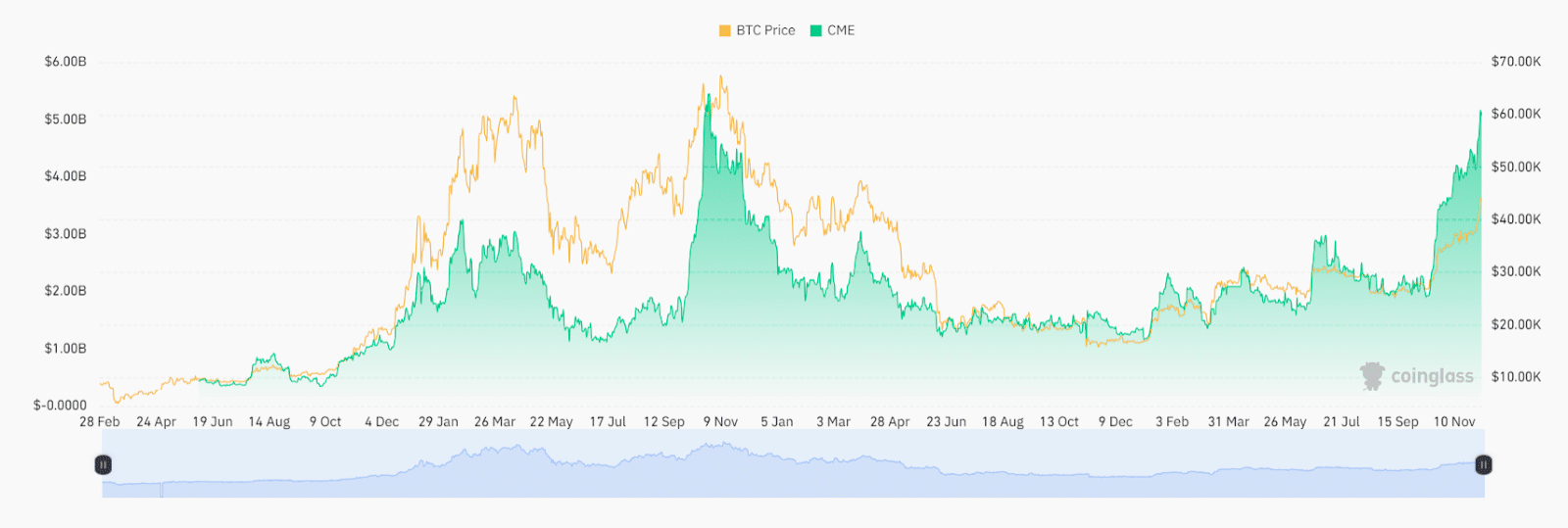

Bitcoin futures open interest on the Chicago Mercantile Exchange (CME) has reached $5.2 billion and neared the all-time high of $5.45 billion recorded in October 2021.

CME has seen a surge in open interest for Bitcoin futures since mid-October, when the BTC price surpassed $30,000, and it has been continually gaining since.

The current Bitcoin futures open interest is $5.17 billion, which is roughly $250 million away from surpassing its all-time high of $5.45 billion, according to data from Coinglass.

While several finance giants are awaiting approval from the SEC on their spot Bitcoin ETFs, and for the 4th Bitcoin halving, the BTC price is seeing a bullish rally, gaining over 15% over the past 7 days.

The rapidly increasing futures open interest on CME shows traders’ renewed attention towards Bitcoin. Several analysts have forecasted that this recent attraction for the Bitcoin price is estimated to break record highs during the ongoing bullish timeline.

Besides the direct factors impacting the BTC price, such as halving and Bitcoin ETFs approval, indirect and external attributes are also accountable for the surge in price, which includes the upcoming presidential election in the U.S. as well as interest rate cuts from the Federal Reserve.

Also read: Bitcoin Breaks $44k Barrier: Rallying Toward $50k Amidst ETF Optimism