Amid optimistic market sentiment over the potential approval of spot Bitcoin ETFs, the demand for Bitcoin has increased among traditional finance players, which suggests a bullish stance on the $40,000 BTC price.

The hunger for Bitcoin futures was proven on November 10, when a massive rush for BTC futures on the Chicago Mercantile Exchange (CME) flipped Binance’s futures markets.

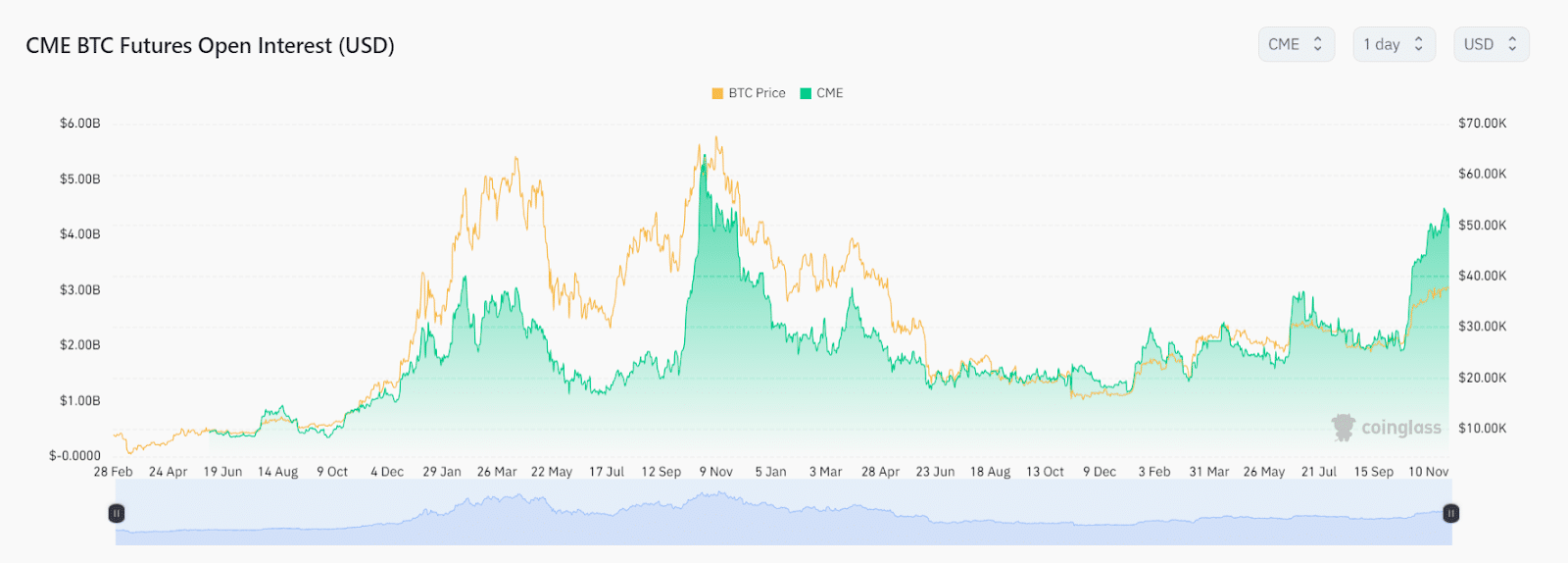

The current Bitcoin futures open interest stands near $4.4 billion on CME, which is its highest since BTC hit its all-time high of $69,000 in November 2021. It has continually surged since October 13, and it has more than doubled throughout November, according to data from Coinglass.

The flabbergasting growth of 125% in BTC futures open interest on CME provides evidence that transitional finance institutions are not leaving behind any chance to get into crypto.

While Bitcoin has surged from $26,000 to the current $37,600 market price during the period, it clearly suggests that the massive surge in futures open interest is aiming to see the BTC price surpass the $40,000 market sooner than it seems.

The upsurge in the Bitcoin market is heavily backed by the optimism around the SEC approving Bitcoin ETFs in near time, which is currently much anticipated by the crypto community.

Also Read: SEC Chair Gensler Keeps His Mouth Shut on Spot Bitcoin ETF