The Executive Chairman of Microstrategy has begun to sell $216 million of stocks from the company as per a regulatory filing with the U.S. SEC.

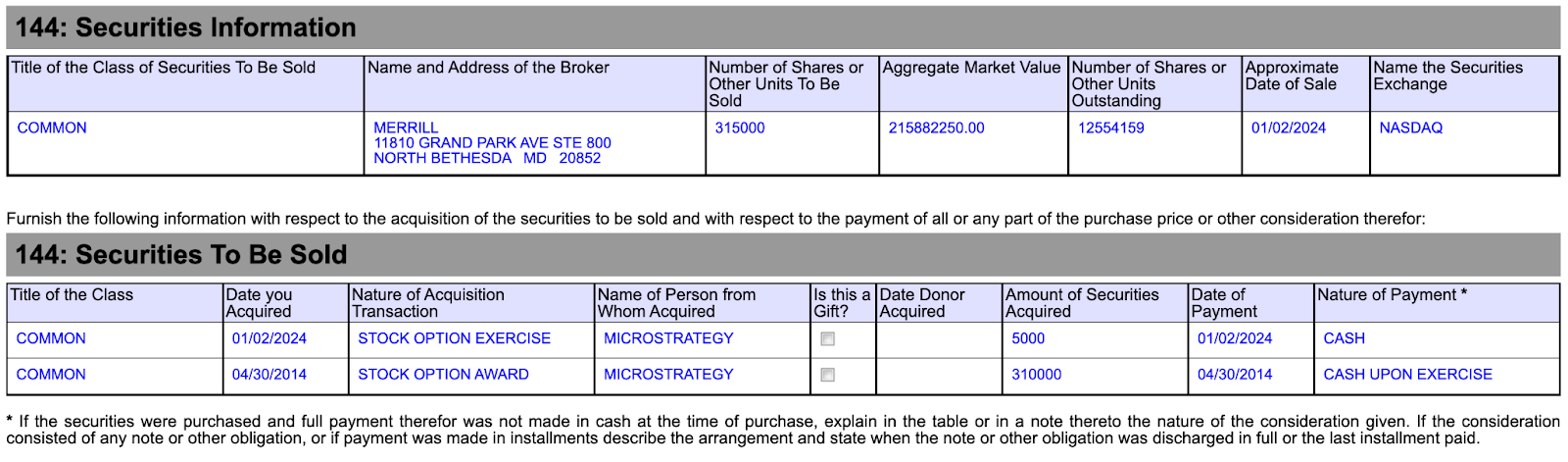

According to a document filed with the U.S. Securities and Exchange Commission, Saylor plans to sell 315,000 stock options he received in 2014, which are due to expire on April 30, 2024.

During Microstrategy’s Q3 financial results discussion, Saylor announced his intention to offload 5,000 shares every day for the subsequent four months, subject to certain price criteria being met.

This strategy was initially revealed in the company’s 10-Q report for that quarter, indicating a potential sale of as many as 400,000 shares from his vested options by April 26.

“Exercising this option will allow me to address personal obligations as well as acquire additional bitcoin (BTC) to my personal account,” Saylor said during the call.

MicroStrategy possesses the largest amount of Bitcoin among corporate firms, with roughly 189,000 BTC in its holdings from its acquisition in December.

At current prices, this is valued at about $8.5 billion. Even as most cryptocurrency-related stocks saw a downturn, MicroStrategy’s stock surged by 8.5% on Tuesday.

Also Read: Coinbase and MicroStrategy Soar as Bitcoin Surpasses $45,000