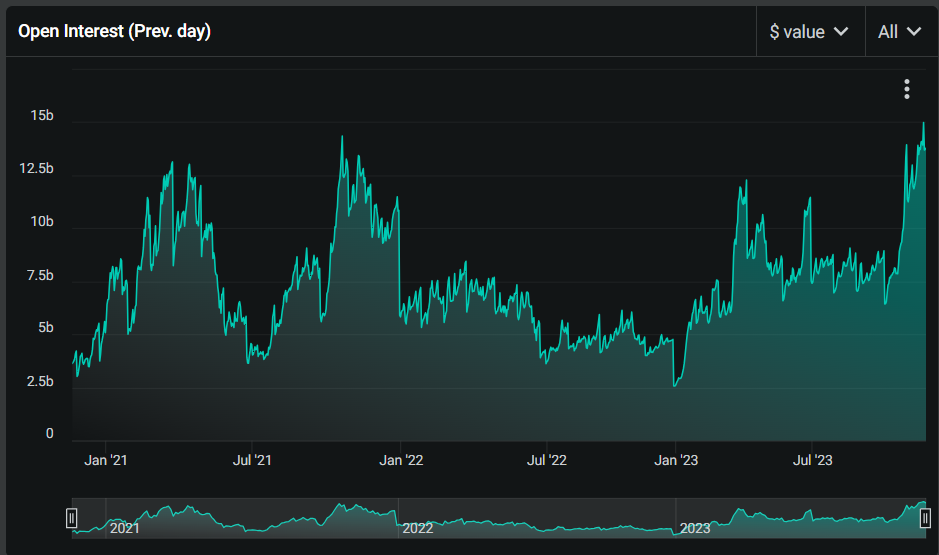

The leading crypto options exchange, Deribit, marked a record-breaking $15 billion of notional open interest in Bitcoin options on November 16.

Open interest, referring to the amount locked in active options contracts, for Bitcoin has increased more than double its size since September. It peaked at $14.36 billion during the bullish market momentum in October 2021, when Bitcoin was trading at a market price of over $60,000.

Deribit is the biggest options exchange for crypto assets, accounting for over 87% of global crypto option open interest, which is nearly $25 billion. At the time of writing, the open interest for Bitcoin options lies around $13.8 billion, according to data from the Deribit exchange.

“We’re excited to announce that we’ve just achieved a record-breaking $15 billion (ATH) in notional open interest in BTC options,” said Luuk Strijers, the Chief Commercial Officer at Deribit. “This development underscores the increasing preference for options as a strategic tool among traders, whether for positioning, hedging, or leveraging the recent surge in implied volatility.”

Options contracts are financial instruments that hold the right to buy or sell the underlying asset at a predefined price. A ‘call’ option represents the buying contract of assets, and ‘put’ represents the selling contract of assets.

Also Read: Bitcoin and Ethereum Active Supply Drops To Record Lows