Cathie Wood’s Ark Invest has intensified its sale of Coinbase shares, offloading substantial amounts from its key funds in a notable shift in investment strategy. The move, reflecting a strategic rebalancing, comes amid a remarkable upswing in Coinbase’s stock value.

Ark’s latest trade filings disclose the sale of 28,638 shares, valued at $4.6 million, from its Innovation ETF. In addition, they also sold 5,623 shares, worth $906,000, from its Next Generation Internet ETF.

This sale follows a previous divestment of $59 million in Coinbase shares last week. Consequently, Coinbase’s stock has soared, closing at $161.16 yesterday, marking a year-to-date increase of 342% and reaching its highest point since April 2022.

Strategic Portfolio Shift Amid Fintech Surge

Ark Invest also sold 121,100 shares of Robinhood (valued at $1.6 million) from its Fintech Innovation ETF. This sale comes after Ark recently acquired $3.3 million worth of Robinhood shares, anticipating the fintech firm’s European crypto trading app launch.

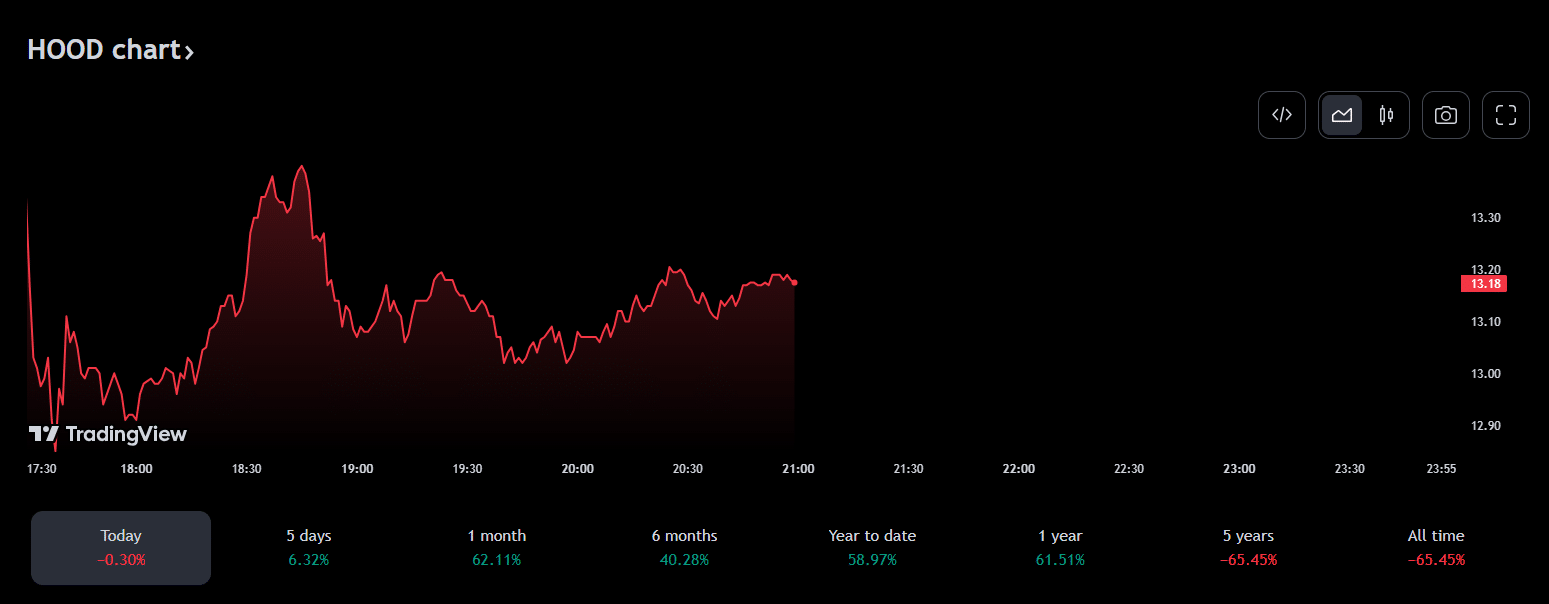

Robinhood’s stock, trading at $13.18 at market close, has experienced a 59% increase year-to-date. The company’s recent expansion in the EU, offering over 25 cryptocurrencies, has been a key driver of this surge. Yet, the stock is still about 76% below its August 2021 high.

This portfolio adjustment by Ark Invest underscores the dynamic and fast-paced nature of the fintech and cryptocurrency markets. The move to divest from Coinbase and Robinhood shares suggests a strategic adaptation to market trends and investor sentiment.

Also Read: Ark Invest Offloaded Over $100M Coinbase Shares Last Week