output in Q3 2023. Currently boasting a commanding 19.2 EH/s hash rate, the company has ambitious plans to elevate it further to 23 EH/s upon the complete operationalization of its Texas mining facility.

However, the company has signaled a strategic shift toward global joint ventures and diversification, unveiling plans for new mining sites in Abu Dhabi and Paraguay. This strategic move indicates a deliberate departure from dependence on U.S.-based mining facilities, which have grappled with issues such as exorbitant costs and operational delays.

Furthermore, While this international expansion may potentially alleviate production expenses, Marathon faces mounting pressure from competitors, given the Bitcoin network’s hash rate surging close to an all-time high of 428 EH/s. With the halving looming amidst the possibility of further market price downturns, Marathon must meticulously navigate its cost structure to ensure sustained profitability.

The upcoming halving event holds significant anticipation within the cryptocurrency community, historically affecting the supply dynamics and market prices of Bitcoin. Marathon’s endeavors to expand operations and minimize expenses via global partnerships could play a pivotal role in sustaining profitability after the halving occurs.

Also Read: Celebrate opBNB Mainnet Launch With Two-Month Airdrop Marathon