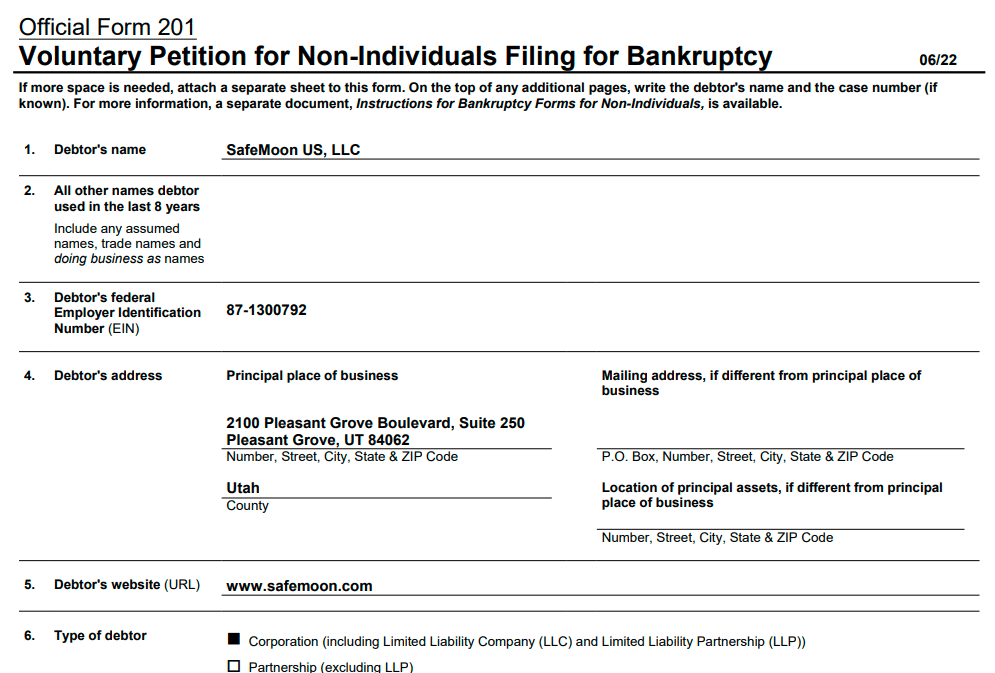

Crypto firm, SafeMoon, filed for Chapter 7 bankruptcy with the United States Bankruptcy Court of Utah State on December 14.

Safemoon’s Chapter 7 bankruptcy filing represents the voluntary liquidation of the company, which has an estimated asset value of $10 million to $50 million.

The bankruptcy filing comes nearly a month after the U.S. SEC accused Safemoon of fraud and security law violations.

On November 2, the SEC charged Safemoon executives for $200 million of project development funds, which they allegedly used for personal expenses and investments.

Following the bankruptcy filing, the project’s SFM token dropped over 50% in the past 24 hours, with its market cap dropping to merely $18 million, which once peaked at $1 billion in February 2022, according to market data from Coinmarketcap.

The bankruptcy of Safemoon was inevitable, as the company was not even able to pay its employees before filing. The restructuring officer of Safemoon sent a letter to all employees after the filing and told them to file claims for unpaid wages with the court.