Grayscale Bitcoin Trust (GBTC) could see an outflow of approximately $2.7 billion after its successful conversion into spot Bitcoin ETF.

A team of JPMorgan analysts said that an estimated amount of around $2.5 billion has flowed into GBTC since the beginning of this year, which can increase to $2.7 billion before Graysacle’s ETF filing gets approval.

The inflow into GBTC started after Grayscale filed for converting it into an ETF and as the trust’s shares were being traded at a huge discount. Traders dived-into buying shares in a hope that once GBTC is converted into an ETF, it can be redeemed at market price.

JPMorgan analysts said that if assumed that traders bought shares at discount just to profit on its ETF conversion, all the inflow of funds – which came driven by share’s discount price – is likely to exit as soon as the ETF starts trading.

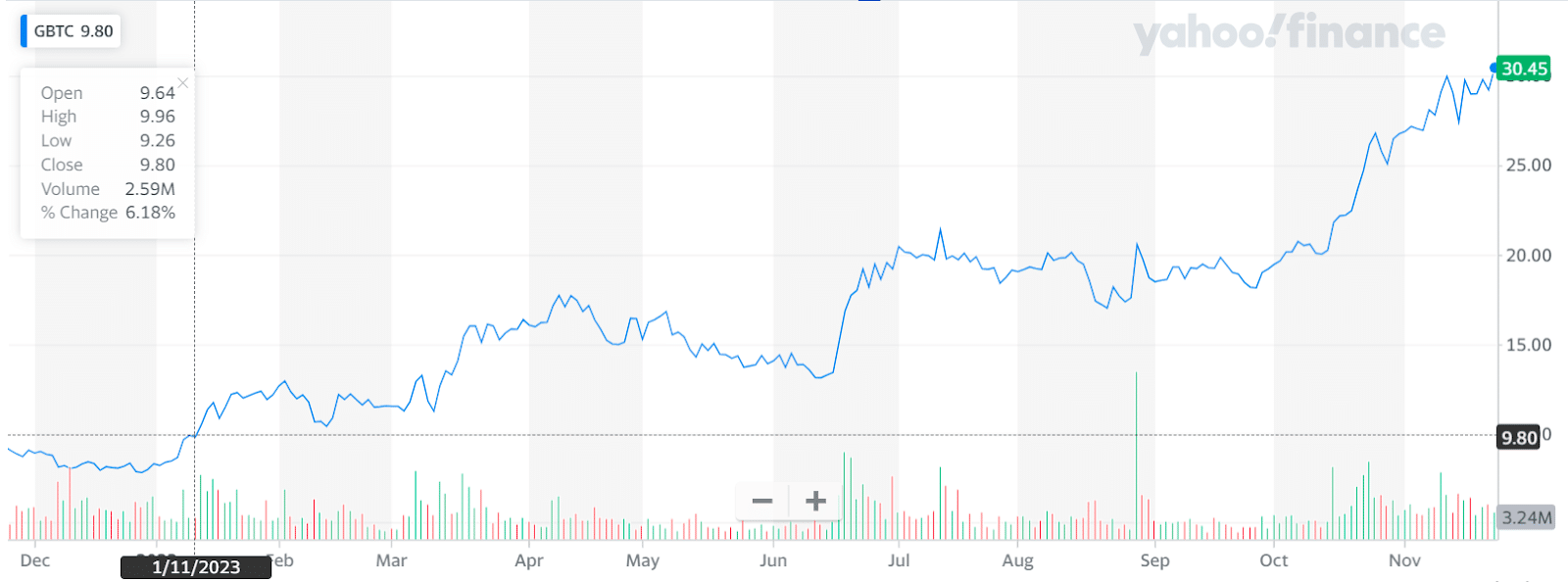

GBTC shares were trading around $10 in January which has now reached to $30, gaining 200% during the period, according to market data.

The figure of $2.7 billion is minimum estimated outflow as it could be significantly more if GBTC’s current fee remains near to 200 basis points post the ETF conversion.

“Once the SEC approves spot bitcoin ETFs in the U.S., we envisage a more intense competition with the average fee for bitcoin ETFs converging towards that of Gold ETFs, which currently stands at around 50 basis points,” said analysts.

Also Read: Is Grayscale Nearing Spot Bitcoin ETF Approval By SEC?