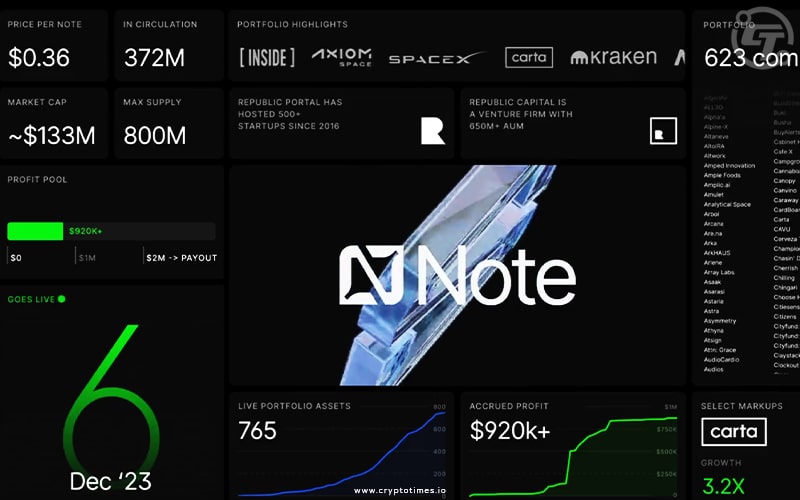

Investment firm Republic is set to list its digital security token, the Republic Note, on the INX trading platform on December 6. The move, leveraging the Avalanche blockchain, marks a significant shift in private equity investment, offering access to Republic’s venture portfolio.

This portfolio includes over 750 private companies across the Web2 and Web3 sectors, featuring notable names like SpaceX, Dapper Labs, and Carta. This diversified portfolio aims to mitigate risk and provide investors with the potential for attractive returns.

Innovative Dividend Distribution Mechanism

Republic’s token operates on a unique profit-sharing model. When a company in the portfolio experiences a liquidity event, such as a dividend payment, the generated profits contribute to a Republic Note dividend pool. Once this pool hits the $2 million mark, Note investors receive dividends in USDC directly to their digital wallets.

This structure aligns investor interests with those of the underlying companies, fostering a sense of shared ownership and long-term value creation.

To further enhance accessibility, the Republic Note will be available for investment with low minimums, making it an attractive option for retail investors who may not have the means to invest in private companies through traditional channels.

Kendrick Nguyen, co-founder and CEO of Republic, views the Republic Note’s listing as more than a company milestone; it represents a paradigm shift in private equity.

The token’s path to listing has already garnered substantial interest, raising over $30 million from entities like Binance and the Avalanche Foundation and individual investors during a private sale.

Since its inception in 2016, Republic has invested over $2.6 billion in privately held ventures. The firm was among the pioneers in enabling private companies to raise capital from uncredited investors through regulation crowdfunding.

The upcoming listing of the Republic Note is a significant event for the Republic and a step forward in democratizing access to private equity investments.

By leveraging blockchain technology and innovative token structures, Republic is empowering individuals to participate in the growth of promising ventures and potentially share in their success.

Also Read: Copper Launches New Trading Platform for Tokenized Securities in UAE