As Bitcoin (BTC) has continued surging in a bullish rally and touched the $42,000 price mark, it has triggered liquidations of more than $180 million of short positions during the past 24 hours.

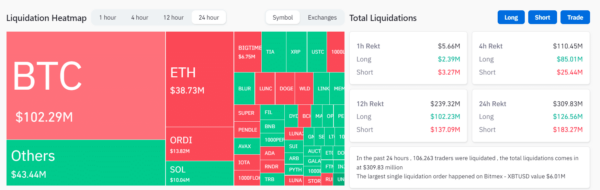

According to liquidation data from Coinglass, approximately $300 million of total liquidation has been recorded in the past 24 hours, of which over $183 million accounts for total short position liquidation.

Data shows that most of the liquidation has taken place on Binance, which has liquidated nearly 40% of its total positions, followed by OKX Exchange, which has liquidated 30% in 24 hours.

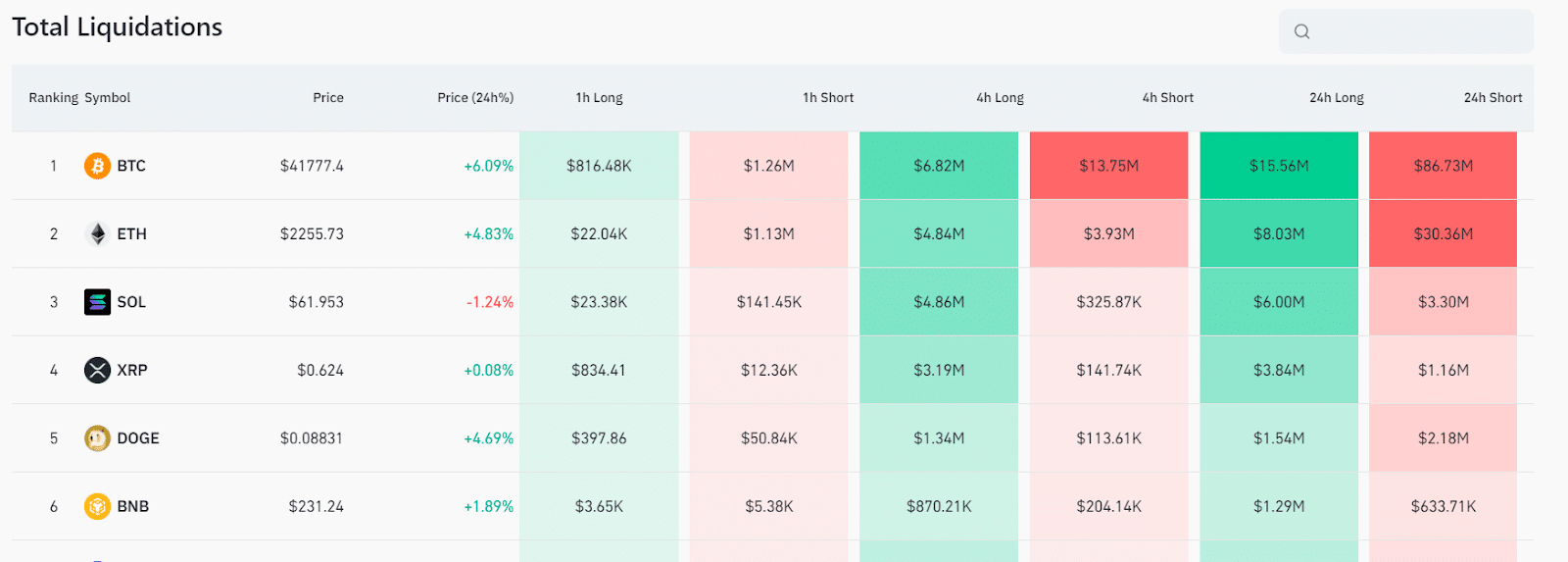

While betting against the market, more than $86 million of BTC short positions were liquidated, along with $30 million of ETH shorts.

Bitcoin is keeping up with its rally and has broken its 19-month highs while recording a daily high of $42,108 on December 4.

Also Read: BTC Price Could Spike by Supply Dynamics in 2024: Grayscale