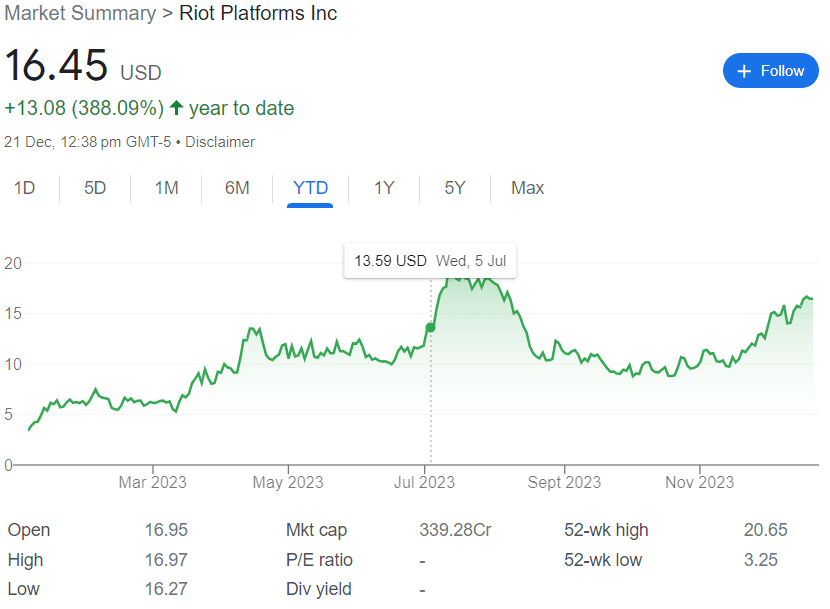

The stock price of Riot Platforms, a publicly traded firm that mines bitcoin, has surged by 389.35% so far this year. Riot Platforms’ stock price as of December 21, 2023, is $16.50, up from $3.37 at the start of the year.

Presently, the market capitalization of the corporation is $339.28 billion. The robust stock performance of Riot Platforms has been attributed to multiple causes.

Here is an Analysis of Riot Platforms’ Major Factors in More Detail:

First off, from about $20,000 at the start of the year to over $44,000 at present, the price of Bitcoin has almost more than doubled in 2023. Given that Riot Platforms’ revenues are directly correlated with the price of Bitcoin, this has increased the company’s revenue.

Furthermore, Riot Platforms has achieved higher mining efficiency by negotiating cheaper electricity tariffs and investing in new mining equipment. Riot made a deal with the China-based bitcoin miner manufacturer MicroBT Electronics Technology. As a result, Riot Platforms’ production costs have decreased, increasing its profitability.

Lastly, Riot Platforms has profited from institutional investors’ rising interest in Bitcoin. The demand for Bitcoin has increased as a result of big Wall Street corporations starting to provide financial products made with Bitcoin.

Even though Riot Platforms performed well in 2023, there are still certain concerns to take into account. Due to its extreme volatility, the price of Bitcoin can drop significantly, which would negatively impact Riot Platforms’ earnings and stock value. Furthermore, the price of mining Bitcoin can increase, which would reduce Riot Platforms’ earnings.

Riot Platforms’ profitability may be impacted by the several big businesses that are having soaring stock prices. Concern over how Bitcoin mining affects the environment is growing. Riot Platforms’ environmental impact may make some investors wary about investing in the company.

Also Read: Riot Buys 66,560 New Bitcoin Mining Rigs of $291M From MicroBT