On Christmas Day, Tether, the king of stablecoins, did some stocking stuffing of its own – but not with presents under the tree. Instead, they minted a cool billion USDT, labeled “authorized but not issued,” raising eyebrows across the cryptosphere.

This wasn’t your average holiday shopping spree. Think of it more like stocking the warehouse shelves – creating USDT tokens ready for future issuance requests and chain swaps. Tether calls it “inventory replenishment,” but some folks are calling it fishy.

However, some observers have argued that Tether has a history of being opaque about its minting practices, and that this latest move could be a way to inflate the supply of USDT without proper backing.

Adrino has assured that this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.

Tether Faq also reads, “These tokens are not part of the total market capitalization of USDT, as they have not been issued or released into circulation yet.”

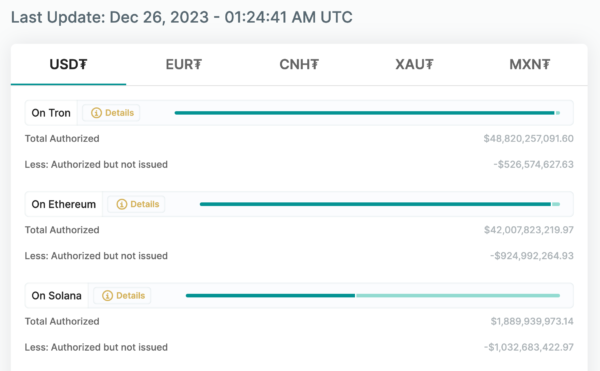

According to data from the Tether Transparency page, $925 million in USDT is “authorized but not issued” on Ethereum as of Dec. 26, 2023.

The skeptics point fingers at a lack of transparency. Is this billion-dollar magic trick fueled by Santa’s magic dust, or something less jolly? Some suggest it’s a Bitcoin pump in the making, with Tether’s new dough used to inflate the price of the crypto king.

This isn’t Tether’s first billion-dollar surprise. September saw a similar Santa-sized sack of USDT, also classified as “authorized but not issued.” Back then, it was Tron’s network waiting for a restock. Now, it’s Ethereum’s turn.

Also Read: Tether’s Letters to US Congress Detail Anti-illicit Measures