The sharp decline in the Bitcoin price has caused $460 million of long positions to be liquidated, with the whole crypto market falling nearly 8% within an hour.

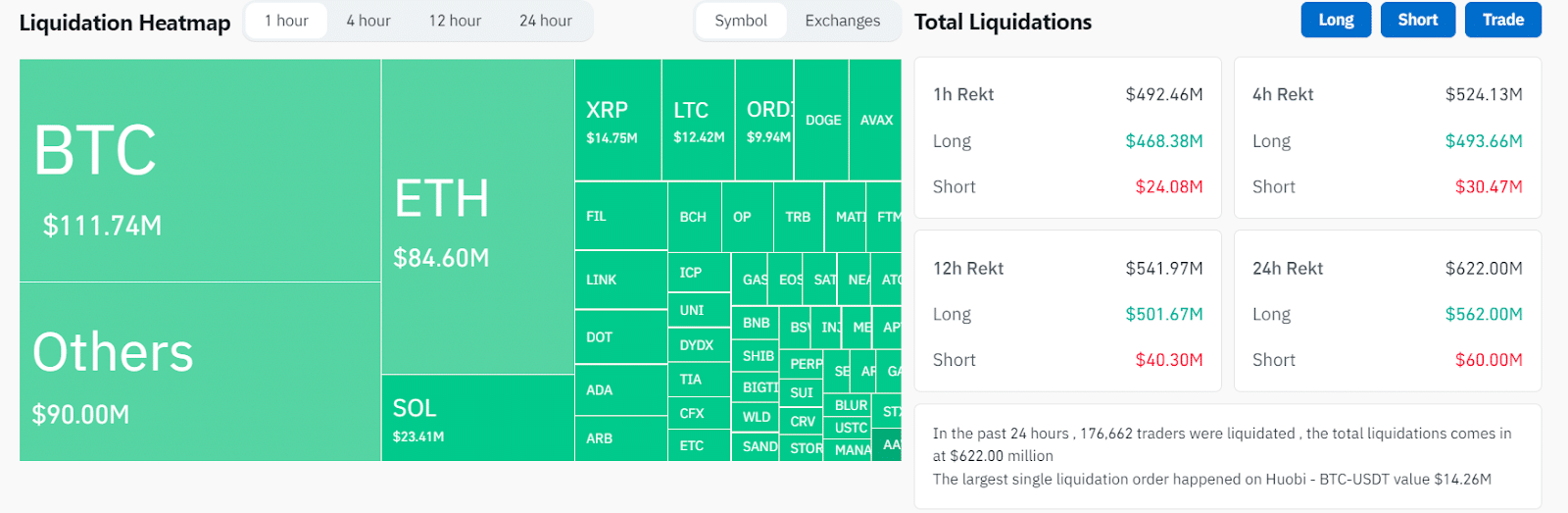

Liquidation data provided by Coinglass shows that nearly $490 million of total crypto asset liquidation has been recorded in the past hour, which includes over $460 million of total long position liquidation alone, while short positions have merely $23 million.

The sudden dip sent the Bitcoin price below $41,000 on leading crypto exchanges, while other assets also dropped by double digits within minutes.

Bitcoin price dropped nearly 10% from around $45,500 to below $41,000 during the hour, which has now recovered to $42,500, according to data from Coinmarketcap.

While the reason behind the drop is currently uncertain, several users tie it to the latest report from Matrixport, which shared a negative stance on Bitcoin ETFs, citing that the SEC will reject ETFs again.

The Matrixport report stated that SEC chair Gary Gensler still sees more “stringent compliance” in the crypto industry. “From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value,” it added.

Also Read: Bitcoin Spot ETF Decision Sparks Sell-the-News Speculation