The month of December has been a wild ride for altcoins, with many of them outperforming Ethereum, which only increased by 9.5% during the same period. Solana has been the star of the show, skyrocketing by a staggering 100%.

Avalanche and Near Protocol have also had impressive gains, increasing by 104.75% and 125% respectively. Injective Protocol, an AI-powered DeFi platform, has also surged over 108% MTD.

Solana

Solana increased by an astounding 100% in the month of December, compared to Ether, which increased by just 9.5% during the same period.

Solana price Analysis

At the beging of the month Sol was trading at $60, in the first two weeks price jumped to $75 and moved side ways for a few days, forming a bullish flag and a breakout from their helped it soar past $100 and make a local heigh of $125. The price has corrected a bit but still above $100.

This month, SOL beat ETH for several reasons. However, it is not the only L1 token that has generated profitable returns this month. Let’s examine three significant tokens that are even surpassing Solana.

Avalanche

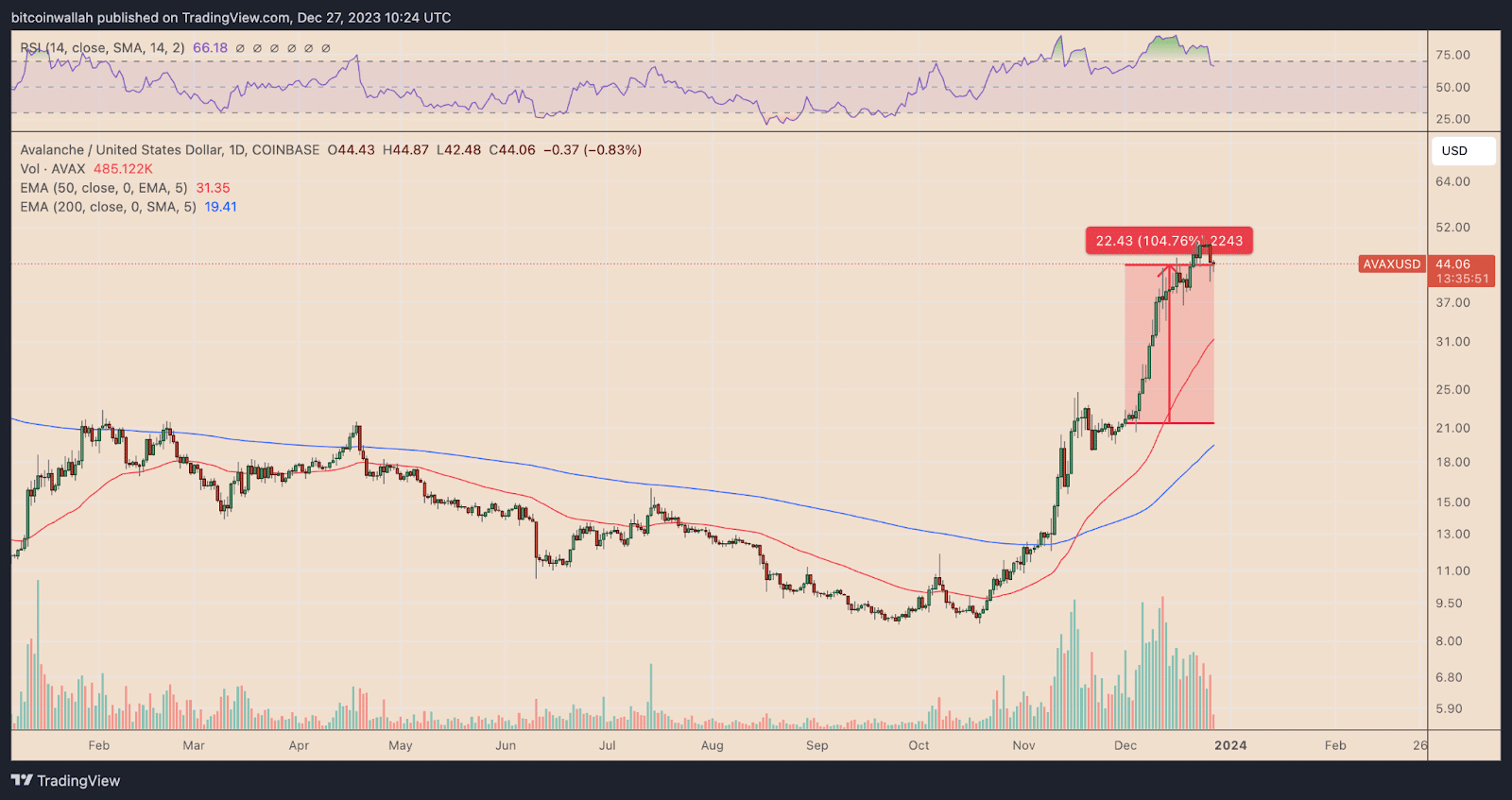

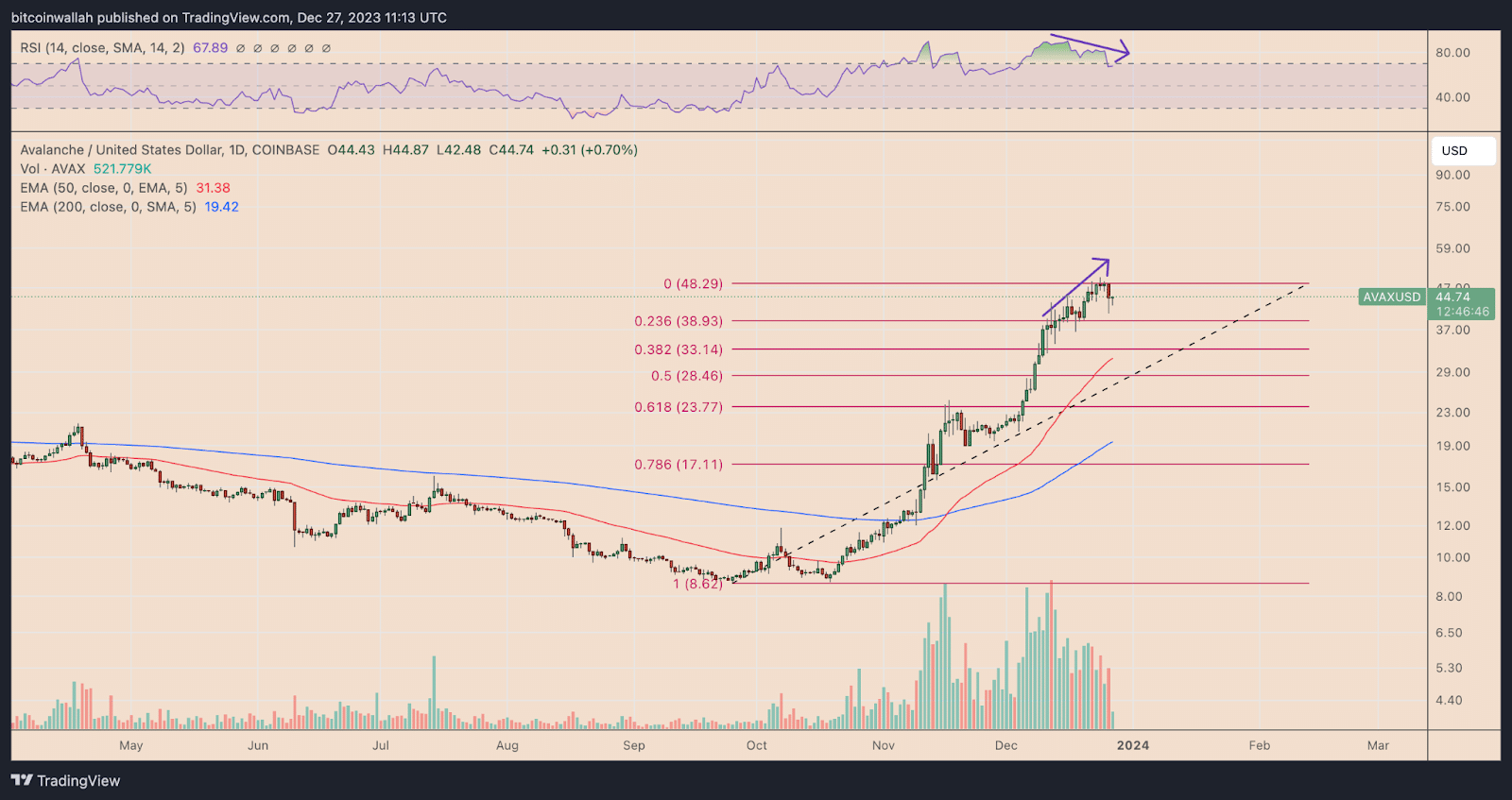

The tenth-largest cryptocurrency by market capitalization, Avalanche, outperformed Solana in December, increasing 104.75% month-to-date (MTD) to around $44.

Remarkably, Avalanche’s MTD increase coincides with the release of 9.54 million AVAX tokens in late November, suggesting that markets took up the extra token supply without depressing the price.

Avalanche price analysis

There is an obvious difference between AVAX’s dropping momentum and rising pricing from a technical perspective. Bearish divergence has been evident in December as AVAX’s price has produced higher highs and its daily relative strength index (RSI) has made lower highs.

Due to this divergence, AVAX’s price may fall by New Year’s or in January 2024 toward the support confluence, which consists of its 50-day exponential moving average (50-day EMA; the red wave) near $31.50 and its 0.383 Fib line near $33.

Near Protocol

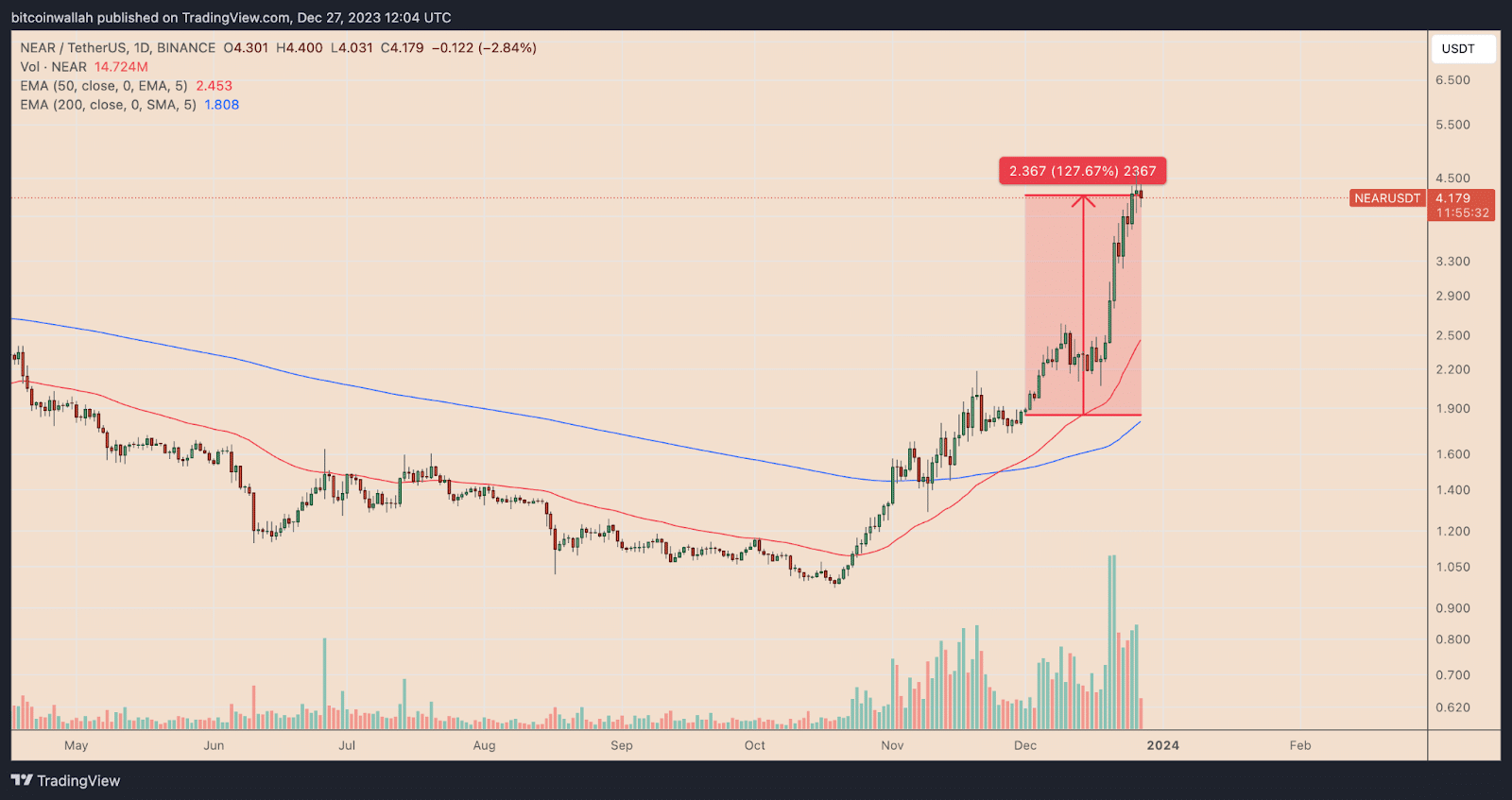

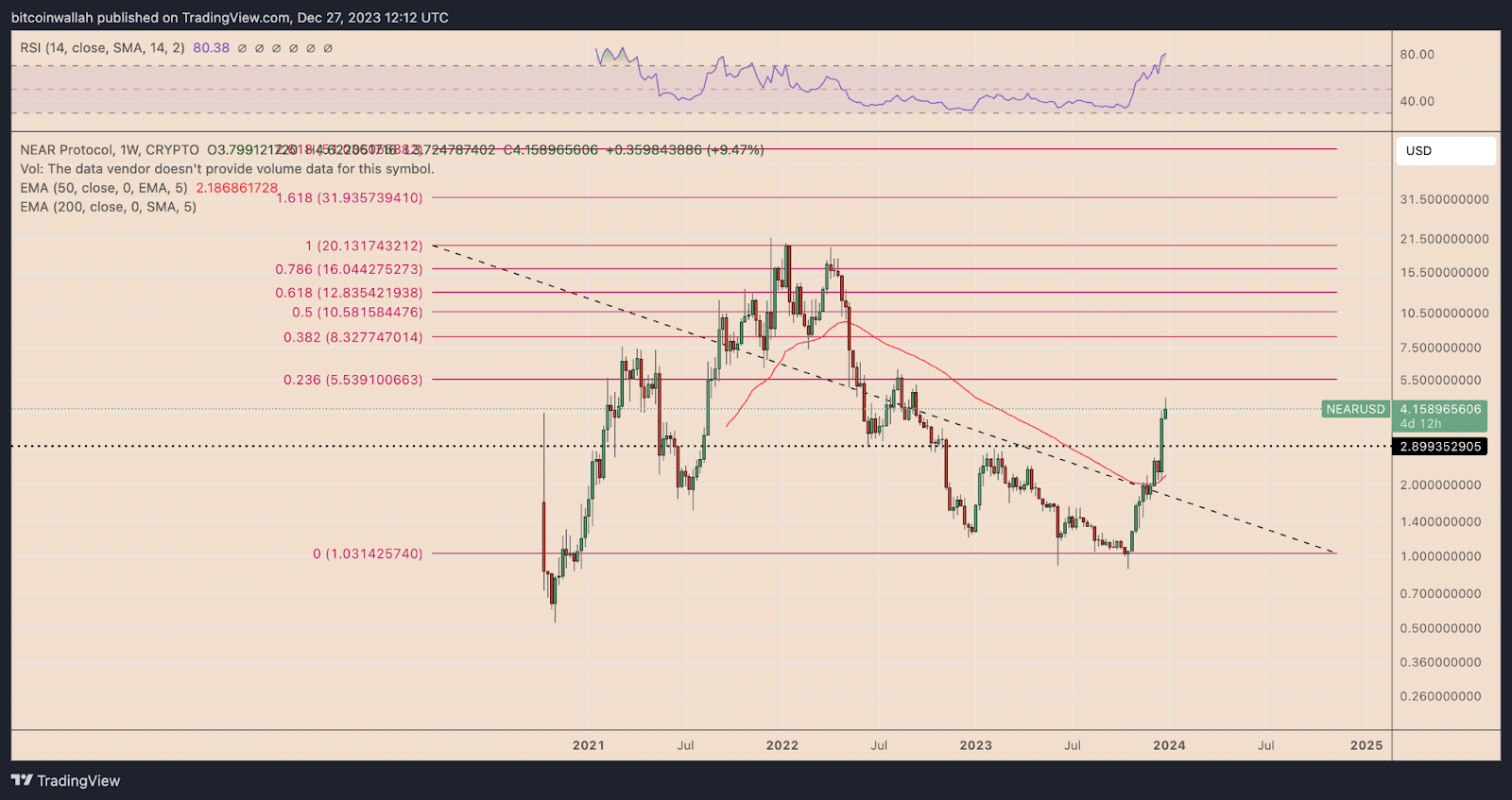

Near Protocol is now trading at $4.20, up nearly 125% MTD. Concurrent with the ascension was a 350% rally in NEKO, a memecoin project related to the Near Protocol that saw significant momentum in December.

The Near Protocol project has been strengthened by strategic alliances like the one with US-based IDS Inc. and Polygon Labs for the development of zkWASM.

NEAR price analysis

Technically, the weekly RSI for NEAR is overbought, suggesting bullish exhaustion that could lead to a correction or consolidation.

Thus, by early January 2024, NEAR pricing may decline near its June–October 2022 support level of about $2.90. Bears may test the 50-week EMA, also known as the red wave, at $2.18 as their next negative objective if they successfully close below $2.90.

Injective Protocol

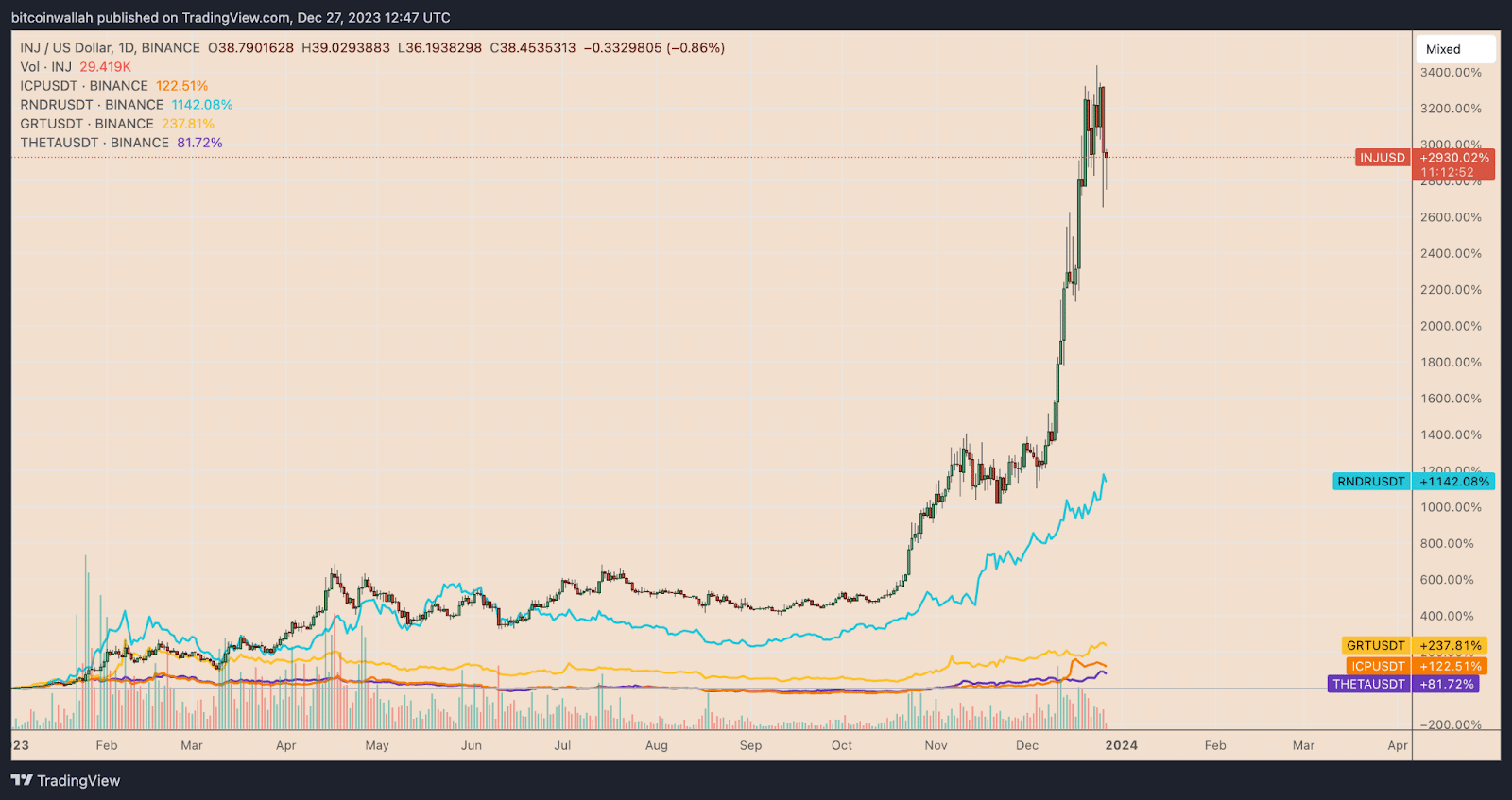

The rise in artificial intelligence (AI) tokens has contributed to the rise in Injective Protocol (INJ), which has surged over 108% MTD to $38.30. Injective, a layer-1 blockchain, combines AI with decentralized finance (DeFi).

There is another pattern among airdrop farmers that may be connected to the spike in the value of Injective Protocol’s INJ token.

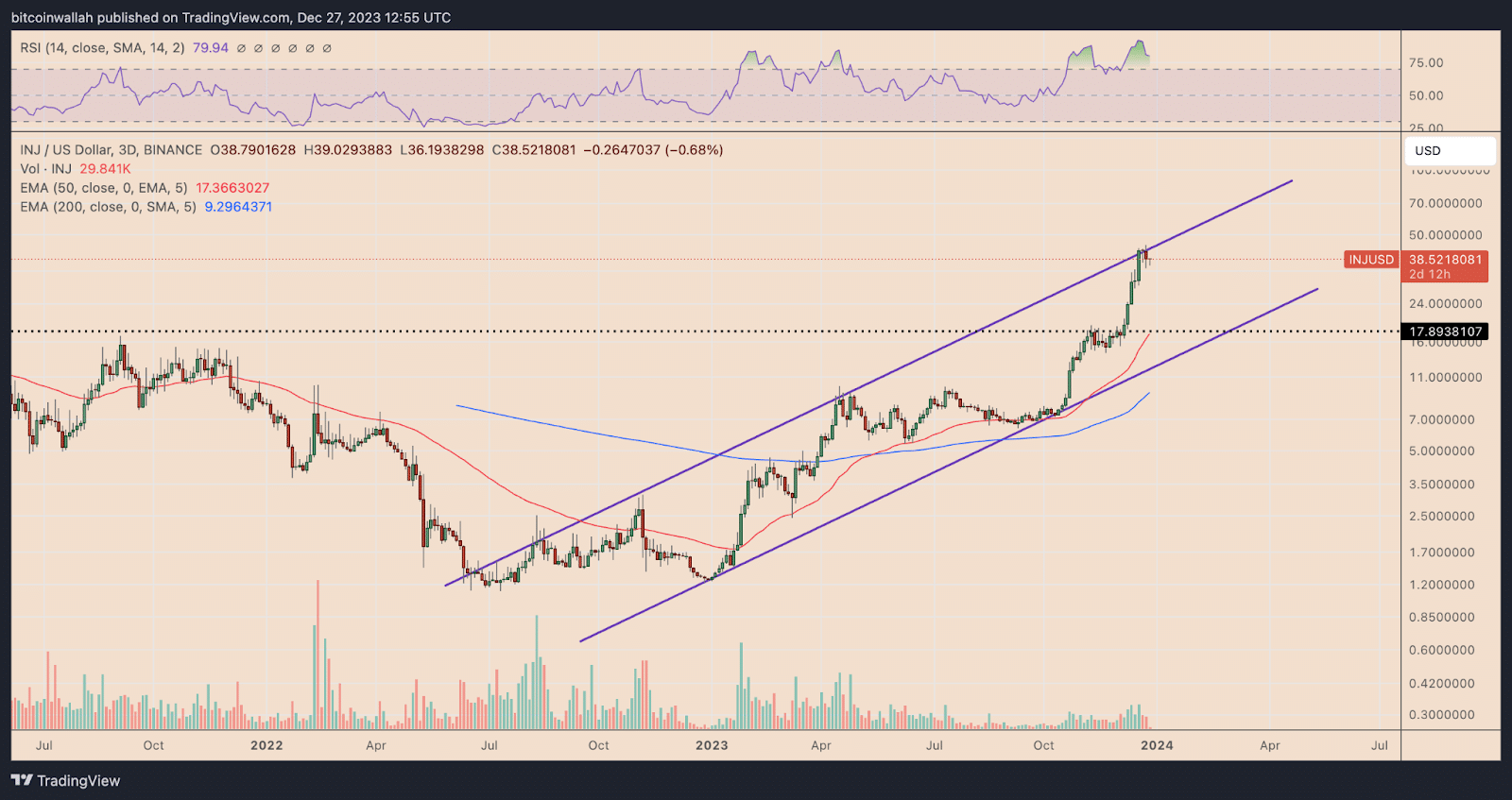

INJ price analysis

Interestingly, during the whole month of December, the cryptocurrency’s three-day RSI score has been over 70. Its price is currently approaching a multi-month rising trendline resistance at $42, which increases the likelihood that it will next go through a correction or consolidation phase.

Traders may be watching a slide into INJ’s ascending trendline support near $18 if there is a pullback from the rising trendline resistance. This level has acted as resistance in November 2023 and September 2021, when prices were down more than 50% from their present levels.

Also Read: Paxos Receives NYDFS Approval For Solana Expansion