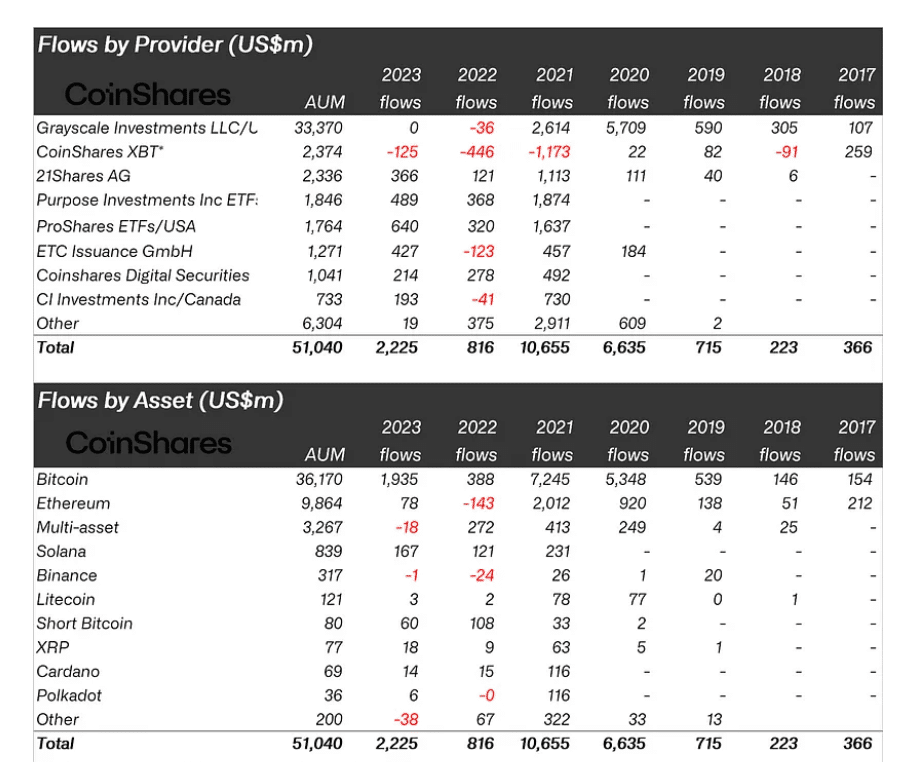

Crypto-focused investment products recorded an inflow of $2.2 billion in 2023, with it being dominated by bitcoin-based investment products, according to CoinShare’s last weekly report of the year.

As per the report, the overall turnaround in yearly inflows is significantly higher compared to the previous year, which saw a net inflow of $816 million.

Much of this inflow took place during the last quarter of the year, followed by the hype around spot Bitcoin ETFs. The year 2023 has become the third largest in terms of attracting funds, falling behind 2021’s $10.6 billion and 2020’s $6.6 billion.

In the total of $2.2 billion, Bitcoin products dominated, contributing $1.9 billion – representing 87% of the total inflows. Surprisingly, Solana has contributed the second-largest inflow of $167 million, followed by Ethereum’s mere contribution of $78 million.

While considering geography, the United States saw the largest inflow as usual, with Americans loading over $792 million, followed by Germany with $663 million and Canada with $543 million.

“Total assets under management (AUM) has risen by 129% over the year, ending at US$51bn, the highest since March 2022,” states the report. While the crypto market is more optimistic about a massive surge in 2024, the year is expected to bring the largest inflow with the approval of spot Bitcoin ETFs.

Also Read: Web3 Loses $1.8 Billion to Hackers and Scammers in 2023