The past week has recorded an outflow of nearly $33 million from Bitcoin products after an 11-week-long streak of inflows.

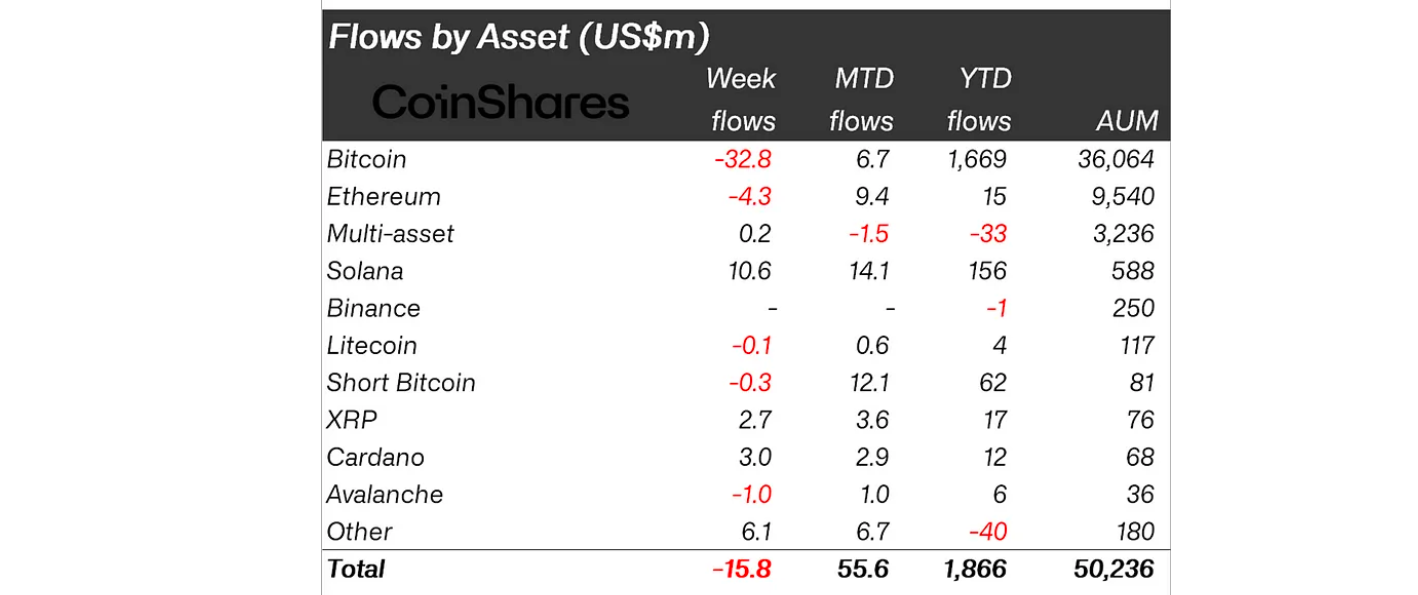

According to CoinShare’s latest weekly report, the Bitcoin-based investment products – offered by several institutions, including Grayscale, CoinShares, and numerous others – have recorded an outflow of $32.8 million during the week of December 11 to December 16. Alongside, Bitcoin short products have also witnessed a minor $0.3 million outflow during the past week.

While the whole crypto market has gone through a net outflow of $15.8 million, Bitcoin products have contributed the most among all assets. Previously all these weeks, Bitcoin was a dominating asset in attracting massive inflows into the crypto industry.

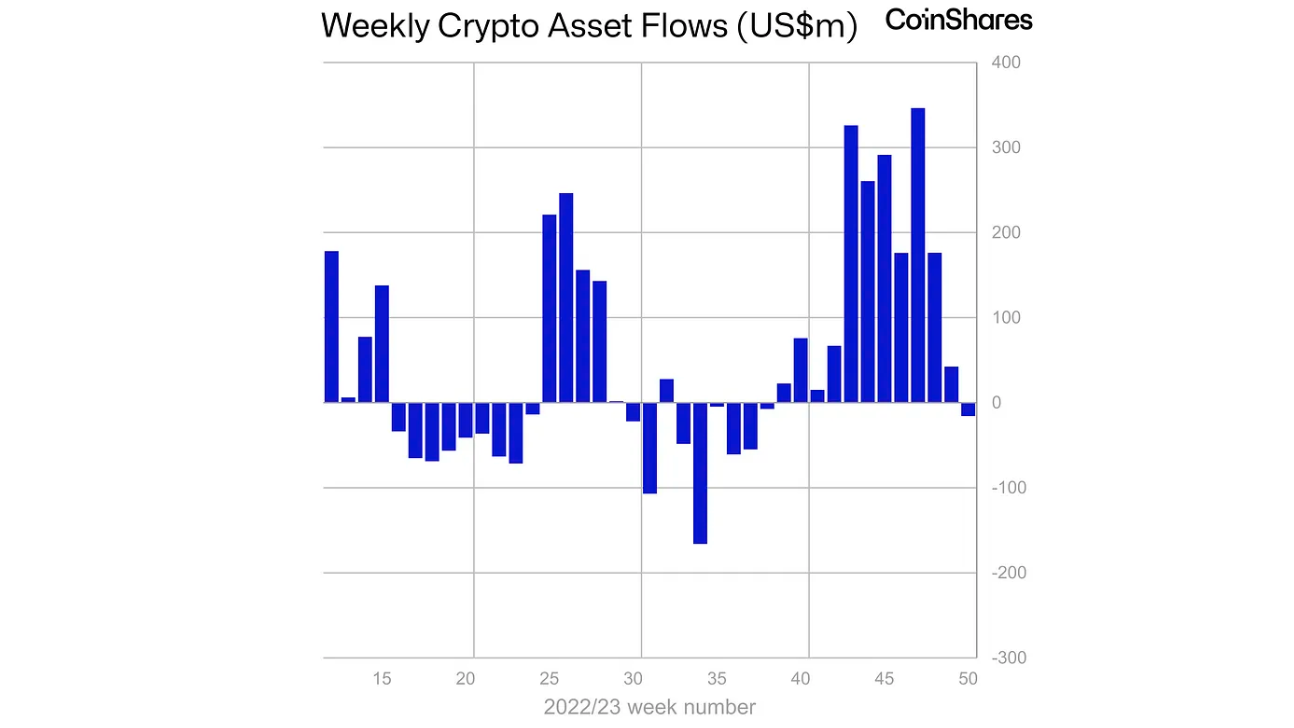

“Digital asset investment products saw minor outflows totalling US$16m, ending an 11-week run of inflows,” cited the report. “Trading activity remained well above the year average though, totalling US$3.6bn for the week, compared to the year-to-date average of US$1.6bn.”

The outflow has apparently coincided with the Bitcoin price, which has put a halt on gains after continually surging over the past 8 weeks from nearly $27,000 to breaking above $44,000 earlier this month. Bitcoin is currently trading at around $40,000, up over 12% in the past month – according to Coinmarketcap data.

Altcoins bucked the trend, seeing US$21 million in inflows. The main beneficiaries are Solana, Cardano, XRP, and Chainlink, totaling US$10.6m, US$3m, US$2.7m, and US$2m respectively. Ethereum and Avalanche suffered a little, seeing US$4.4m and US$1m respectively.

Also Read: Bitcoin Likely to Outpace Gold in 2024: Strategist