Crypto derivatives exchange Deribit has an enormous amount of $11 billion of options, including $7.7 billion of BTC and $3.5 billion of ETH, on the edge of expiring as the market has reached this year’s last quarterly settlement due on Friday.

The amount is Deribit’s largest expiry, which will have nearly $5 billion in cash, and it is expected to result in “above average hedging and trading activity,” according to Deribit’s chief commercial officer, Luuk Strijers.

While this quarter has seen a 60% upsurge in Bitcoin (BTC) and a 43% increase in Ether (ETH) prices, investors have rushed towards call options, which has also essentially resulted in record-high notional open interest.

With this surge in both assets’ market prices, traders have been actively rolling their option contract’s expiry from December to January and further.

This resetting is also expected to continue at this Friday’s quarterly settlement. “After the expiration, all eyes and trading activity will be focused on the upcoming ETF decision,” says Luuk.

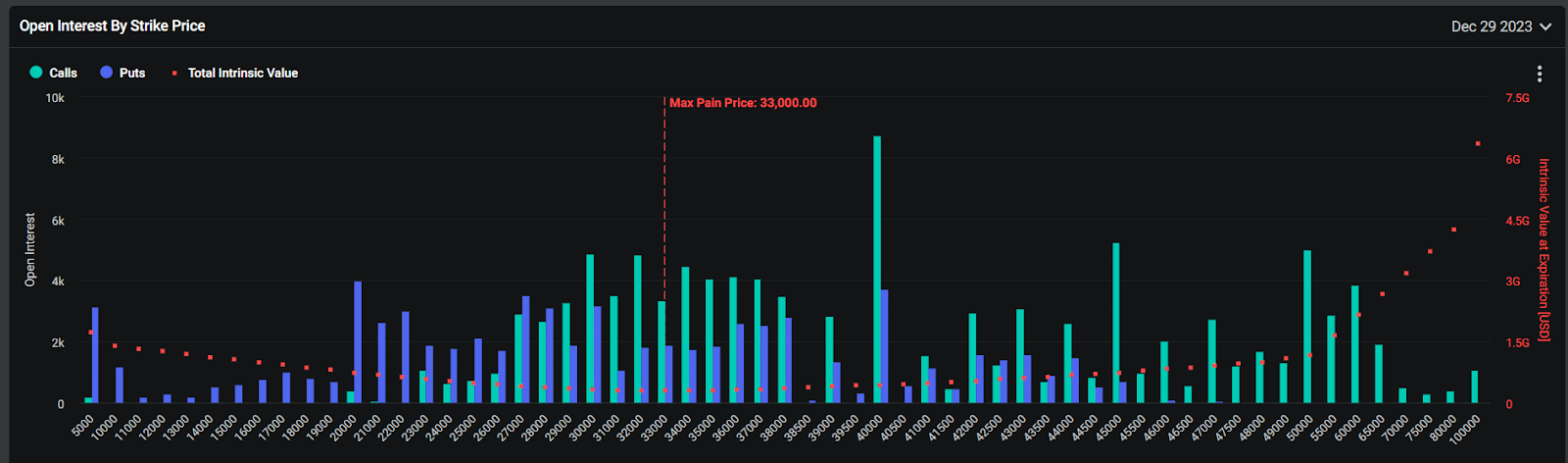

Data provided by the Deribit exchange shows that the Friday settlement’s max pain price (MPP) for BTC is $33,000, where option buyers are expected to lose most money and the BTC price tends to move towards MPP while at expiry settlement. In the same way, the max pain price (MPP) of Ethereum is $1900.

However, the Bitcoin price is currently at a stage where it cannot seek to match MPP while seeing higher volatility, says a market analyst.